Sichuan Jiuyuan Yinhai Software.Co.,Ltd's (SZSE:002777) Shares Leap 26% Yet They're Still Not Telling The Full Story

Those holding Sichuan Jiuyuan Yinhai Software.Co.,Ltd (SZSE:002777) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

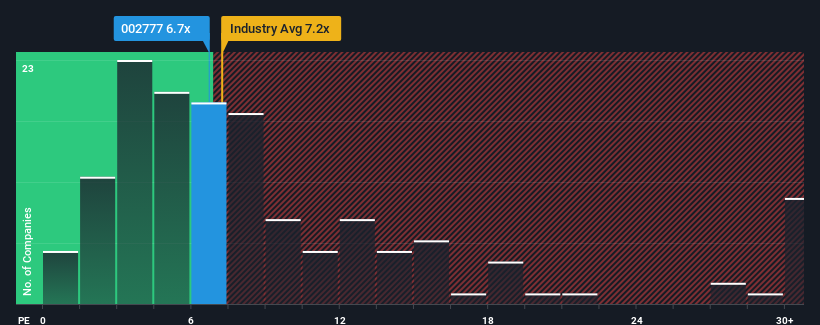

Even after such a large jump in price, there still wouldn't be many who think Sichuan Jiuyuan Yinhai Software.Co.Ltd's price-to-sales (or "P/S") ratio of 6.7x is worth a mention when the median P/S in China's Software industry is similar at about 7.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Sichuan Jiuyuan Yinhai Software.Co.Ltd

What Does Sichuan Jiuyuan Yinhai Software.Co.Ltd's P/S Mean For Shareholders?

Sichuan Jiuyuan Yinhai Software.Co.Ltd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sichuan Jiuyuan Yinhai Software.Co.Ltd.Is There Some Revenue Growth Forecasted For Sichuan Jiuyuan Yinhai Software.Co.Ltd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sichuan Jiuyuan Yinhai Software.Co.Ltd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. As a result, revenue from three years ago have also fallen 5.7% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 36% over the next year. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Sichuan Jiuyuan Yinhai Software.Co.Ltd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Sichuan Jiuyuan Yinhai Software.Co.Ltd's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Sichuan Jiuyuan Yinhai Software.Co.Ltd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Sichuan Jiuyuan Yinhai Software.Co.Ltd that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002777

Sichuan Jiuyuan Yinhai Software.Co.Ltd

Provides medical insurance, digital government affairs, and smart cities services for government departments and industry ecosystem entities in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives