Improved Revenues Required Before Venustech Group Inc. (SZSE:002439) Stock's 29% Jump Looks Justified

Venustech Group Inc. (SZSE:002439) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

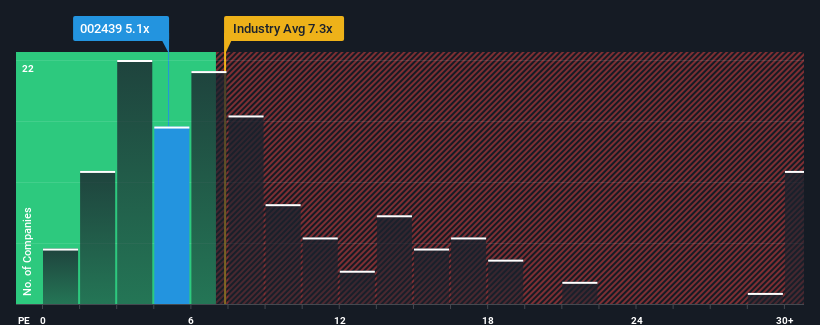

Although its price has surged higher, Venustech Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 5.1x, since almost half of all companies in the Software industry in China have P/S ratios greater than 7.3x and even P/S higher than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Venustech Group

How Has Venustech Group Performed Recently?

Venustech Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Venustech Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Venustech Group?

In order to justify its P/S ratio, Venustech Group would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 12% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 24% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Venustech Group's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Venustech Group's P/S?

The latest share price surge wasn't enough to lift Venustech Group's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Venustech Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with Venustech Group (including 1 which shouldn't be ignored).

If you're unsure about the strength of Venustech Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives