As global markets continue to navigate through a landscape marked by political turmoil in Europe and mixed economic signals, investors are showing heightened interest in growth companies, particularly those with substantial insider ownership. These firms often signal strong confidence from those closest to the business, aligning well with current market dynamics where discerning long-term value is paramount.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

| Gaming Innovation Group (OB:GIG) | 13.2% | 36.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Vow (OB:VOW) | 31.8% | 97.6% |

Let's review some notable picks from our screened stocks.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

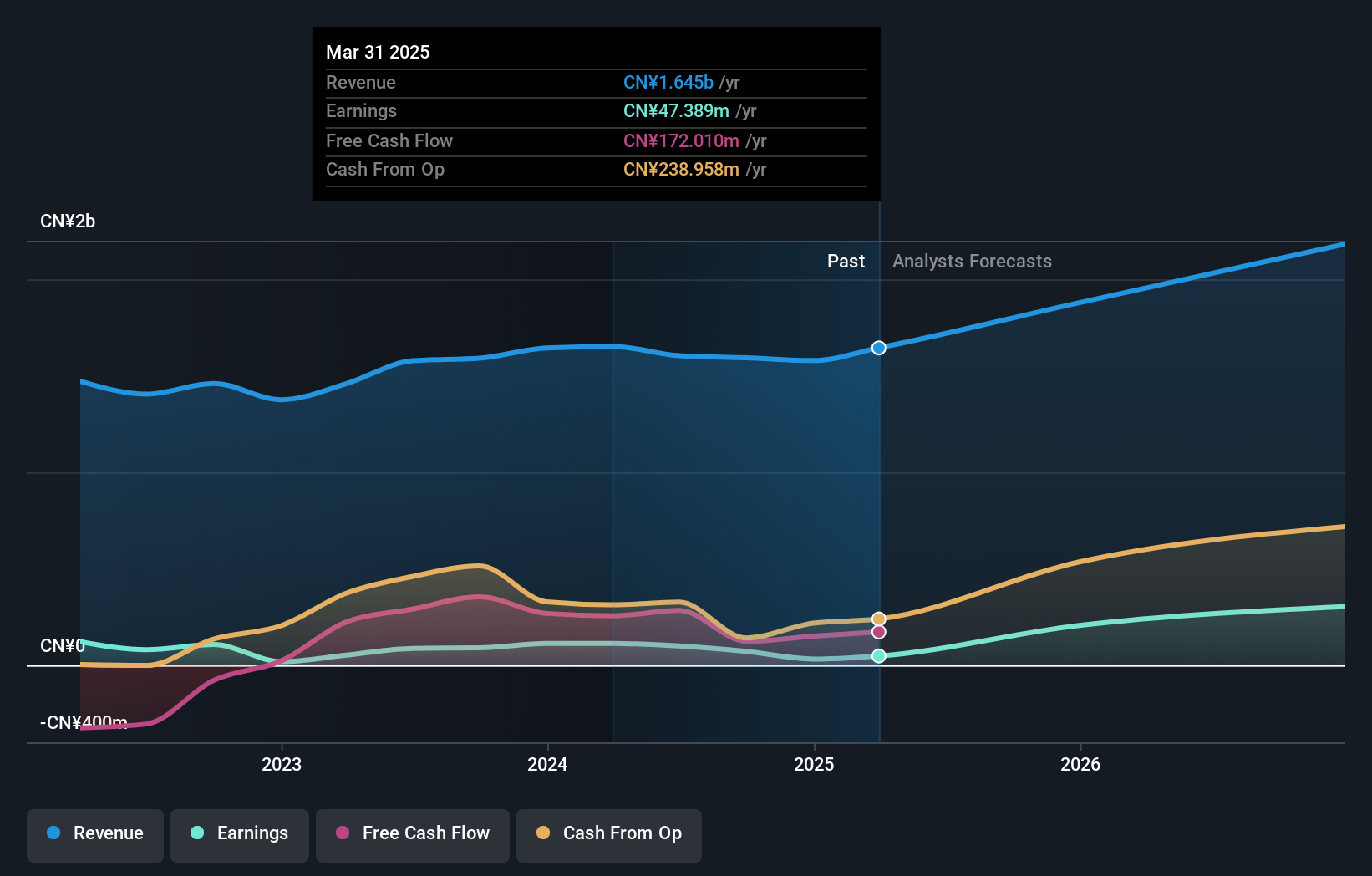

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. operates in the technology sector, focusing on smart access systems, with a market capitalization of approximately CN¥5.60 billion.

Operations: The company generates revenue primarily from its smart access systems segment.

Insider Ownership: 38%

Revenue Growth Forecast: 16.2% p.a.

Shenzhen Jieshun Science and Technology Industry Co.,Ltd. has demonstrated robust growth, with earnings increasing by 119.5% last year and forecasted to grow at 32.84% annually over the next three years, outpacing the Chinese market's average. Despite this strong profit growth, revenue projections are more moderate at 16.2% annually, slightly above the market trend. The company's Return on Equity is expected to remain low at 9.8%. Recent activities include a dividend payout and an annual general meeting discussing future plans and financial reports.

- Click here to discover the nuances of Shenzhen Jieshun Science and Technology IndustryLtd with our detailed analytical future growth report.

- Our valuation report unveils the possibility Shenzhen Jieshun Science and Technology IndustryLtd's shares may be trading at a premium.

Beijing eGOVA Co (SZSE:300075)

Simply Wall St Growth Rating: ★★★★★☆

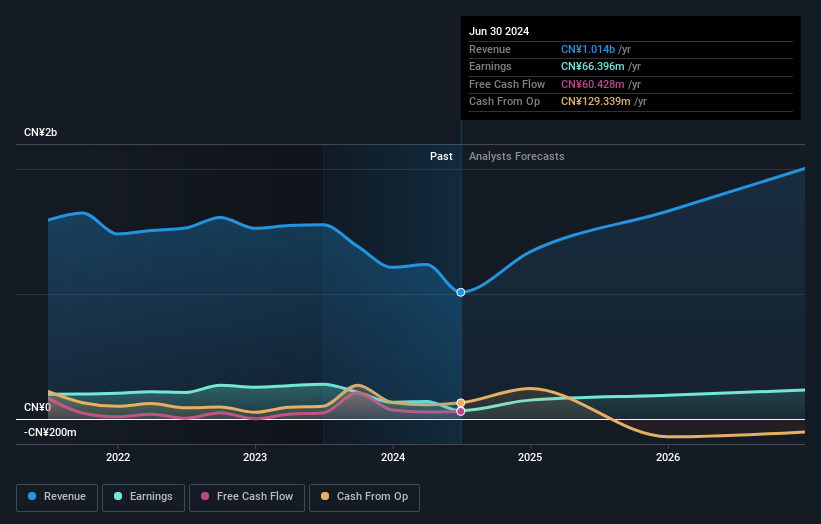

Overview: Beijing eGOVA Co., Ltd. specializes in providing core application services and operational solutions for smart cities across China, with a market capitalization of approximately CN¥9.77 billion.

Operations: The company generates its revenue primarily from core application services and operational solutions tailored for smart cities in China.

Insider Ownership: 27.8%

Revenue Growth Forecast: 24.5% p.a.

Beijing eGOVA Co., Ltd. is positioned for significant growth with forecasted annual earnings and revenue increases of 38.28% and 24.5%, respectively, outstripping the broader Chinese market projections. However, its profit margins have dipped from 17.2% to 11.4% over the past year, indicating some efficiency challenges despite rapid growth. The company's recent activities include multiple dividend affirmations and a substantial share buyback program, signaling confidence from management in its financial health and future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing eGOVA Co.

- According our valuation report, there's an indication that Beijing eGOVA Co's share price might be on the expensive side.

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

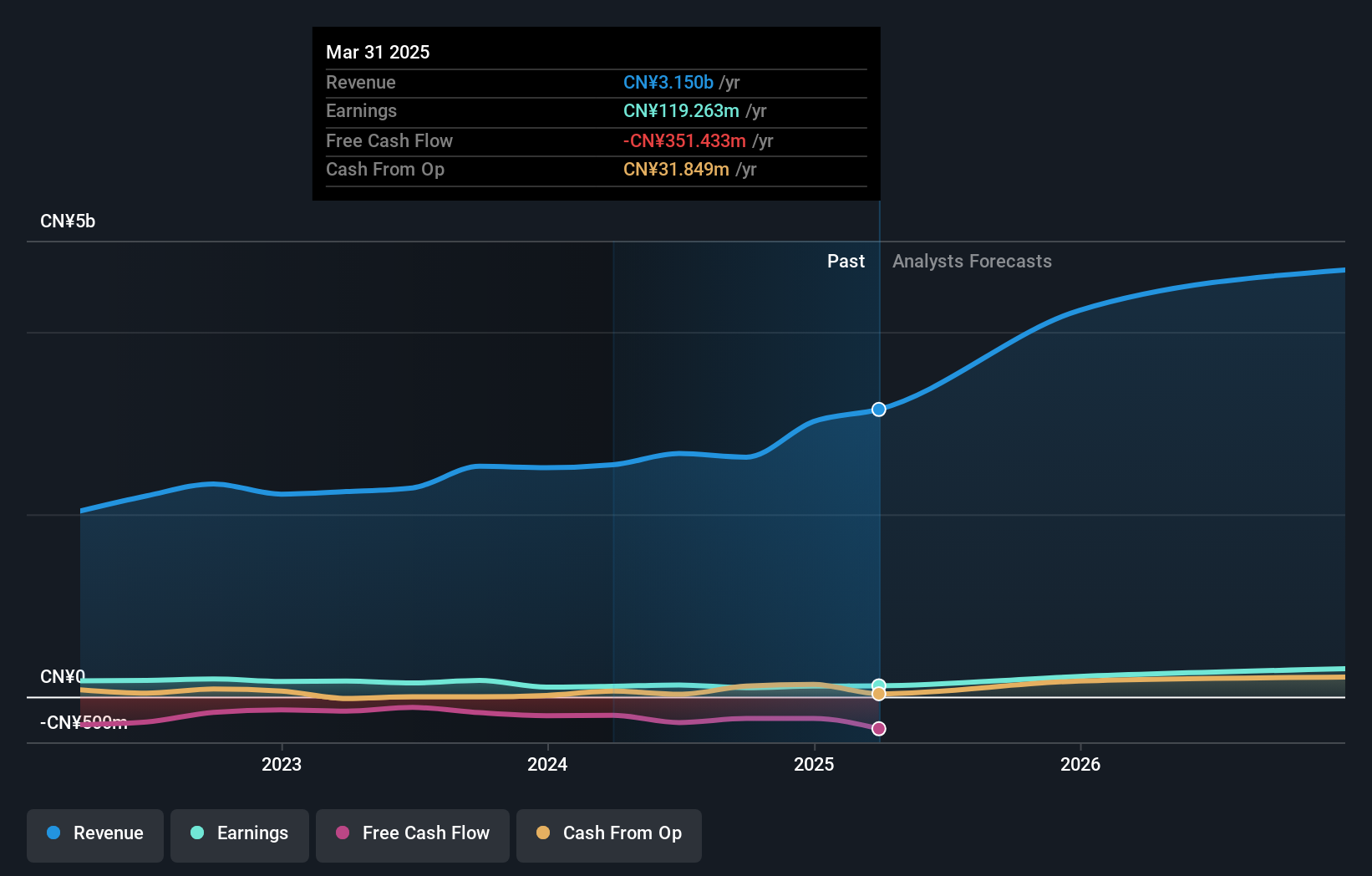

Overview: Guangdong Shenling Environmental Systems Co., Ltd. is a company that specializes in the manufacture and sale of environmental control systems, with a market capitalization of approximately CN¥5.87 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 38.7%

Revenue Growth Forecast: 26.4% p.a.

Guangdong Shenling Environmental Systems Co., Ltd. demonstrates robust growth potential, with revenue and earnings expected to increase by 26.4% and 45.2% per year respectively, outpacing the Chinese market averages of 13.9% and 22.7%. Despite this promising outlook, the company's profit margins have declined from last year, posing a challenge to its efficiency. Additionally, its dividend coverage is weak, reflecting potential cash flow concerns despite recent dividend declarations and high insider ownership that typically signals confidence in management's future plans.

- Take a closer look at Guangdong Shenling Environmental Systems' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Guangdong Shenling Environmental Systems' current price could be inflated.

Seize The Opportunity

- Gain an insight into the universe of 1442 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301018

Guangdong Shenling Environmental Systems

Guangdong Shenling Environmental Systems Co., Ltd.

High growth potential with excellent balance sheet.