Newland Digital Technology Co.,Ltd. (SZSE:000997) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Newland Digital Technology Co.,Ltd. (SZSE:000997) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

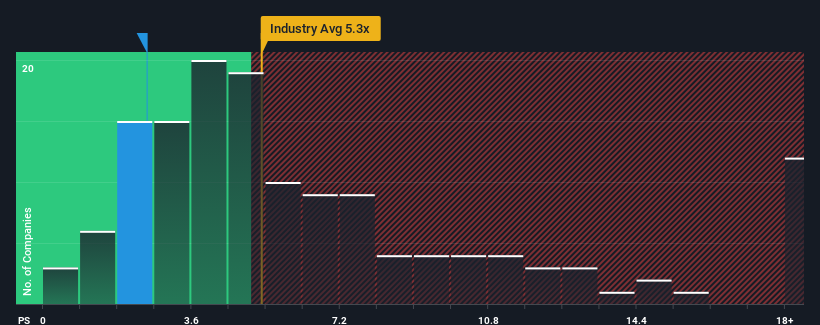

Although its price has surged higher, Newland Digital TechnologyLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.3x and even P/S higher than 9x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Newland Digital TechnologyLtd

What Does Newland Digital TechnologyLtd's Recent Performance Look Like?

Newland Digital TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Newland Digital TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Newland Digital TechnologyLtd's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the four analysts following the company. With the industry predicted to deliver 33% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Newland Digital TechnologyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Newland Digital TechnologyLtd's P/S Mean For Investors?

Shares in Newland Digital TechnologyLtd have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Newland Digital TechnologyLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Newland Digital TechnologyLtd that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Newland Digital TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000997

Newland Digital TechnologyLtd

Engages in the design, development, sales, operation, and maintenance of financial POS terminal equipment in China.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives