BeijingABT NetworksLtd's (SHSE:688168) earnings have declined over five years, contributing to shareholders 66% loss

BeijingABT Networks Co.,Ltd. (SHSE:688168) shareholders should be happy to see the share price up 12% in the last week. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 67% after a long stretch. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

While the last five years has been tough for BeijingABT NetworksLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for BeijingABT NetworksLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

BeijingABT NetworksLtd became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The modest 0.2% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 21% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

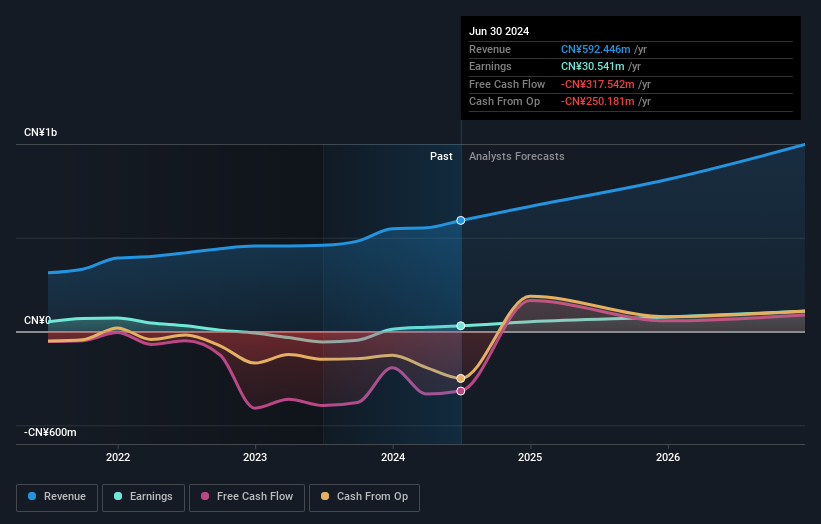

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that BeijingABT NetworksLtd has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on BeijingABT NetworksLtd

A Different Perspective

BeijingABT NetworksLtd shareholders are down 6.0% over twelve months (even including dividends), which isn't far from the market return of -6.0%. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. It could well be that the business has begun to stabilize, although we'd be hesitant to buy without clear information suggesting the company will grow. It's always interesting to track share price performance over the longer term. But to understand BeijingABT NetworksLtd better, we need to consider many other factors. For example, we've discovered 1 warning sign for BeijingABT NetworksLtd that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BeijingABT NetworksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688168

BeijingABT NetworksLtd

Develops and provides visualized network security technology solutions in China.

High growth potential with adequate balance sheet.