Jilin University Zhengyuan Information Technologies Co., Ltd. (SZSE:003029) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

Jilin University Zhengyuan Information Technologies Co., Ltd. (SZSE:003029) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

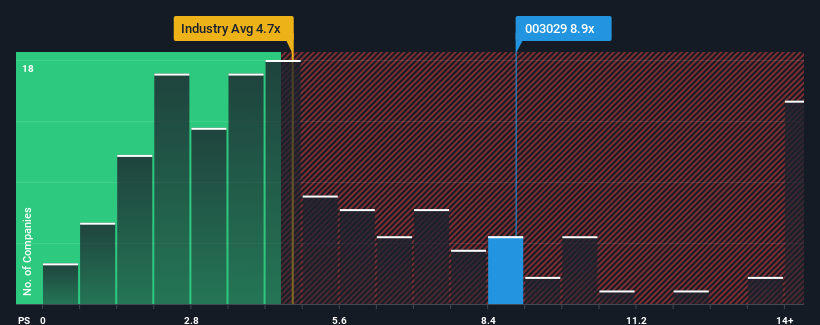

In spite of the heavy fall in price, Jilin University Zhengyuan Information Technologies may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.9x, when you consider almost half of the companies in the Software industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Jilin University Zhengyuan Information Technologies

How Jilin University Zhengyuan Information Technologies Has Been Performing

While the industry has experienced revenue growth lately, Jilin University Zhengyuan Information Technologies' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Jilin University Zhengyuan Information Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Jilin University Zhengyuan Information Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin University Zhengyuan Information Technologies' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. As a result, revenue from three years ago have also fallen 36% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 166% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 30%, the company is positioned for a stronger revenue result.

With this information, we can see why Jilin University Zhengyuan Information Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Jilin University Zhengyuan Information Technologies' P/S Mean For Investors?

Even after such a strong price drop, Jilin University Zhengyuan Information Technologies' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Jilin University Zhengyuan Information Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Jilin University Zhengyuan Information Technologies (1 is a bit unpleasant!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003029

Jilin University Zhengyuan Information Technologies

Jilin University Zhengyuan Information Technologies Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives