Montnets Cloud Technology Group Co., Ltd.'s (SZSE:002123) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Montnets Cloud Technology Group Co., Ltd. (SZSE:002123) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

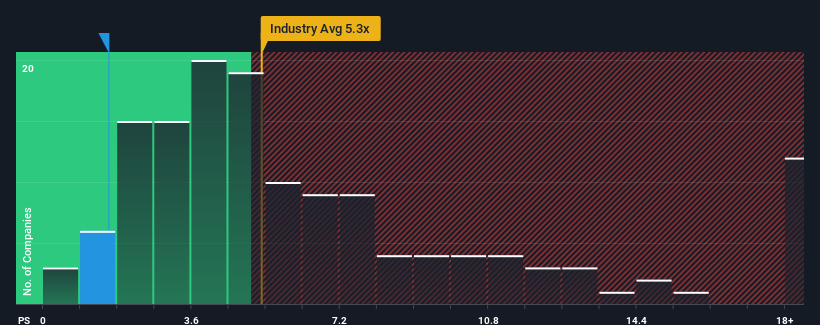

Even after such a large jump in price, Montnets Cloud Technology Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.3x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Montnets Cloud Technology Group

What Does Montnets Cloud Technology Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Montnets Cloud Technology Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Montnets Cloud Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Montnets Cloud Technology Group's Revenue Growth Trending?

In order to justify its P/S ratio, Montnets Cloud Technology Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The latest three year period has also seen an excellent 64% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 33%, which is noticeably more attractive.

With this in consideration, its clear as to why Montnets Cloud Technology Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Montnets Cloud Technology Group's P/S Mean For Investors?

Shares in Montnets Cloud Technology Group have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Montnets Cloud Technology Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Montnets Cloud Technology Group with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002123

Montnets Cloud Technology Group

Montnets Cloud Technology Group Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives