Even With A 38% Surge, Cautious Investors Are Not Rewarding Asiainfo Security Technologies Co.,Ltd.'s (SHSE:688225) Performance Completely

Asiainfo Security Technologies Co.,Ltd. (SHSE:688225) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

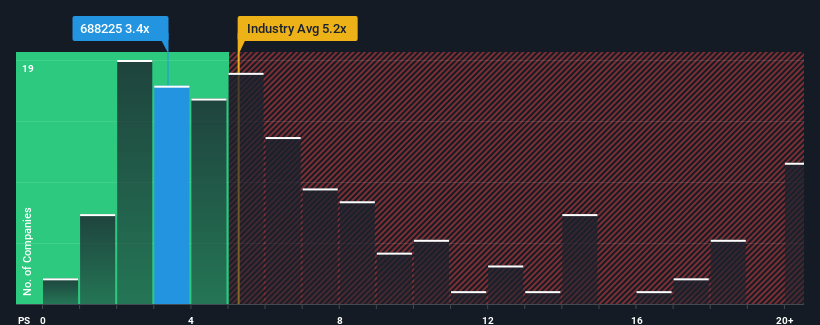

Even after such a large jump in price, Asiainfo Security TechnologiesLtd's price-to-sales (or "P/S") ratio of 3.4x might still make it look like a buy right now compared to the Software industry in China, where around half of the companies have P/S ratios above 5.2x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Asiainfo Security TechnologiesLtd

How Has Asiainfo Security TechnologiesLtd Performed Recently?

Asiainfo Security TechnologiesLtd's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Asiainfo Security TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Asiainfo Security TechnologiesLtd?

The only time you'd be truly comfortable seeing a P/S as low as Asiainfo Security TechnologiesLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 22% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 26% over the next year. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Asiainfo Security TechnologiesLtd's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Asiainfo Security TechnologiesLtd's P/S Mean For Investors?

Despite Asiainfo Security TechnologiesLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Asiainfo Security TechnologiesLtd currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Asiainfo Security TechnologiesLtd that you should be aware of.

If these risks are making you reconsider your opinion on Asiainfo Security TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688225

Asiainfo Security TechnologiesLtd

Provides network security software in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives