Why Investors Shouldn't Be Surprised By Bonree Data Technology Co., Ltd's (SHSE:688229) 29% Share Price Surge

Bonree Data Technology Co., Ltd (SHSE:688229) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

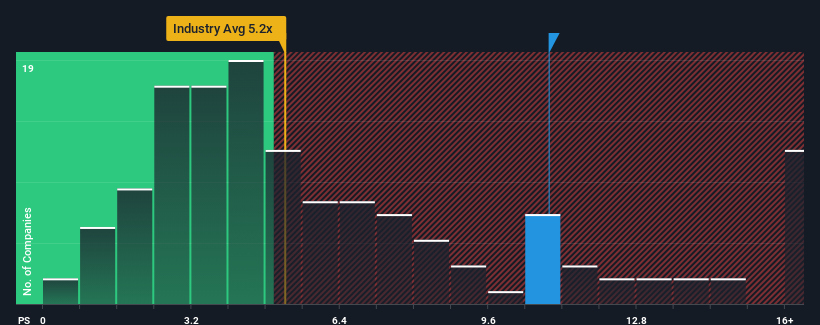

After such a large jump in price, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider Bonree Data Technology as a stock not worth researching with its 10.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Bonree Data Technology

What Does Bonree Data Technology's Recent Performance Look Like?

There hasn't been much to differentiate Bonree Data Technology's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bonree Data Technology.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bonree Data Technology's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.0% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 10% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 33% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Bonree Data Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Bonree Data Technology's P/S Mean For Investors?

The strong share price surge has lead to Bonree Data Technology's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bonree Data Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for Bonree Data Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bonree Data Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688229

Bonree Data Technology

Provides application performance management services for enterprises in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives