Shenzhen Sunline Tech Co., Ltd.'s (SZSE:300348) Shares Leap 33% Yet They're Still Not Telling The Full Story

Shenzhen Sunline Tech Co., Ltd. (SZSE:300348) shares have continued their recent momentum with a 33% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.6% in the last twelve months.

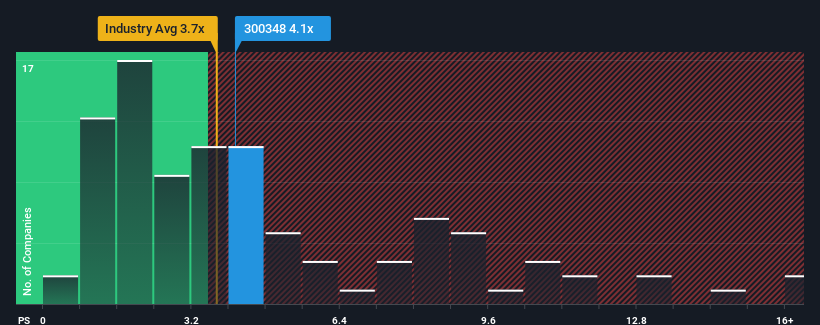

Even after such a large jump in price, it's still not a stretch to say that Shenzhen Sunline Tech's price-to-sales (or "P/S") ratio of 4.1x right now seems quite "middle-of-the-road" compared to the IT industry in China, where the median P/S ratio is around 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shenzhen Sunline Tech

How Has Shenzhen Sunline Tech Performed Recently?

While the industry has experienced revenue growth lately, Shenzhen Sunline Tech's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Shenzhen Sunline Tech's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shenzhen Sunline Tech's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Shenzhen Sunline Tech's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 21% per annum during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 14% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Shenzhen Sunline Tech's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Shenzhen Sunline Tech appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Shenzhen Sunline Tech's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Shenzhen Sunline Tech that we have uncovered.

If these risks are making you reconsider your opinion on Shenzhen Sunline Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300348

Shenzhen Sunline Tech

Provides IT solutions and services for commercial banks and financial institutions in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success