Investors Still Aren't Entirely Convinced By Nanjing Sciyon Wisdom Technology Group Co., Ltd.'s (SZSE:002380) Revenues Despite 26% Price Jump

Nanjing Sciyon Wisdom Technology Group Co., Ltd. (SZSE:002380) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 88% in the last year.

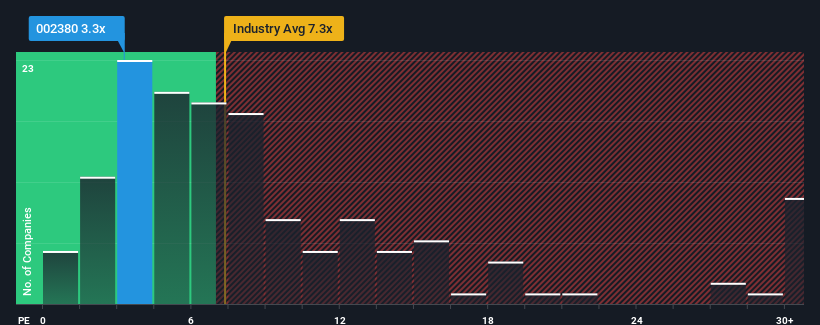

Although its price has surged higher, Nanjing Sciyon Wisdom Technology Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.3x, since almost half of all companies in the Software industry in China have P/S ratios greater than 7.3x and even P/S higher than 14x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nanjing Sciyon Wisdom Technology Group

How Nanjing Sciyon Wisdom Technology Group Has Been Performing

With revenue growth that's superior to most other companies of late, Nanjing Sciyon Wisdom Technology Group has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Nanjing Sciyon Wisdom Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Nanjing Sciyon Wisdom Technology Group's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Pleasingly, revenue has also lifted 60% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Nanjing Sciyon Wisdom Technology Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Nanjing Sciyon Wisdom Technology Group's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Nanjing Sciyon Wisdom Technology Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Nanjing Sciyon Wisdom Technology Group with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Sciyon Wisdom Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002380

Nanjing Sciyon Wisdom Technology Group

Nanjing Sciyon Wisdom Technology Group Co., Ltd.

Undervalued with solid track record.

Market Insights

Community Narratives