Stock Analysis

As global markets grapple with rising U.S. Treasury yields and a tempered outlook for Federal Reserve rate cuts, the tech-heavy Nasdaq Composite Index has shown resilience, slightly gaining amidst broader market declines. In such an environment, identifying high-growth tech stocks requires a keen eye on companies that can capitalize on technological advancements and maintain robust growth trajectories despite economic headwinds.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market capitalization of HK$55.22 billion.

Operations: Sunny Optical Technology focuses on optical components, optical instruments, and optoelectronic products. The company generates significant revenue from optoelectronic products (CN¥25.10 billion) and optical components (CN¥12.32 billion).

Sunny Optical Technology has demonstrated robust financial health, with a notable 17.2% earnings growth over the past year, surpassing the electronic industry's average of 11.7%. This growth trajectory is supported by substantial R&D investment, aligning with its strategic focus on enhancing technological capabilities in optical solutions. Furthermore, the company's recent executive board changes and share repurchase activities reflect a proactive approach in governance and shareholder value enhancement. With revenue and earnings projected to grow at 10.2% and 20.8% per year respectively, Sunny Optical is poised to maintain its competitive edge in the high-tech optics sector.

- Navigate through the intricacies of Sunny Optical Technology (Group) with our comprehensive health report here.

Learn about Sunny Optical Technology (Group)'s historical performance.

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Greatwall Technology Group Co., Ltd. is a company that operates in the technology sector, focusing on system equipment and computing industry solutions with a market capitalization of approximately CN¥46.48 billion.

Operations: Greatwall Technology generates revenue primarily from its system equipment and computing industry solutions, with the latter contributing significantly more at approximately CN¥10.73 billion compared to CN¥4.13 billion from system equipment.

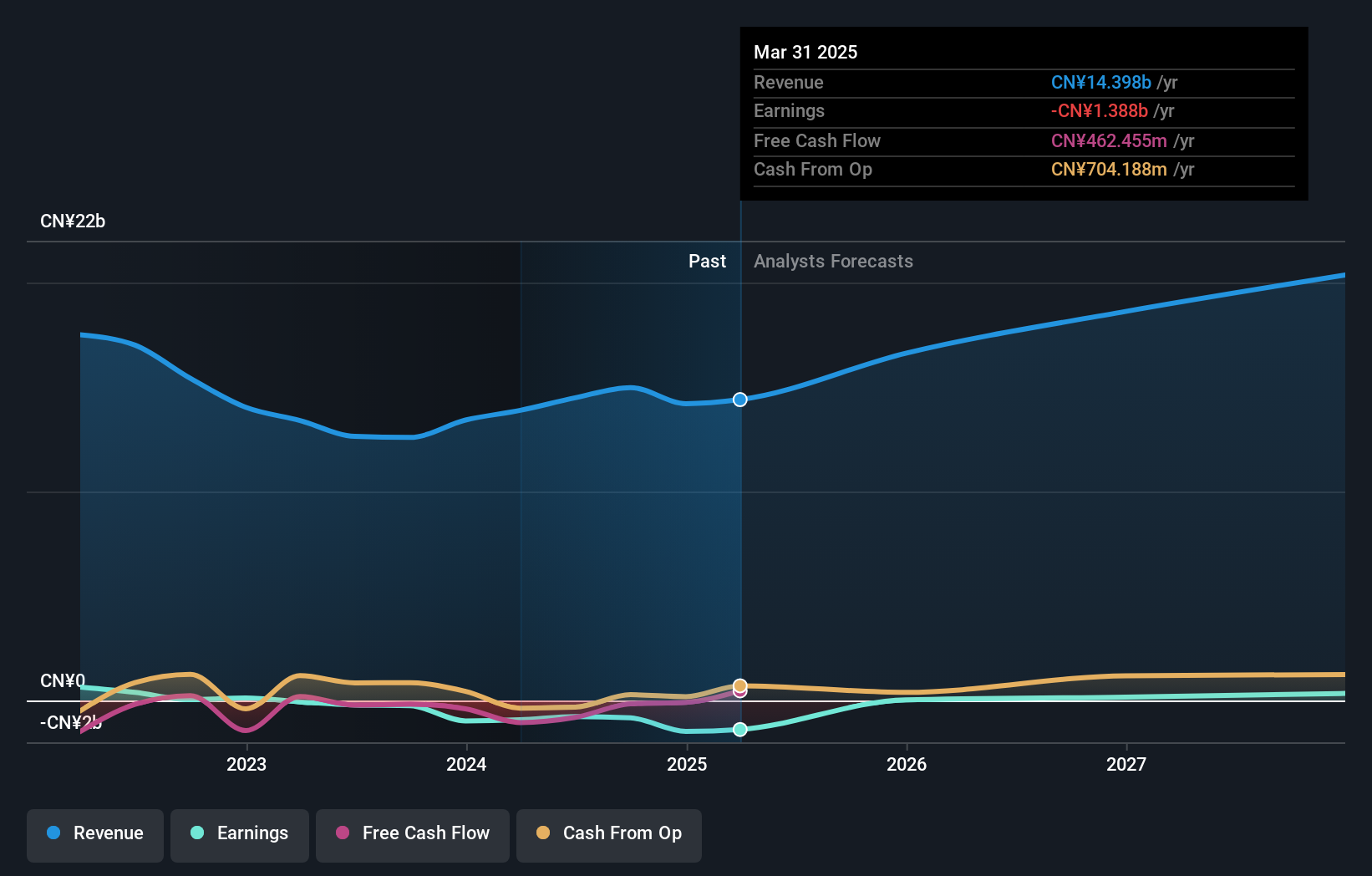

China Greatwall Technology Group has shown a promising uptick in revenue, reporting a 17.8% increase year-over-year, signaling robust market demand for its products. Despite current unprofitability with a net loss decreasing from CNY 830.92 million to CNY 687.64 million, the firm's strategic focus on AI-driven devices hints at potential shifts in its business trajectory. Impressively, earnings are forecasted to surge by 100.4% annually, reflecting strong future prospects as the company continues to innovate and expand its high-performance tech offerings like the GW Shiheng X AIGC workstation and ultra-light computing devices showcased recently.

- Click here to discover the nuances of China Greatwall Technology Group with our detailed analytical health report.

Understand China Greatwall Technology Group's track record by examining our Past report.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology INC. operates in the education and technology sector with a market capitalization of CN¥19.82 billion.

Operations: Doushen (Beijing) Education & Technology INC. focuses on the education and technology sectors, leveraging its expertise to generate revenue through various educational solutions and technological services.

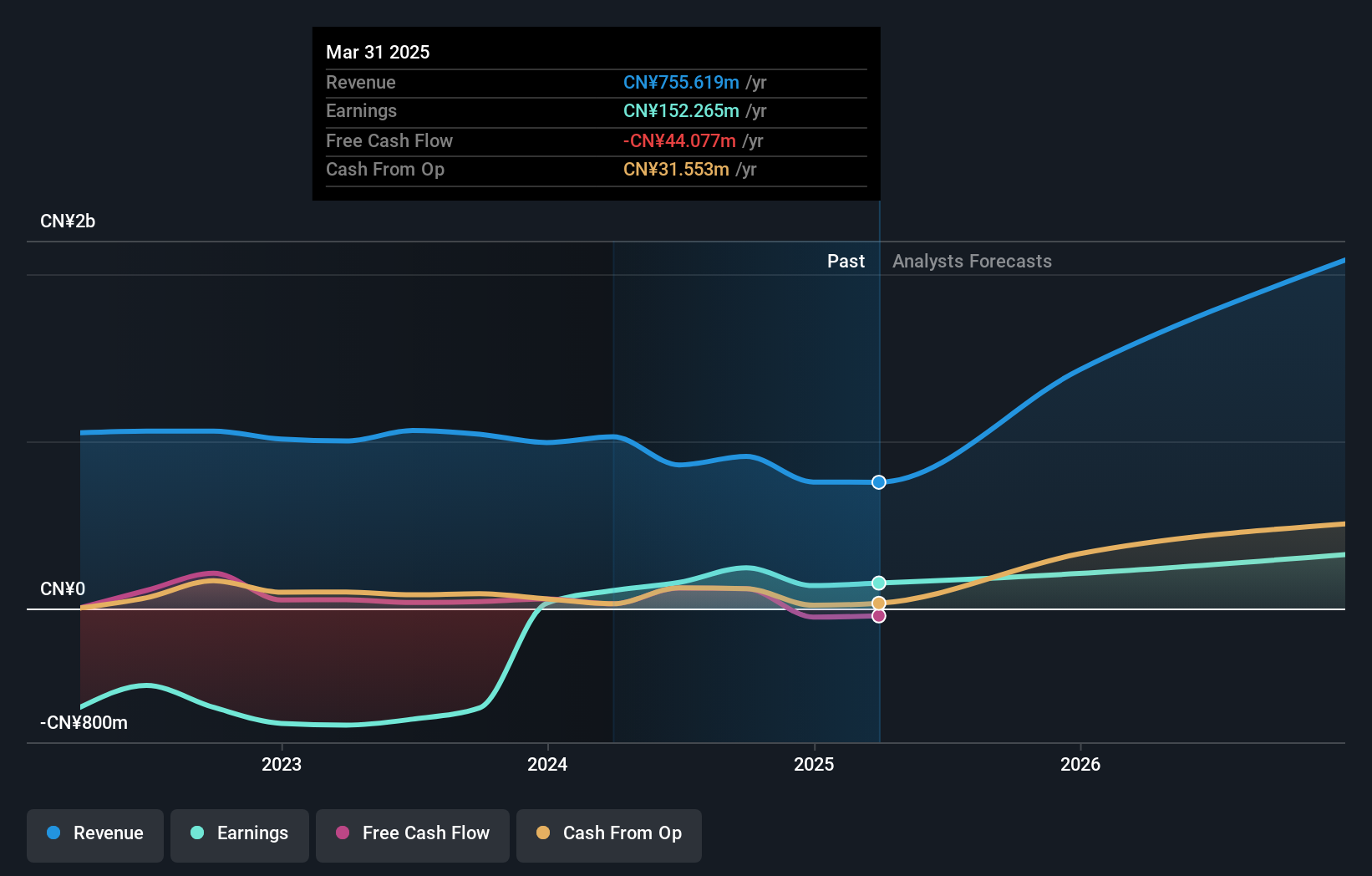

Doushen (Beijing) Education & Technology has made a notable turnaround, transitioning from a net loss to posting CNY 110.87 million in net income for the nine months ending September 2024. This shift is underscored by a robust projected annual revenue growth rate of 38.4%, significantly outpacing the broader Chinese market's growth expectation of 13.7%. While earnings are expected to climb at an annual rate of 23.8%, this figure slightly trails the market forecast of 24.6%. The company's commitment to innovation is evident in its R&D spending, which remains a critical focus as it seeks to sustain and build upon its recent profitability and market position enhancements, including being added to the S&P Global BMI Index—a testament to its evolving industry stature.

Key Takeaways

- Unlock our comprehensive list of 1281 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.