Investors Give Beijing Infosec Technologies Co.,Ltd (SHSE:688201) Shares A 28% Hiding

Beijing Infosec Technologies Co.,Ltd (SHSE:688201) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

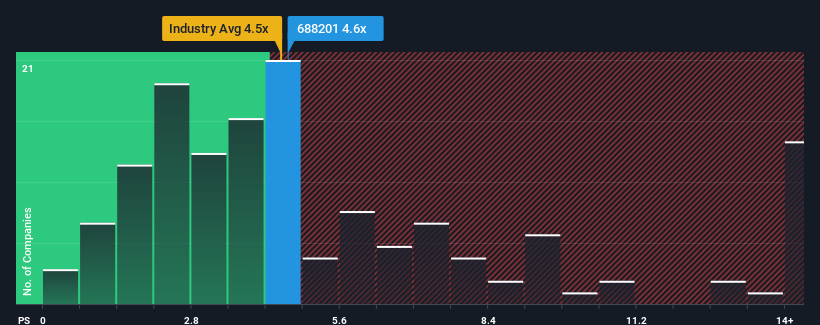

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Beijing Infosec TechnologiesLtd's P/S ratio of 4.6x, since the median price-to-sales (or "P/S") ratio for the Software industry in China is also close to 4.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beijing Infosec TechnologiesLtd

What Does Beijing Infosec TechnologiesLtd's P/S Mean For Shareholders?

Beijing Infosec TechnologiesLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Beijing Infosec TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Beijing Infosec TechnologiesLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 82% over the next year. With the industry only predicted to deliver 30%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Beijing Infosec TechnologiesLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Beijing Infosec TechnologiesLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Beijing Infosec TechnologiesLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Beijing Infosec TechnologiesLtd (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives