Transportation Telecommunication & Information Development Inc.Ltd.Zhejiang (SZSE:300469) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

Those holding Transportation Telecommunication & Information Development Inc.Ltd.Zhejiang (SZSE:300469) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 279% following the latest surge, making investors sit up and take notice.

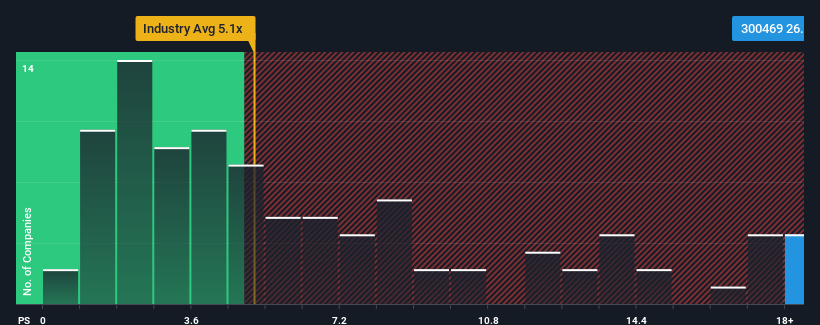

Following the firm bounce in price, Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's price-to-sales (or "P/S") ratio of 26.4x might make it look like a strong sell right now compared to other companies in the IT industry in China, where around half of the companies have P/S ratios below 5.1x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Transportation Telecommunication & Information DevelopmentLtd.Zhejiang

How Has Transportation Telecommunication & Information DevelopmentLtd.Zhejiang Performed Recently?

For instance, Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Transportation Telecommunication & Information DevelopmentLtd.Zhejiang, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Transportation Telecommunication & Information DevelopmentLtd.Zhejiang?

The only time you'd be truly comfortable seeing a P/S as steep as Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.2%. As a result, revenue from three years ago have also fallen 44% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 17% shows it's an unpleasant look.

With this information, we find it concerning that Transportation Telecommunication & Information DevelopmentLtd.Zhejiang is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's P/S Mean For Investors?

Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Transportation Telecommunication & Information DevelopmentLtd.Zhejiang revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Transportation Telecommunication & Information DevelopmentLtd.Zhejiang you should know about.

If these risks are making you reconsider your opinion on Transportation Telecommunication & Information DevelopmentLtd.Zhejiang, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Transportation Telecommunication & Information DevelopmentLtd.Zhejiang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300469

Transportation Telecommunication & Information DevelopmentLtd.Zhejiang

Engages in industry specific cloud integration that uses big data and blockchain technologies for food safety, archives, government, and enterprises in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives