- Sweden

- /

- Entertainment

- /

- OM:HACK

Exploring Three High Growth Tech Stocks with Global Potential

Reviewed by Simply Wall St

Amid a mixed performance in global markets, where large-cap tech stocks have driven gains while smaller-cap indexes like the S&P 600 have faced declines, investors are keenly observing the impact of economic indicators such as interest rate adjustments and trade agreements on market sentiment. In this environment, identifying high-growth tech stocks with global potential involves looking for companies that can leverage technological advancements and international opportunities to navigate these complex conditions effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Pharma Mar | 26.56% | 58.15% | ★★★★★★ |

| Fositek | 37.51% | 48.52% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Hacksaw (OM:HACK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hacksaw AB (publ) is a B2B technology platform and game development company operating in Sweden and the Czech Republic, with a market cap of SEK21.18 billion.

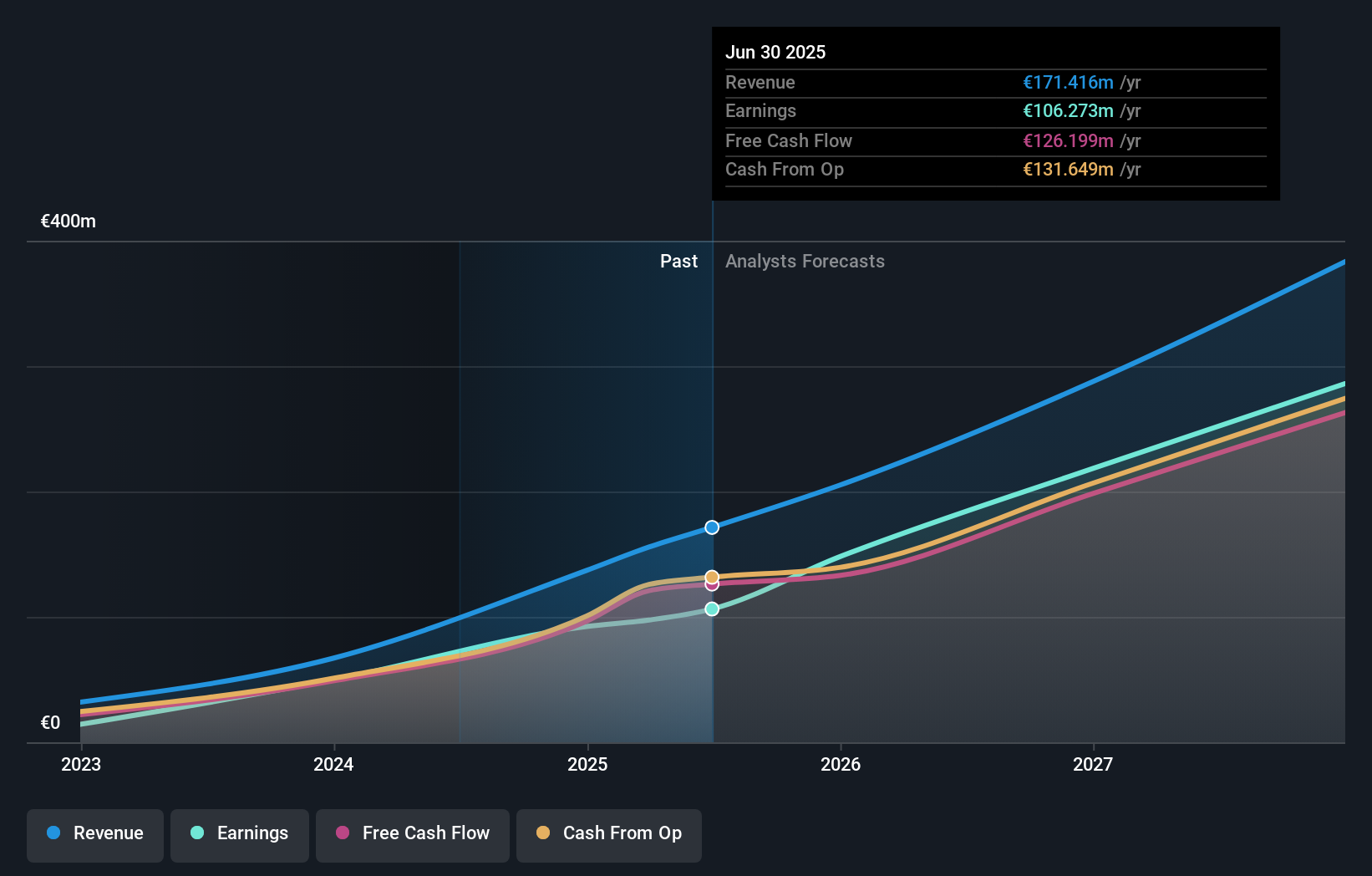

Operations: The company generates revenue primarily by providing online casino solutions and related services to gaming operators, amounting to €171.42 million.

Hacksaw's recent performance underscores its robust position in the tech sector, with a year-over-year revenue surge to EUR 142.38 million and net income climbing to EUR 91.59 million, reflecting annualized growth rates of 26% and 37.6%, respectively. These figures are significantly above the Swedish market averages, demonstrating Hacksaw's ability to outperform in a competitive landscape. The company’s strategic expansion into the Czech Republic through a partnership with Apollo Games Casino not only diversifies its European market presence but also enhances its product accessibility, aligning with industry trends towards localized gaming experiences. Moreover, strengthening ties with William Hill by broadening their game offerings highlights Hacksaw’s commitment to innovation and customer engagement in key markets like the UK, promising continued growth and market penetration.

- Navigate through the intricacies of Hacksaw with our comprehensive health report here.

Examine Hacksaw's past performance report to understand how it has performed in the past.

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. offers collaborative management software, solutions, platforms, and cloud services to organizational customers in China with a market cap of CN¥2.92 billion.

Operations: The company generates revenue through its suite of collaborative management software, solutions, platforms, and cloud services tailored for organizational clients in China. It operates within the technology sector, focusing on enhancing business processes and communication within enterprises.

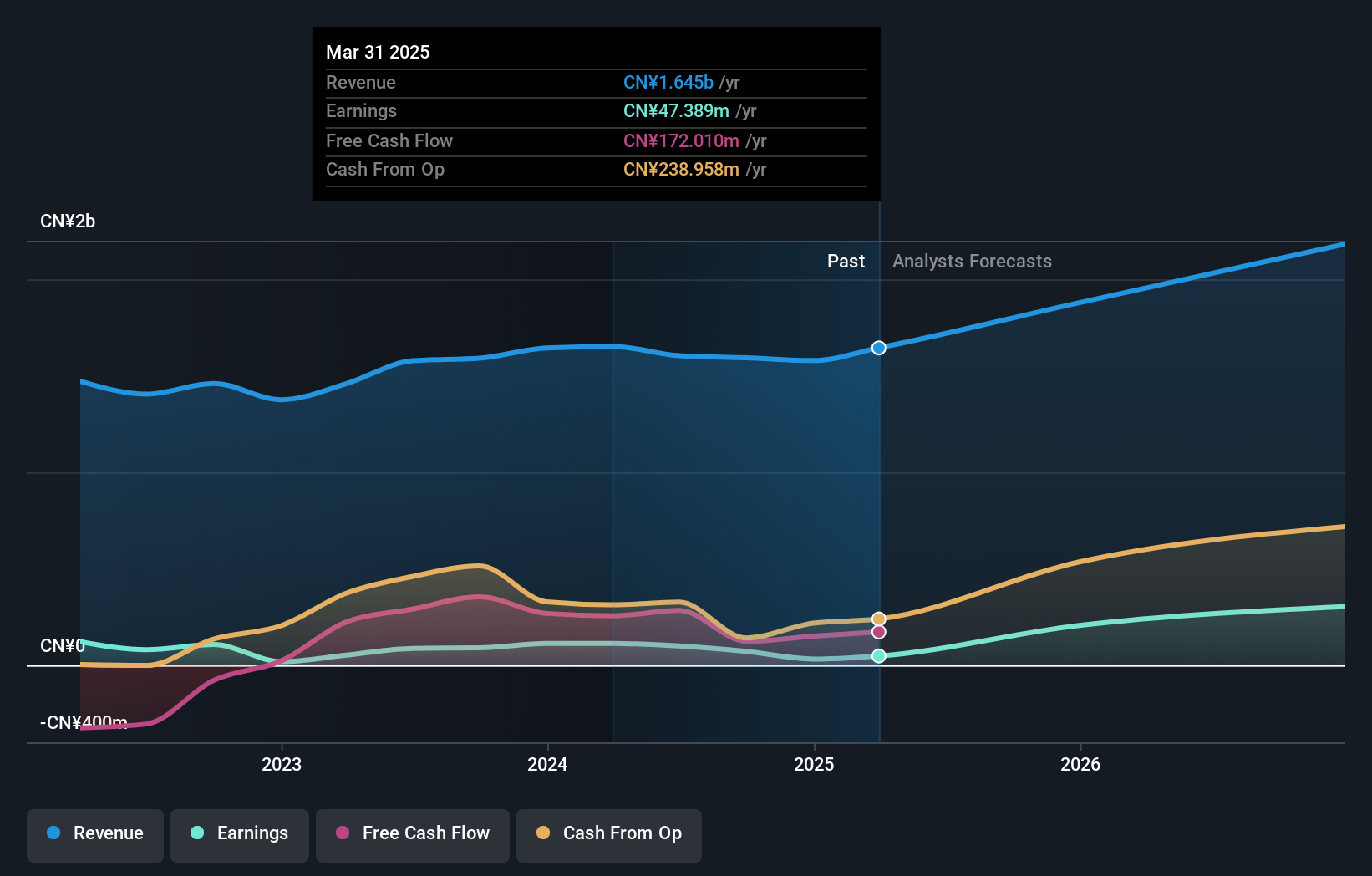

BeiJing Seeyon Internet Software, despite recent financial setbacks with a reported net loss of CNY 219.04 million for the nine months ending September 2025, demonstrates potential for recovery with projected annual revenue growth at 15.1%. This figure surpasses the Chinese market average of 14.3%, indicating resilience and adaptability in a challenging environment. The company's commitment to innovation is evident from its R&D investments, crucial for maintaining competitiveness in the fast-evolving tech landscape. As it navigates through its financial difficulties, BeiJing Seeyon's strategic focus on development could position it favorably for future profitability, expected to materialize within the next three years with an anticipated earnings growth of 117.35% per annum.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. operates in the technology sector, focusing on intelligent parking management systems and related services, with a market cap of CN¥6.29 billion.

Operations: Jieshun focuses on intelligent parking management systems, generating revenue primarily from the sale and service of these systems. The company has a market cap of CN¥6.29 billion.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. has demonstrated robust growth, with a notable 18.7% increase in annual revenue, outpacing the Chinese market average of 14.3%. This growth is supported by a significant rise in earnings, forecasted to expand by 51.5% annually. The firm's commitment to innovation is reflected in its R&D spending trends which are strategically aligned with its expanding business scope, as evidenced by recent corporate amendments aimed at enhancing operational capabilities and governance structures. These financial and strategic developments suggest a promising trajectory for Shenzhen Jieshun in the competitive tech landscape.

Turning Ideas Into Actions

- Navigate through the entire inventory of 233 Global High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hacksaw might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HACK

Hacksaw

Operates as a B2B technology platform and game development company in Sweden and Czech Republic.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives