Stock Analysis

- China

- /

- Entertainment

- /

- SZSE:300133

Insider-Owned Growth Champions To Watch In May 2024

Reviewed by Simply Wall St

As global markets exhibit resilience with major U.S. indices like the Dow Jones and Nasdaq hitting record highs amidst moderating inflation, investors are keenly watching for opportunities that align with these evolving economic conditions. In this context, growth companies with high insider ownership stand out as particularly intriguing, as such alignment often signals confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| Vow (OB:VOW) | 31.8% | 99.3% |

| Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

| Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

| EHang Holdings (NasdaqGM:EH) | 33% | 104.9% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.9% | 48.1% |

Let's uncover some gems from our specialized screener.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Aiko Solar Energy Co., Ltd. specializes in the research, manufacture, and sale of crystalline silicon solar cells, with a market capitalization of approximately CN¥21.65 billion.

Operations: The company primarily generates its revenue from the research, manufacture, and sale of crystalline silicon solar cells.

Insider Ownership: 18%

Revenue Growth Forecast: 32.5% p.a.

Shanghai Aiko Solar Energy Co., Ltd. has faced a significant revenue drop in Q1 2024, with sales decreasing to CNY 2.51 billion from CNY 7.75 billion the previous year, alongside a shift to a net loss of CNY 91.22 million from a net profit of CNY 701.63 million last year. Despite current financial strains, including poorly covered interest payments, the company is expected to see robust future growth with revenue potentially increasing by an impressive rate annually and earnings forecasted to grow significantly per year over the next three years. Additionally, insider ownership remains substantial though recent buying or selling activities have not been reported.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai Aiko Solar EnergyLtd.

- The valuation report we've compiled suggests that Shanghai Aiko Solar EnergyLtd's current price could be quite moderate.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. specializes in the production and distribution of film and television dramas, both domestically and internationally, with a market capitalization of CN¥14.38 billion.

Operations: The company's primary revenue streams are derived from the production and distribution of film and television content.

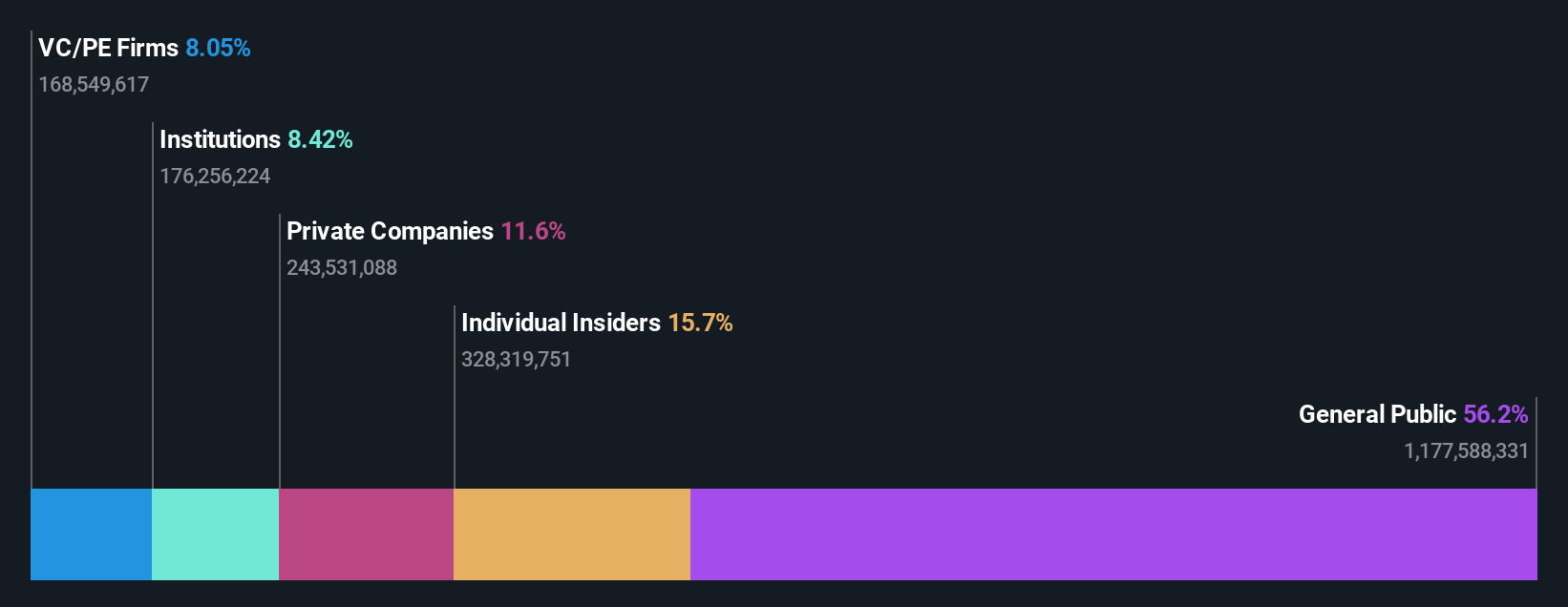

Insider Ownership: 21.8%

Revenue Growth Forecast: 31.8% p.a.

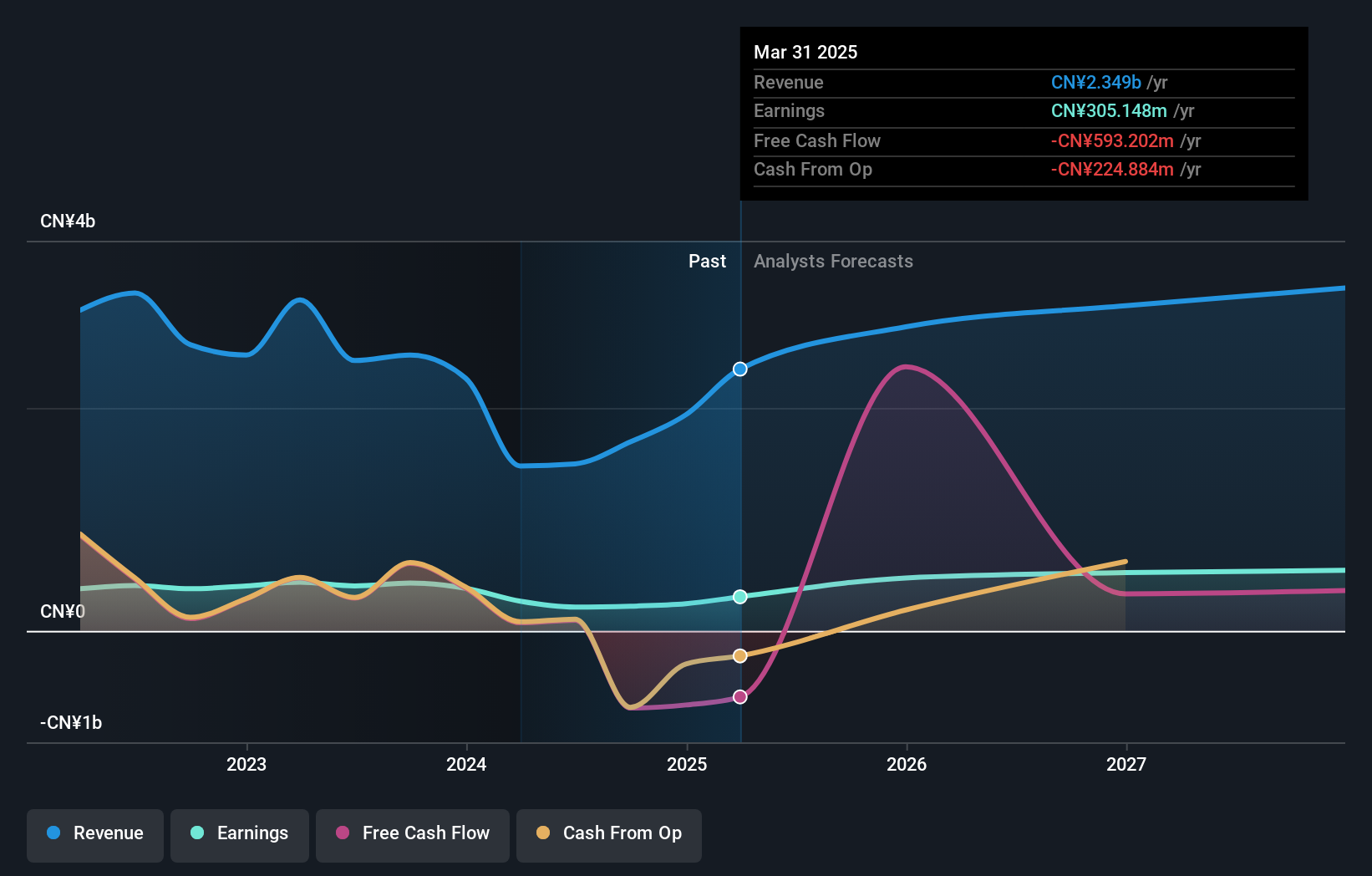

Zhejiang Huace Film & TV has recently proposed a modest dividend and demonstrated substantial insider ownership, signaling confidence from key stakeholders. However, its latest financial reports show a sharp decline in quarterly and annual revenues and net income, with significant one-off items impacting results. Despite this downturn, the company is expected to achieve robust earnings growth of 31.7% per year, outpacing the broader Chinese market's forecasted growth rates in both revenue and earnings over the next three years.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Huace Film & TV.

- Our valuation report unveils the possibility Zhejiang Huace Film & TV's shares may be trading at a premium.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. specializes in providing operating system products and technologies globally, with a market capitalization of approximately CN¥21.27 billion.

Operations: The company generates revenue from its global sales of operating system products and technologies.

Insider Ownership: 27.7%

Revenue Growth Forecast: 17.2% p.a.

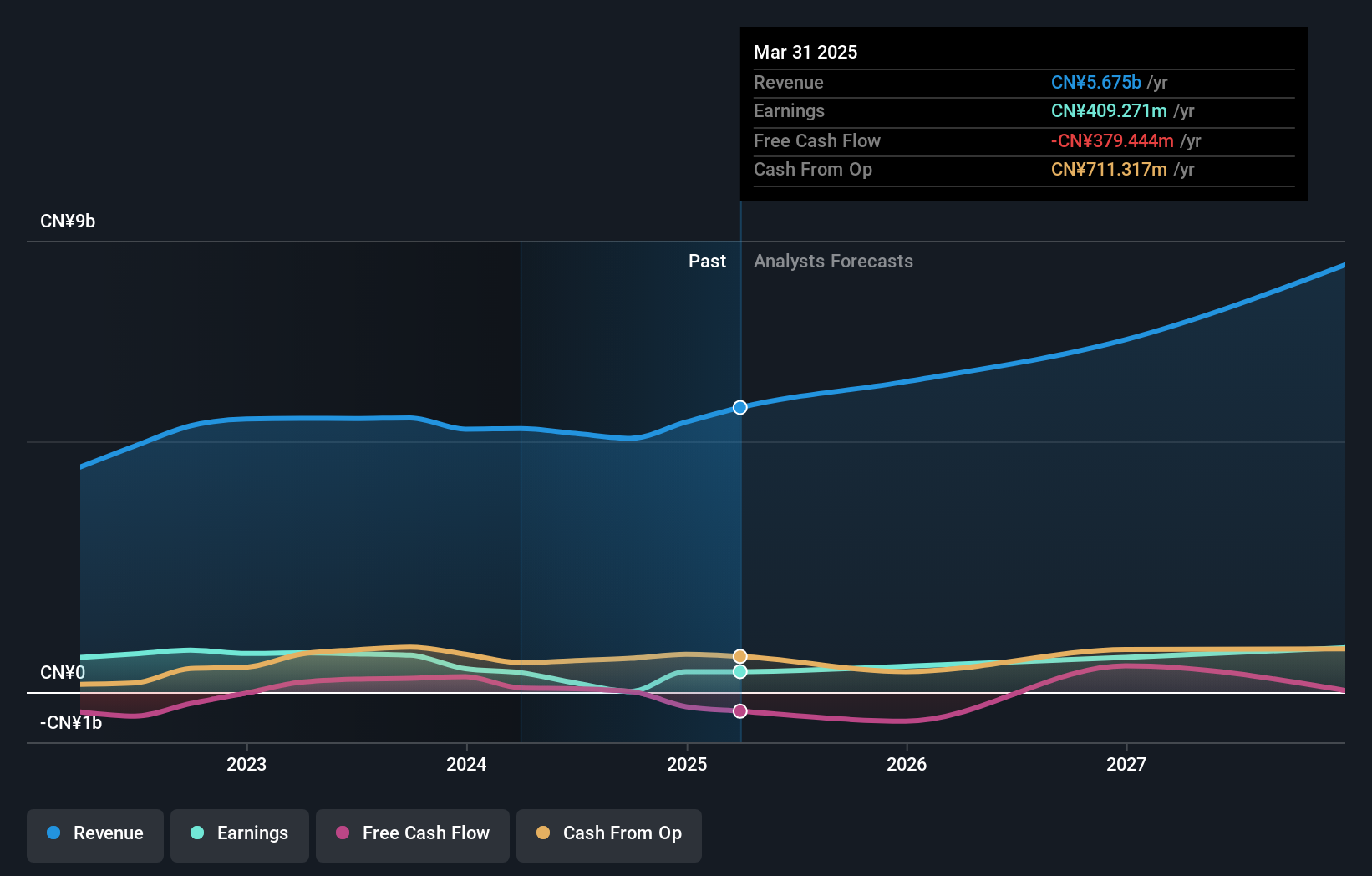

Thunder Software Technology Co., Ltd. has seen a slight increase in quarterly revenue but faced a significant drop in net income and earnings per share compared to the previous year. Despite this, the company's earnings are expected to grow by 26.3% annually, outperforming the broader Chinese market's growth. However, profit margins have decreased, and large one-off items have affected financial results. The firm recently adjusted its dividend payouts and corporate governance structures, reflecting strategic shifts amidst these challenges.

- Click here to discover the nuances of Thunder Software TechnologyLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Thunder Software TechnologyLtd's share price might be too pessimistic.

Seize The Opportunity

- Click here to access our complete index of 1504 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Huace Film & TV is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

High growth potential with excellent balance sheet.