Stock Analysis

ZJBC Information Technology (SZSE:000889 investor five-year losses grow to 81% as the stock sheds CN¥290m this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding ZJBC Information Technology Co., Ltd (SZSE:000889) during the five years that saw its share price drop a whopping 81%. And the share price decline continued over the last week, dropping some 15%. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for ZJBC Information Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for ZJBC Information Technology

Given that ZJBC Information Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade ZJBC Information Technology reduced its trailing twelve month revenue by 20% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 13% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

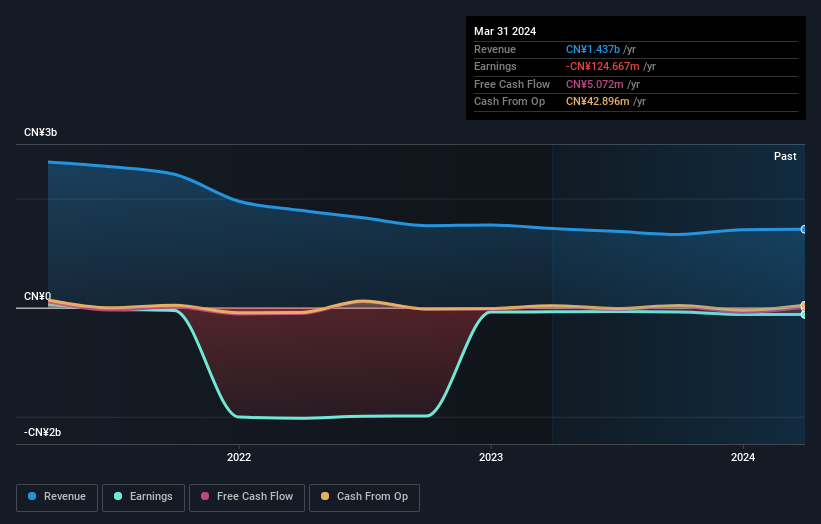

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While it's certainly disappointing to see that ZJBC Information Technology shares lost 6.1% throughout the year, that wasn't as bad as the market loss of 14%. What is more upsetting is the 13% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand ZJBC Information Technology better, we need to consider many other factors. For instance, we've identified 2 warning signs for ZJBC Information Technology (1 is potentially serious) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether ZJBC Information Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether ZJBC Information Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000889

ZJBC Information Technology

Through its subsidiaries, primarily provides information intelligent transmission services in China.

Adequate balance sheet and slightly overvalued.