The Market Lifts ArcherMind Technology (Nanjing) Co., Ltd. (SZSE:300598) Shares 35% But It Can Do More

ArcherMind Technology (Nanjing) Co., Ltd. (SZSE:300598) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

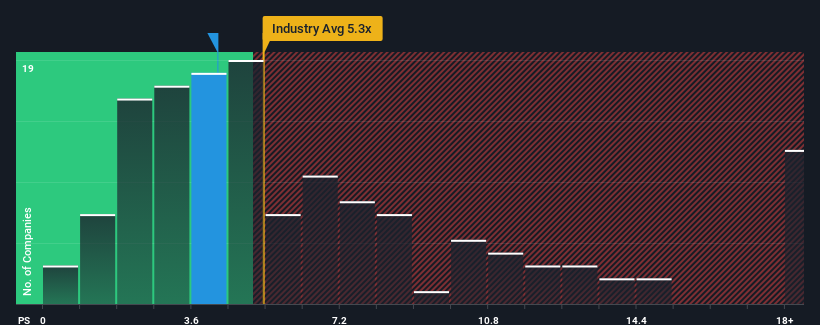

Even after such a large jump in price, ArcherMind Technology (Nanjing) may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.2x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 5.3x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for ArcherMind Technology (Nanjing)

How Has ArcherMind Technology (Nanjing) Performed Recently?

For example, consider that ArcherMind Technology (Nanjing)'s financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on ArcherMind Technology (Nanjing) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for ArcherMind Technology (Nanjing), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, ArcherMind Technology (Nanjing) would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 128% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 33% shows it's about the same on an annualised basis.

In light of this, it's peculiar that ArcherMind Technology (Nanjing)'s P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On ArcherMind Technology (Nanjing)'s P/S

Despite ArcherMind Technology (Nanjing)'s share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that ArcherMind Technology (Nanjing) currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for ArcherMind Technology (Nanjing) (of which 1 is concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300598

ArcherMind Technology

Focuses on the research and development of intelligent interconnection and operating system technology.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success