Strong week for Business-intelligence of Oriental Nations (SZSE:300166) shareholders doesn't alleviate pain of five-year loss

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166), since the last five years saw the share price fall 48%. And it's not just long term holders hurting, because the stock is down 44% in the last year. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

While the stock has risen 6.2% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Business-intelligence of Oriental Nations

Given that Business-intelligence of Oriental Nations didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Business-intelligence of Oriental Nations grew its revenue at 3.0% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 8% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

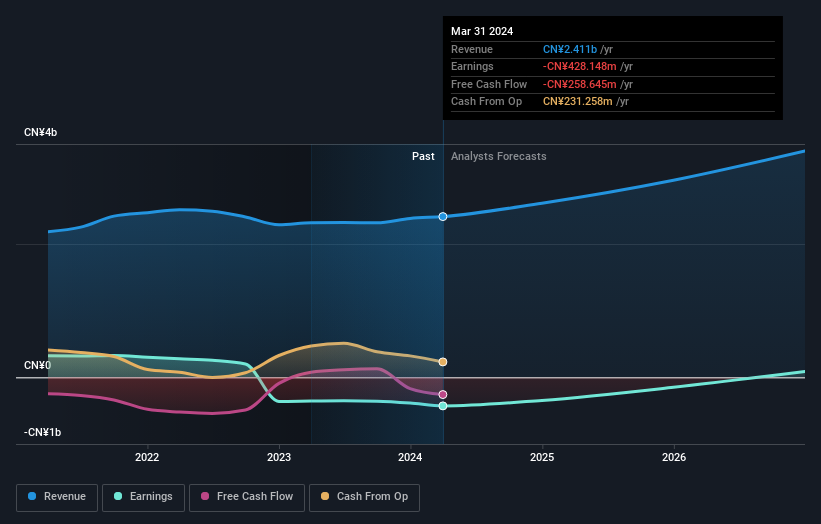

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 16% in the twelve months, Business-intelligence of Oriental Nations shareholders did even worse, losing 44%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Business-intelligence of Oriental Nations better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Business-intelligence of Oriental Nations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300166

Business-intelligence of Oriental Nations

Business-intelligence of Oriental Nations Corporation Ltd.

Adequate balance sheet and slightly overvalued.