Zhengyuan Zhihui Group Co.,Ltd.'s (SZSE:300645) Business And Shares Still Trailing The Industry

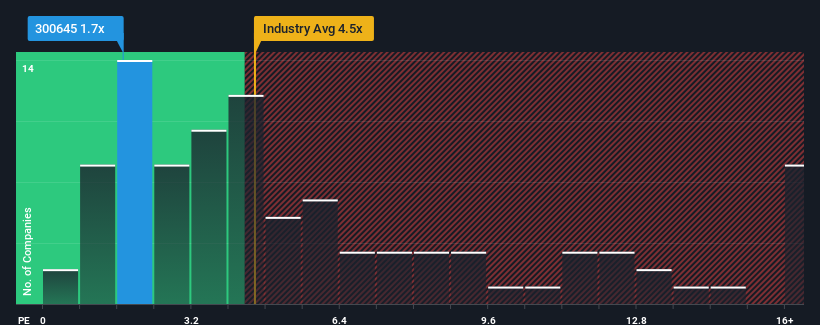

Zhengyuan Zhihui Group Co.,Ltd.'s (SZSE:300645) price-to-sales (or "P/S") ratio of 1.7x might make it look like a strong buy right now compared to the IT industry in China, where around half of the companies have P/S ratios above 4.5x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zhengyuan Zhihui GroupLtd

What Does Zhengyuan Zhihui GroupLtd's Recent Performance Look Like?

For instance, Zhengyuan Zhihui GroupLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhengyuan Zhihui GroupLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Zhengyuan Zhihui GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Zhengyuan Zhihui GroupLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Zhengyuan Zhihui GroupLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Zhengyuan Zhihui GroupLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Zhengyuan Zhihui GroupLtd (1 makes us a bit uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhengyuan Zhihui GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300645

Zhengyuan Zhihui GroupLtd

Engages in system construction, operation and maintenance services, and intelligent management and control of smart card-related businesses to colleges, schools, and military and police, and enterprises in China.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives