- China

- /

- Entertainment

- /

- SZSE:002624

Ecovacs Robotics And 2 Other Chinese Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, Chinese equities have shown a modest uptick, buoyed by the U.S. Federal Reserve's interest rate cuts despite some disappointing economic data. This environment presents an intriguing opportunity for investors to explore stocks that may be undervalued relative to their intrinsic value. Identifying stocks that are trading below their intrinsic value can be particularly rewarding in such market conditions, as these investments often have strong fundamentals and potential for growth once the broader economic sentiment improves.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningxia Baofeng Energy Group (SHSE:600989) | CN¥14.68 | CN¥28.75 | 48.9% |

| Beijing SDL TechnologyLtd (SZSE:002658) | CN¥5.47 | CN¥10.56 | 48.2% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥31.96 | CN¥63.70 | 49.8% |

| NBTM New Materials Group (SHSE:600114) | CN¥13.34 | CN¥26.52 | 49.7% |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥138.28 | CN¥272.23 | 49.2% |

| Jiangsu Gian Technology (SZSE:300709) | CN¥28.70 | CN¥55.28 | 48.1% |

| Jiangsu Hongdou IndustrialLTD (SHSE:600400) | CN¥2.07 | CN¥4.08 | 49.2% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.05 | CN¥13.97 | 49.5% |

| Jiugui Liquor (SZSE:000799) | CN¥37.85 | CN¥73.92 | 48.8% |

| Cybrid Technologies (SHSE:603212) | CN¥9.63 | CN¥18.88 | 49% |

We'll examine a selection from our screener results.

Ecovacs Robotics (SHSE:603486)

Overview: Ecovacs Robotics Co., Ltd. is involved in the research, development, design, manufacture, and sale of robotic products in China and has a market cap of CN¥23.99 billion.

Operations: Ecovacs Robotics generates revenue from the research, development, design, manufacture, and sale of robotic products within China.

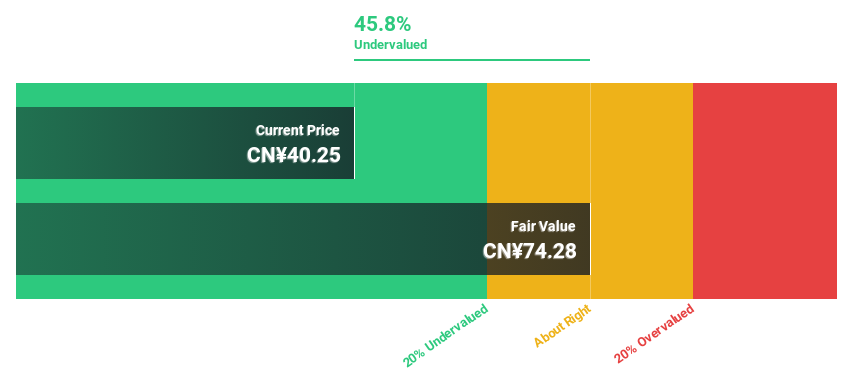

Estimated Discount To Fair Value: 43.4%

Ecovacs Robotics is trading at CN¥42.14, significantly below its estimated fair value of CN¥74.4, indicating potential undervaluation based on cash flows. Despite a slight decline in revenue from last year (CN¥6.98 billion vs. CN¥7.14 billion), net income increased to CN¥608.98 million from CN¥584.08 million, and earnings per share improved marginally, reflecting strong cash flow management and profitability prospects with expected annual profit growth of 34%.

- Our comprehensive growth report raises the possibility that Ecovacs Robotics is poised for substantial financial growth.

- Navigate through the intricacies of Ecovacs Robotics with our comprehensive financial health report here.

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services and solutions globally, with a market cap of CN¥16.15 billion.

Operations: The company generates revenue primarily from Information Network Security, amounting to CN¥4.53 billion.

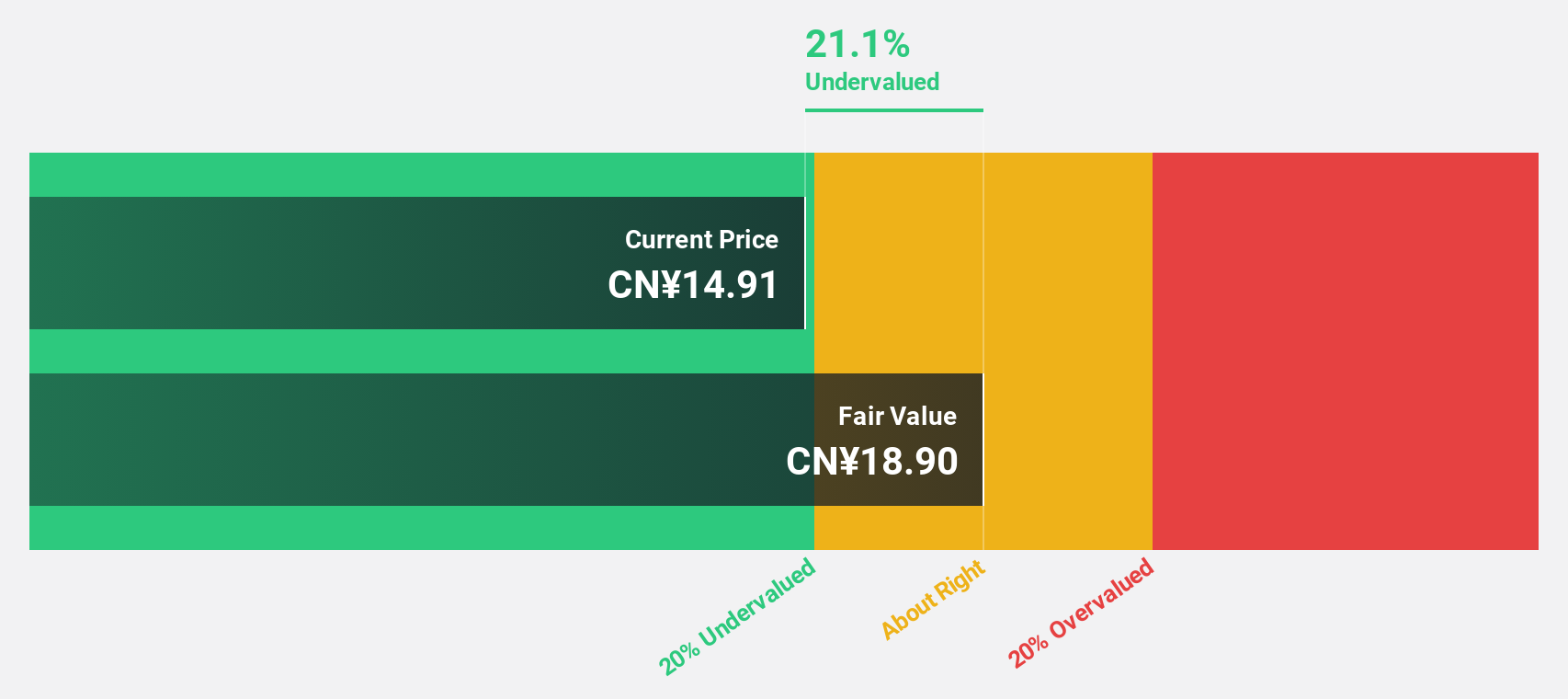

Estimated Discount To Fair Value: 37%

Venustech Group is trading at CN¥13.34, significantly below its estimated fair value of CN¥21.19, suggesting undervaluation based on cash flows. Despite an increase in revenue to CN¥1.57 billion for the half year ended June 30, 2024, the company reported a net loss of CN¥182.25 million compared to a net income of CN¥184.84 million last year. Earnings are forecast to grow 28.45% annually over the next three years, outpacing market expectations.

- Our growth report here indicates Venustech Group may be poised for an improving outlook.

- Click here to discover the nuances of Venustech Group with our detailed financial health report.

Perfect World (SZSE:002624)

Overview: Perfect World Co., Ltd. operates in the online games and movies and television sectors in China, with a market cap of CN¥15.98 billion.

Operations: The company's revenue segments include online games and movies and television businesses in China.

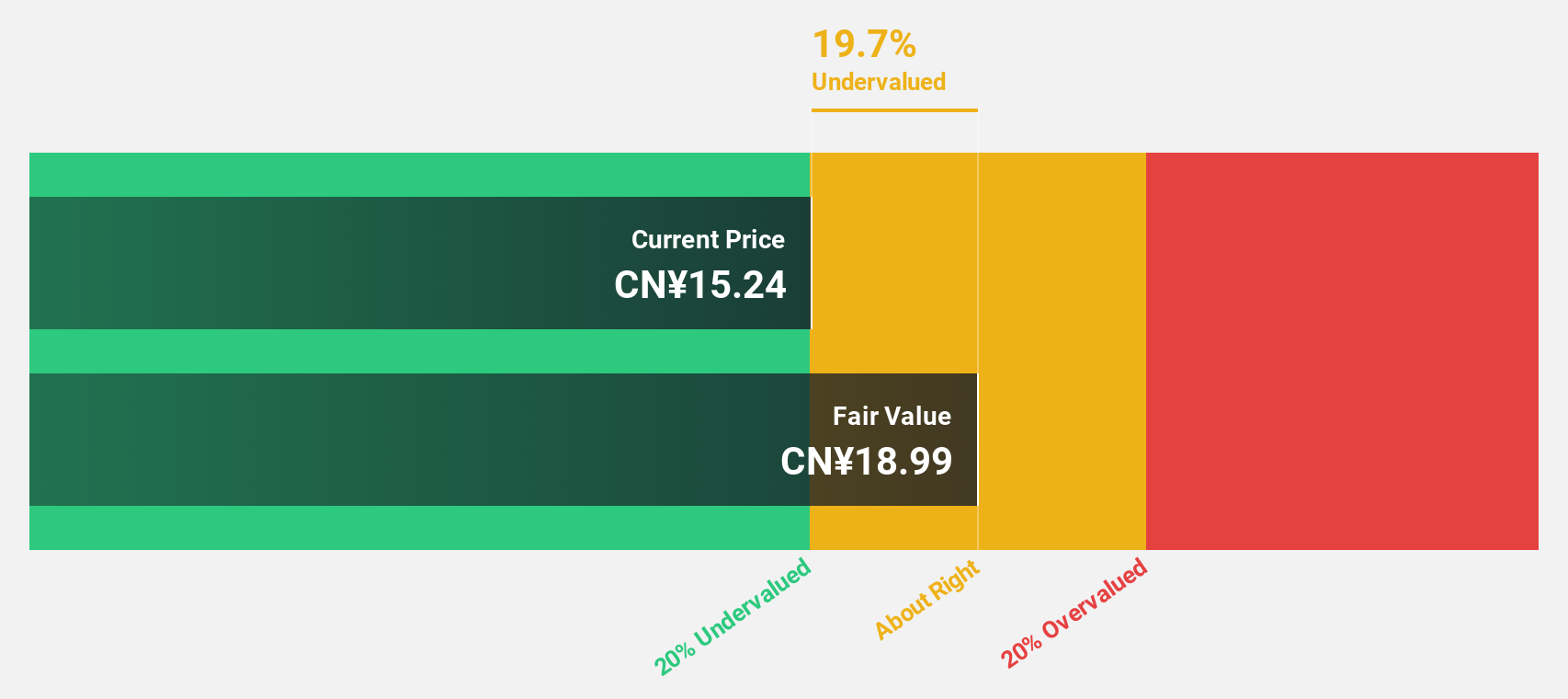

Estimated Discount To Fair Value: 31.2%

Perfect World, trading at CN¥8.03, is significantly undervalued based on cash flows with an estimated fair value of CN¥11.68. Despite recent earnings showing a net loss of CN¥176.86 million for the half year ended June 30, 2024, compared to a net income of CN¥379.93 million last year, revenue growth is expected to outpace the market at 16.8% annually. Earnings are forecast to grow substantially by 81.5% per year over the next three years.

- Our expertly prepared growth report on Perfect World implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Perfect World stock in this financial health report.

Make It Happen

- Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 115 more companies for you to explore.Click here to unveil our expertly curated list of 118 Undervalued Chinese Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002624

Perfect World

Engages in the online games, and movies and television businesses in China.

Undervalued with excellent balance sheet.