Beijing Infosec Technologies Co.,Ltd (SHSE:688201) Looks Just Right With A 37% Price Jump

Beijing Infosec Technologies Co.,Ltd (SHSE:688201) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

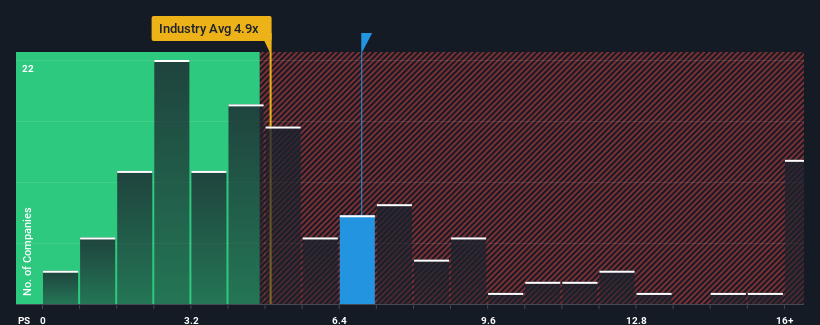

Following the firm bounce in price, Beijing Infosec TechnologiesLtd may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.9x, since almost half of all companies in the Software in China have P/S ratios under 4.9x and even P/S lower than 2x are not unusual. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing Infosec TechnologiesLtd

How Beijing Infosec TechnologiesLtd Has Been Performing

Beijing Infosec TechnologiesLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Infosec TechnologiesLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Beijing Infosec TechnologiesLtd would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 35% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 78% as estimated by the two analysts watching the company. With the industry only predicted to deliver 32%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Beijing Infosec TechnologiesLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Beijing Infosec TechnologiesLtd's P/S

The large bounce in Beijing Infosec TechnologiesLtd's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Beijing Infosec TechnologiesLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for Beijing Infosec TechnologiesLtd (1 is potentially serious!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Beijing Infosec TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives