Improved Revenues Required Before Beijing Sinnet Technology Co.,Ltd (SZSE:300383) Stock's 30% Jump Looks Justified

Those holding Beijing Sinnet Technology Co.,Ltd (SZSE:300383) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.5% over the last year.

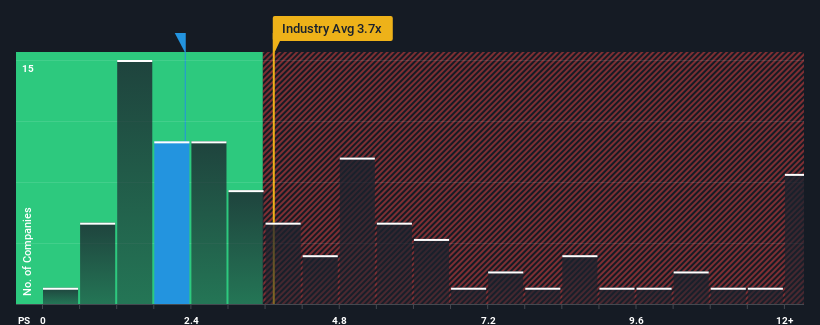

Even after such a large jump in price, Beijing Sinnet TechnologyLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the IT industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing Sinnet TechnologyLtd

What Does Beijing Sinnet TechnologyLtd's P/S Mean For Shareholders?

Beijing Sinnet TechnologyLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Sinnet TechnologyLtd.Is There Any Revenue Growth Forecasted For Beijing Sinnet TechnologyLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beijing Sinnet TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.7% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 9.1% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 16% per annum, which is noticeably more attractive.

With this information, we can see why Beijing Sinnet TechnologyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Beijing Sinnet TechnologyLtd's P/S

Despite Beijing Sinnet TechnologyLtd's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Beijing Sinnet TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Beijing Sinnet TechnologyLtd with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sinnet TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300383

Beijing Sinnet TechnologyLtd

Provides internet data center (IDC), cloud computing, and internet access services in China and Hong Kong.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives