Transportation Telecommunication & Information Development Inc.Ltd.Zhejiang (SZSE:300469) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Transportation Telecommunication & Information Development Inc.Ltd.Zhejiang (SZSE:300469) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

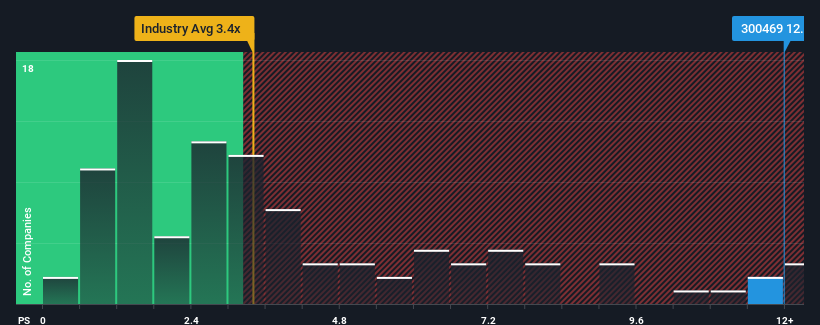

In spite of the heavy fall in price, given around half the companies in China's IT industry have price-to-sales ratios (or "P/S") below 3.4x, you may still consider Transportation Telecommunication & Information DevelopmentLtd.Zhejiang as a stock to avoid entirely with its 12x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Transportation Telecommunication & Information DevelopmentLtd.Zhejiang

How Has Transportation Telecommunication & Information DevelopmentLtd.Zhejiang Performed Recently?

For instance, Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Transportation Telecommunication & Information DevelopmentLtd.Zhejiang, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Transportation Telecommunication & Information DevelopmentLtd.Zhejiang?

In order to justify its P/S ratio, Transportation Telecommunication & Information DevelopmentLtd.Zhejiang would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. As a result, revenue from three years ago have also fallen 63% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

A significant share price dive has done very little to deflate Transportation Telecommunication & Information DevelopmentLtd.Zhejiang's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Transportation Telecommunication & Information DevelopmentLtd.Zhejiang currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

You always need to take note of risks, for example - Transportation Telecommunication & Information DevelopmentLtd.Zhejiang has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Transportation Telecommunication & Information DevelopmentLtd.Zhejiang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300469

Transportation Telecommunication & Information DevelopmentLtd.Zhejiang

Engages in industry specific cloud integration that uses big data and blockchain technologies for food safety, archives, government, and enterprises in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives