3 Companies Estimated To Be Trading Below Their Intrinsic Value In October 2024

Reviewed by Simply Wall St

In the midst of escalating geopolitical tensions and unexpected economic developments, global markets have shown resilience, with U.S. large-cap stocks achieving a fourth consecutive weekly gain despite concerns over Middle East conflicts and domestic labor disruptions. As investors navigate this complex landscape, identifying undervalued stocks becomes crucial; these are companies trading below their intrinsic value, offering potential opportunities amidst the broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$266.50 | NT$531.75 | 49.9% |

| MidWestOne Financial Group (NasdaqGS:MOFG) | US$27.03 | US$53.83 | 49.8% |

| DroneShield (ASX:DRO) | A$1.345 | A$2.68 | 49.9% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.60 | CHF104.74 | 49.8% |

| Icon Offshore Berhad (KLSE:ICON) | MYR1.10 | MYR2.19 | 49.9% |

| MedAdvisor (ASX:MDR) | A$0.425 | A$0.85 | 50% |

| Manorama Industries (BSE:541974) | ₹835.90 | ₹1665.51 | 49.8% |

| Little Green Pharma (ASX:LGP) | A$0.085 | A$0.17 | 49.8% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €3.18 | €6.33 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

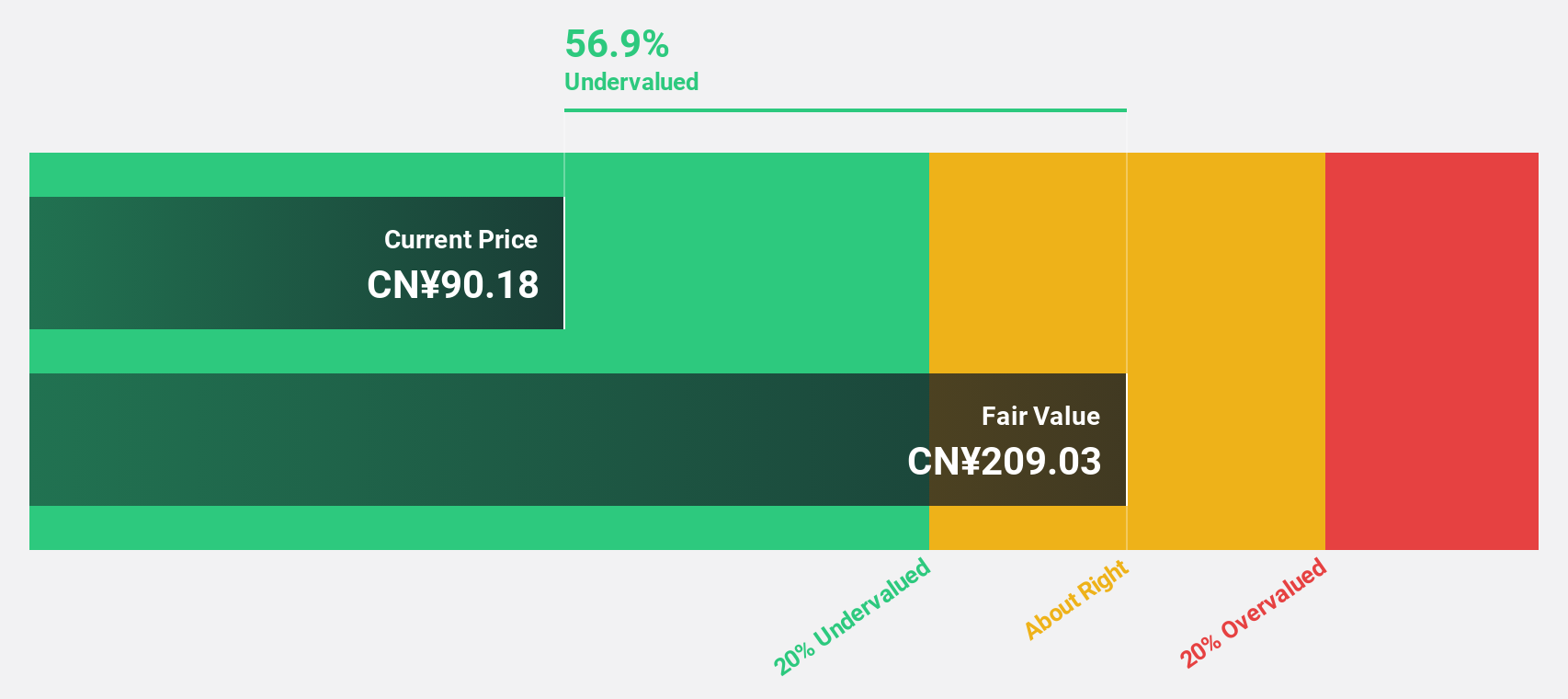

Geovis TechnologyLtd (SHSE:688568)

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market cap of CN¥20.35 billion.

Operations: Geovis Technology Co., Ltd generates revenue from its digital earth products tailored for government, enterprise, and public sectors within China.

Estimated Discount To Fair Value: 45.4%

Geovis Technology Ltd. reported half-year sales of CNY 1.10 billion, up from CNY 722.13 million, and net income increased to CNY 63.59 million from CNY 35.32 million year-over-year. Currently trading at CN¥44.95, it is valued significantly below its estimated fair value of CN¥82.34 and is forecasted for strong revenue growth of 28.9% annually, surpassing market expectations with anticipated earnings growth of over 34% per year despite a low future ROE forecast.

- In light of our recent growth report, it seems possible that Geovis TechnologyLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Geovis TechnologyLtd.

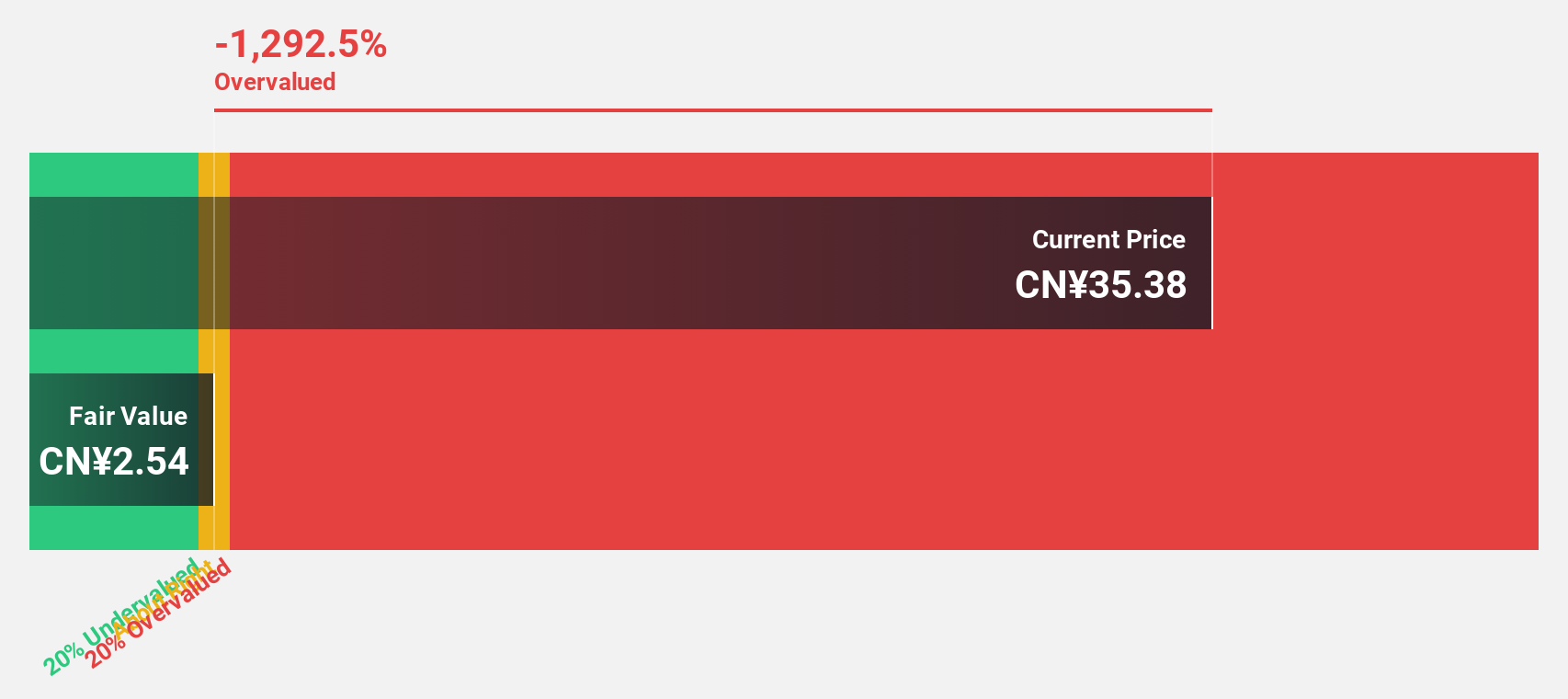

Sangfor Technologies (SZSE:300454)

Overview: Sangfor Technologies Inc. provides IT infrastructure solutions in China and internationally, with a market cap of CN¥29.16 billion.

Operations: The company's revenue segments include IT infrastructure solutions both domestically and internationally.

Estimated Discount To Fair Value: 47.7%

Sangfor Technologies reported a half-year revenue of CNY 2.71 billion, down from CNY 2.93 billion year-over-year, with a net loss widening to CNY 591.95 million. Despite volatile share prices and lower profit margins, it trades at CN¥84.29—significantly below its fair value estimate of CN¥161.23—suggesting undervaluation based on cash flows. Revenue growth is projected at 14.4% annually, with earnings expected to rise significantly above market rates over the next three years.

- According our earnings growth report, there's an indication that Sangfor Technologies might be ready to expand.

- Click here to discover the nuances of Sangfor Technologies with our detailed financial health report.

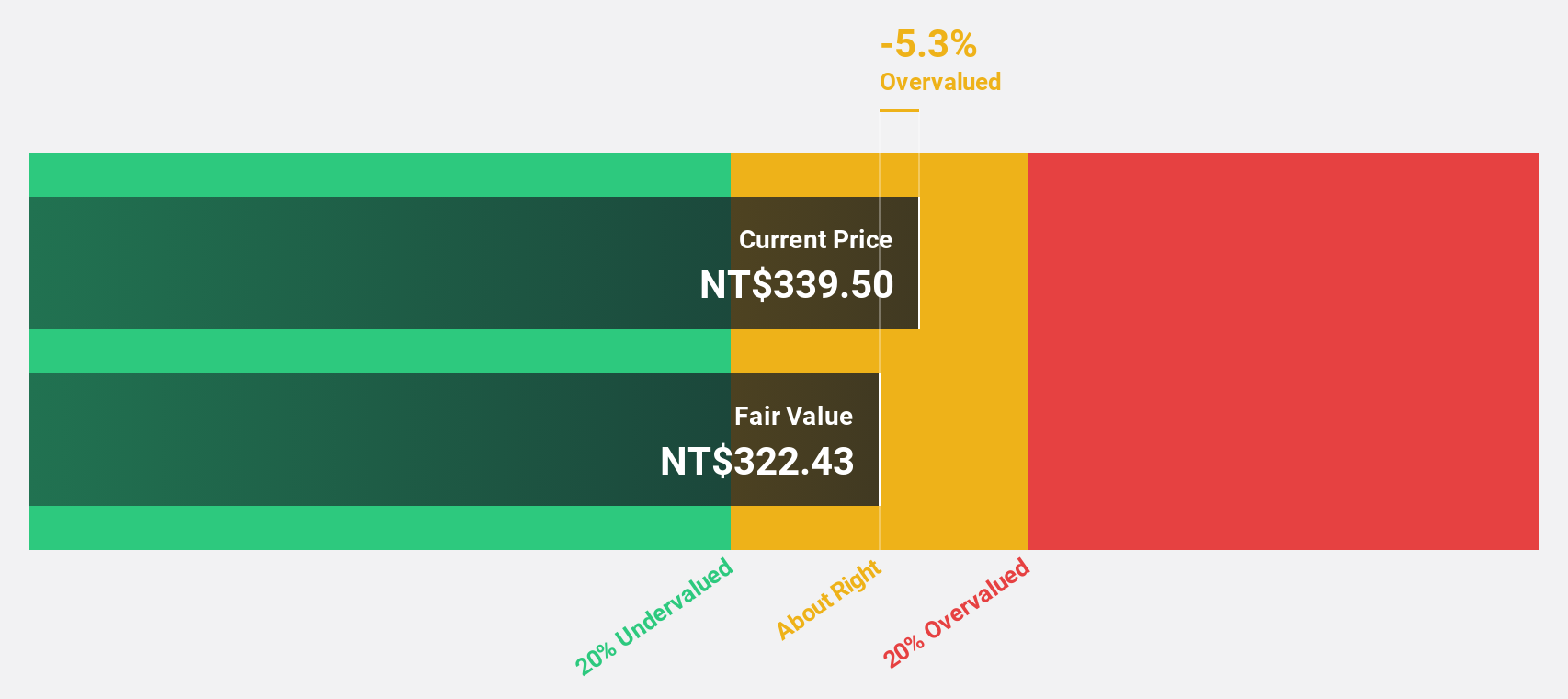

Silergy (TWSE:6415)

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and related technical services in China and internationally, with a market cap of NT$214.87 billion.

Operations: The company's revenue is primarily derived from its semiconductors segment, which generated NT$16.85 billion.

Estimated Discount To Fair Value: 12.3%

Silergy's recent financial performance highlights its potential undervaluation based on cash flows. Trading at NT$547, it's priced below the fair value estimate of NT$623.61. The company reported a significant turnaround in Q2 2024 with sales of TWD 4.62 billion and net income of TWD 560.6 million, compared to a net loss last year. Earnings are forecast to grow significantly at 39.82% annually, outpacing market expectations despite recent share price volatility and declining profit margins.

- The analysis detailed in our Silergy growth report hints at robust future financial performance.

- Navigate through the intricacies of Silergy with our comprehensive financial health report here.

Summing It All Up

- Delve into our full catalog of 928 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300454

Sangfor Technologies

Provides IT infrastructure solutions in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives