Shanghai Hollywave Electronic System's (SHSE:688682) Weak Earnings May Only Reveal A Part Of The Whole Picture

Shanghai Hollywave Electronic System Co., Ltd.'s (SHSE:688682) stock showed strength, with investors undeterred by its weak earnings report. Sometimes, shareholders are willing to ignore soft numbers with the hope that they will improve, but our analysis suggests this is unlikely for Shanghai Hollywave Electronic System.

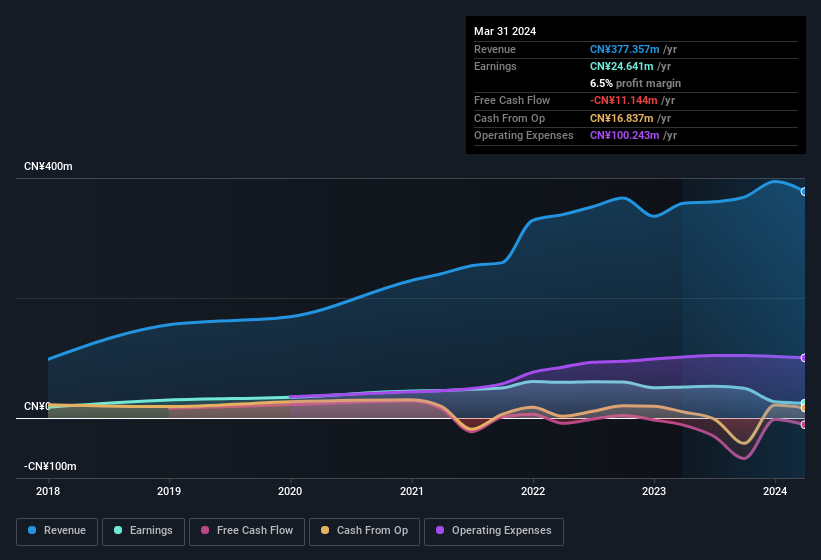

View our latest analysis for Shanghai Hollywave Electronic System

An Unusual Tax Situation

Shanghai Hollywave Electronic System reported a tax benefit of CN¥7.1m, which is well worth noting. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shanghai Hollywave Electronic System.

Our Take On Shanghai Hollywave Electronic System's Profit Performance

Shanghai Hollywave Electronic System reported that it received a tax benefit, rather than paid tax, in its last report. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that Shanghai Hollywave Electronic System's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've found that Shanghai Hollywave Electronic System has 3 warning signs (1 shouldn't be ignored!) that deserve your attention before going any further with your analysis.

Today we've zoomed in on a single data point to better understand the nature of Shanghai Hollywave Electronic System's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688682

Shanghai Hollywave Electronic System

Shanghai Hollywave Electronic System Co., Ltd.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success