Market Might Still Lack Some Conviction On NSFOCUS Technologies Group Co., Ltd. (SZSE:300369) Even After 30% Share Price Boost

NSFOCUS Technologies Group Co., Ltd. (SZSE:300369) shareholders have had their patience rewarded with a 30% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

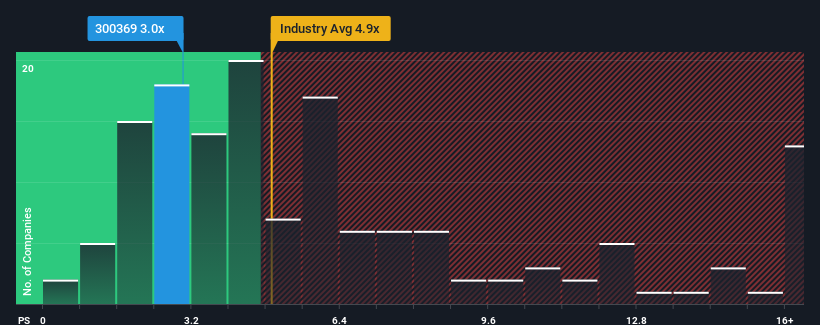

Although its price has surged higher, NSFOCUS Technologies Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 4.9x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for NSFOCUS Technologies Group

What Does NSFOCUS Technologies Group's P/S Mean For Shareholders?

NSFOCUS Technologies Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think NSFOCUS Technologies Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For NSFOCUS Technologies Group?

NSFOCUS Technologies Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 21% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 27% over the next year. That's shaping up to be similar to the 26% growth forecast for the broader industry.

With this information, we find it odd that NSFOCUS Technologies Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does NSFOCUS Technologies Group's P/S Mean For Investors?

The latest share price surge wasn't enough to lift NSFOCUS Technologies Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for NSFOCUS Technologies Group remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 1 warning sign for NSFOCUS Technologies Group that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NSFOCUS Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300369

NSFOCUS Technologies Group

Provides Internet and application security services worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives