Newland Digital Technology Co.,Ltd.'s (SZSE:000997) Price Is Right But Growth Is Lacking After Shares Rocket 28%

The Newland Digital Technology Co.,Ltd. (SZSE:000997) share price has done very well over the last month, posting an excellent gain of 28%. The last 30 days bring the annual gain to a very sharp 35%.

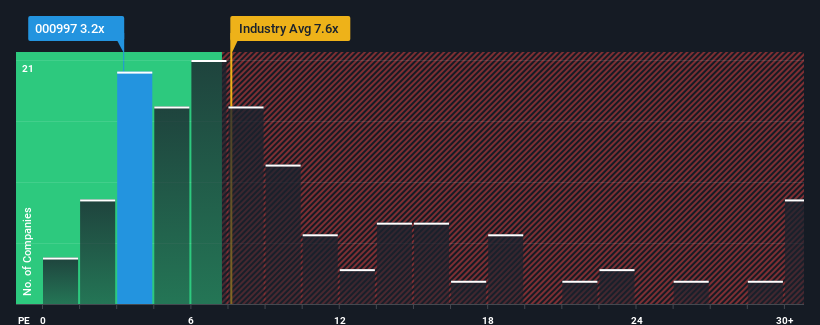

In spite of the firm bounce in price, Newland Digital TechnologyLtd may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 7.6x and even P/S higher than 14x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Newland Digital TechnologyLtd

How Newland Digital TechnologyLtd Has Been Performing

Recent revenue growth for Newland Digital TechnologyLtd has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Newland Digital TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Newland Digital TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. The solid recent performance means it was also able to grow revenue by 5.2% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

With this information, we can see why Newland Digital TechnologyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Newland Digital TechnologyLtd have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Newland Digital TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Newland Digital TechnologyLtd that you should be aware of.

If these risks are making you reconsider your opinion on Newland Digital TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Newland Digital TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000997

Newland Digital TechnologyLtd

Engages in the design, development, sales, operation, and maintenance of financial POS terminal equipment in China.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives