Topsec Technologies Group Inc. (SZSE:002212) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Topsec Technologies Group Inc. (SZSE:002212) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

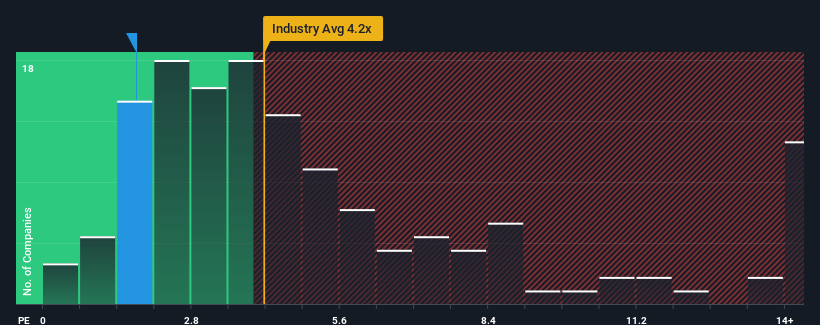

Since its price has dipped substantially, Topsec Technologies Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.8x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 4.2x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Topsec Technologies Group

What Does Topsec Technologies Group's P/S Mean For Shareholders?

Recent times have been advantageous for Topsec Technologies Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Topsec Technologies Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Topsec Technologies Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 43% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 42% as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 28% growth forecast for the broader industry.

With this information, we find it odd that Topsec Technologies Group is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Shares in Topsec Technologies Group have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Topsec Technologies Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Topsec Technologies Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002212

Topsec Technologies Group

Provides network security and intelligent cloud solutions for basic networks, industrial internet, internet of vehicles, and internet of things in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives