Global Infotech Co., Ltd. (SZSE:300465) Stock Catapults 43% Though Its Price And Business Still Lag The Industry

The Global Infotech Co., Ltd. (SZSE:300465) share price has done very well over the last month, posting an excellent gain of 43%. Notwithstanding the latest gain, the annual share price return of 9.2% isn't as impressive.

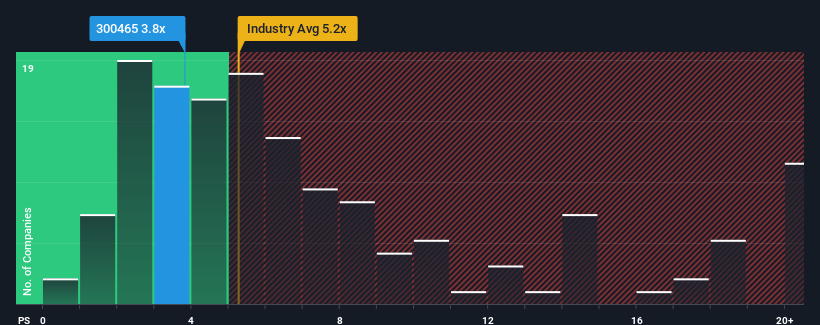

In spite of the firm bounce in price, Global Infotech may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.8x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.2x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Global Infotech

What Does Global Infotech's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Global Infotech over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Global Infotech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Global Infotech?

The only time you'd be truly comfortable seeing a P/S as low as Global Infotech's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.4%. The last three years don't look nice either as the company has shrunk revenue by 47% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 26% shows it's an unpleasant look.

With this in mind, we understand why Global Infotech's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The latest share price surge wasn't enough to lift Global Infotech's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Global Infotech confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Global Infotech (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Global Infotech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300465

Global Infotech

Provides financial information software products and integrated services in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives