Stock Analysis

- China

- /

- Electrical

- /

- SZSE:300129

Sieyuan Electric Leads Three Growth Stocks With High Insider Ownership On The Chinese Exchange

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets and heightened trade tensions, China's equity landscape presents unique opportunities. The resilience of the Chinese market, particularly in sectors less impacted by international discord, highlights the potential value of growth companies with substantial insider ownership. These firms often demonstrate robust alignment between management’s interests and those of shareholders, which can be especially appealing in uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 26.5% |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Underneath we present a selection of stocks filtered out by our screen.

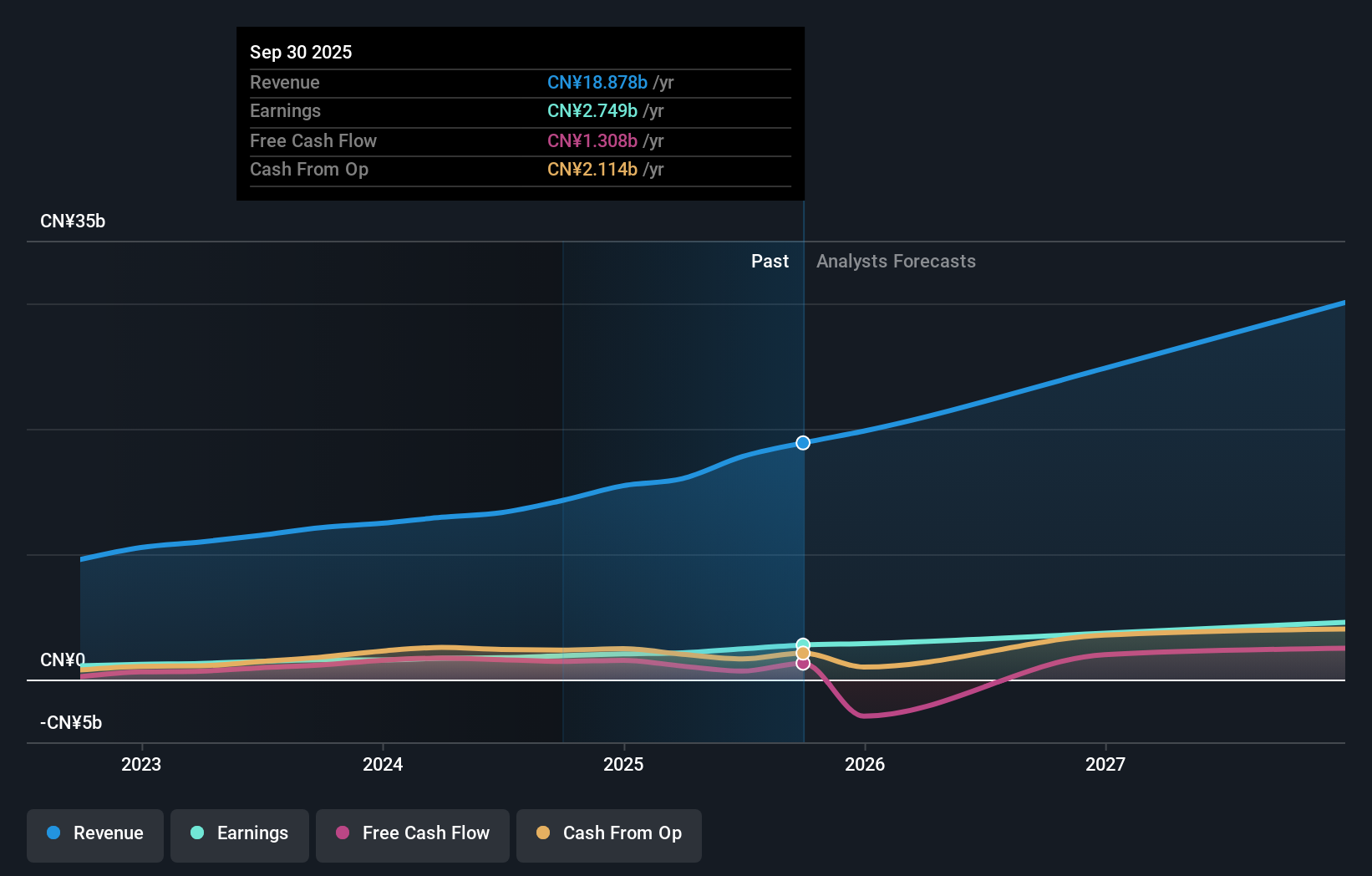

Sieyuan Electric (SZSE:002028)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sieyuan Electric Co., Ltd. specializes in the research, development, production, sale, and service of power transmission and distribution equipment both in China and globally, with a market capitalization of approximately CN¥47.49 billion.

Operations: The company generates CN¥13.32 billion in revenue from its transmission and distribution equipment segment.

Insider Ownership: 34.6%

Earnings Growth Forecast: 22.5% p.a.

Sieyuan Electric, despite a forecasted low Return on Equity of 19.1% in three years, shows promising growth prospects with earnings expected to rise by 22.5% annually, outpacing the broader Chinese market's 22.1%. The company’s recent performance underscores this potential; half-year sales reached CNY 6.17 billion, up from CNY 5.30 billion year-over-year, and net income increased to CNY 887.14 million from CNY 700.54 million. Additionally, Sieyuan has maintained competitive pricing with a Price-to-Earnings ratio slightly below the market average at 27.2x.

- Take a closer look at Sieyuan Electric's potential here in our earnings growth report.

- According our valuation report, there's an indication that Sieyuan Electric's share price might be on the expensive side.

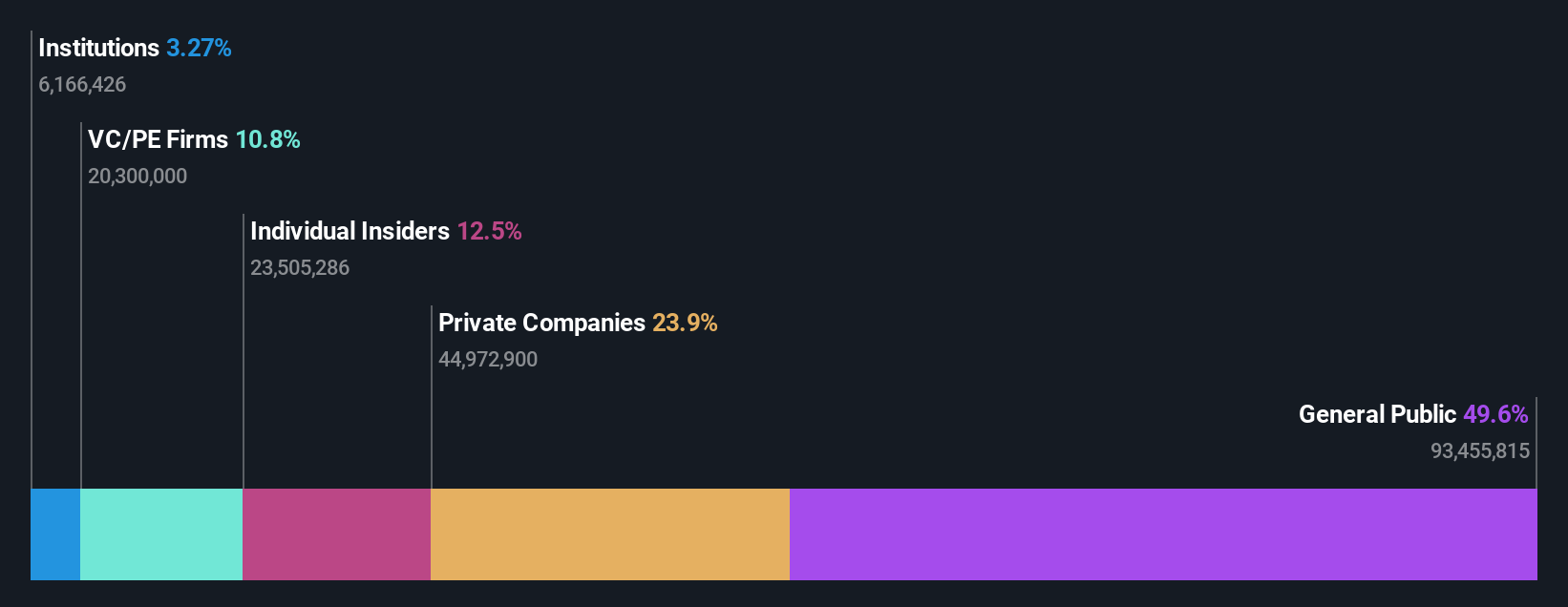

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector with a market capitalization of approximately CN¥3.31 billion.

Operations: The business overview does not provide specific revenue segment details for Jilin University Zhengyuan Information Technologies.

Insider Ownership: 12.4%

Earnings Growth Forecast: 78.9% p.a.

Jilin University Zhengyuan Information Technologies, while experiencing a highly volatile share price and recent exclusion from the S&P Global BMI Index, is projected to see substantial revenue growth at 42.3% annually. Despite a net loss in Q1 2024 and shareholder dilution over the past year, it is expected to turn profitable within three years. The company's forecasted Return on Equity remains modest at 18.7%, reflecting both challenges and growth potential in its operational strategy.

- Click here and access our complete growth analysis report to understand the dynamics of Jilin University Zhengyuan Information Technologies.

- The valuation report we've compiled suggests that Jilin University Zhengyuan Information Technologies' current price could be inflated.

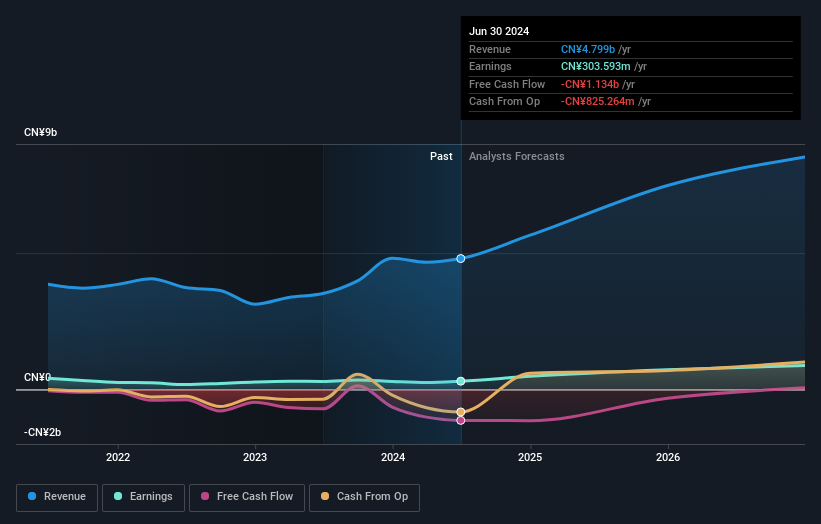

Shanghai Taisheng Wind Power Equipment (SZSE:300129)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Taisheng Wind Power Equipment Co., Ltd. specializes in the manufacture of wind power equipment and components, with a market capitalization of approximately CN¥6.06 billion.

Operations: The company generates revenue primarily from the manufacture of wind power equipment and components.

Insider Ownership: 11.3%

Earnings Growth Forecast: 39.5% p.a.

Shanghai Taisheng Wind Power Equipment, despite a recent dip in quarterly revenue and net income, is poised for significant growth with earnings forecasted to increase by 39.52% annually. The company's revenue growth is also expected to outpace the Chinese market average, expanding at 25.3% per year. However, its profit margins have decreased from last year, and its modest dividend yield of 0.77% is poorly covered by free cash flows, reflecting some financial vulnerabilities amidst its growth trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Shanghai Taisheng Wind Power Equipment.

- Our expertly prepared valuation report Shanghai Taisheng Wind Power Equipment implies its share price may be lower than expected.

Taking Advantage

- Reveal the 362 hidden gems among our Fast Growing Chinese Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300129

Shanghai Taisheng Wind Power Equipment

Shanghai Taisheng Wind Power Equipment Co., Ltd.

High growth potential with adequate balance sheet.