GuoChuang Software Co.,Ltd. (SZSE:300520) Soars 27% But It's A Story Of Risk Vs Reward

GuoChuang Software Co.,Ltd. (SZSE:300520) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

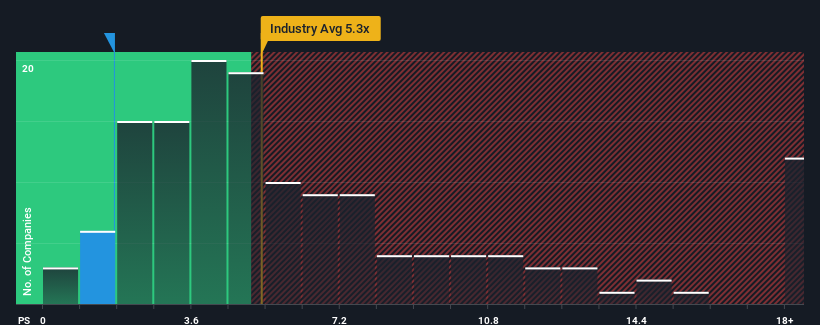

Even after such a large jump in price, GuoChuang SoftwareLtd's price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Software industry in China, where around half of the companies have P/S ratios above 5.3x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for GuoChuang SoftwareLtd

How GuoChuang SoftwareLtd Has Been Performing

GuoChuang SoftwareLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think GuoChuang SoftwareLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

GuoChuang SoftwareLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 41% last year. The strong recent performance means it was also able to grow revenue by 86% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that GuoChuang SoftwareLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On GuoChuang SoftwareLtd's P/S

Shares in GuoChuang SoftwareLtd have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems GuoChuang SoftwareLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for GuoChuang SoftwareLtd that you should be aware of.

If you're unsure about the strength of GuoChuang SoftwareLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300520

GuoChuang SoftwareLtd

Operates as a software company in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives