Primeton Information Technologies, Inc. (SHSE:688118) Shares Fly 27% But Investors Aren't Buying For Growth

Primeton Information Technologies, Inc. (SHSE:688118) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 33%.

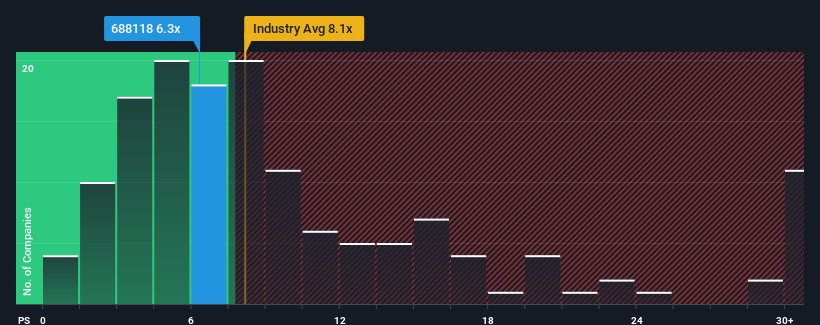

Although its price has surged higher, Primeton Information Technologies may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 6.3x, since almost half of all companies in the Software industry in China have P/S ratios greater than 8.1x and even P/S higher than 15x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Primeton Information Technologies

What Does Primeton Information Technologies' Recent Performance Look Like?

Primeton Information Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Primeton Information Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Primeton Information Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Primeton Information Technologies would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. The last three years don't look nice either as the company has shrunk revenue by 3.7% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the lone analyst following the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this in consideration, its clear as to why Primeton Information Technologies' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Primeton Information Technologies' P/S

Primeton Information Technologies' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Primeton Information Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Primeton Information Technologies.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688118

Primeton Information Technologies

Provides software infrastructure platform products and solutions in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives