- China

- /

- Entertainment

- /

- SHSE:601595

High Growth Tech Stocks To Explore In November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances across major indices and cautious monetary policies, the Asian tech sector continues to draw attention amid fluctuating economic indicators and broader market sentiment. In this environment, identifying high growth potential in tech stocks involves evaluating factors such as innovation capacity, market adaptability, and resilience to regulatory shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 33.63% | 34.88% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Film Co., Ltd. is involved in film distribution and screening activities in China with a market capitalization of CN¥13.85 billion.

Operations: Shanghai Film Co., Ltd. generates revenue primarily from film distribution and screening activities within China. The company's operations are focused on leveraging its market presence to facilitate the distribution of films across various platforms, aiming to capture a significant share of the entertainment sector.

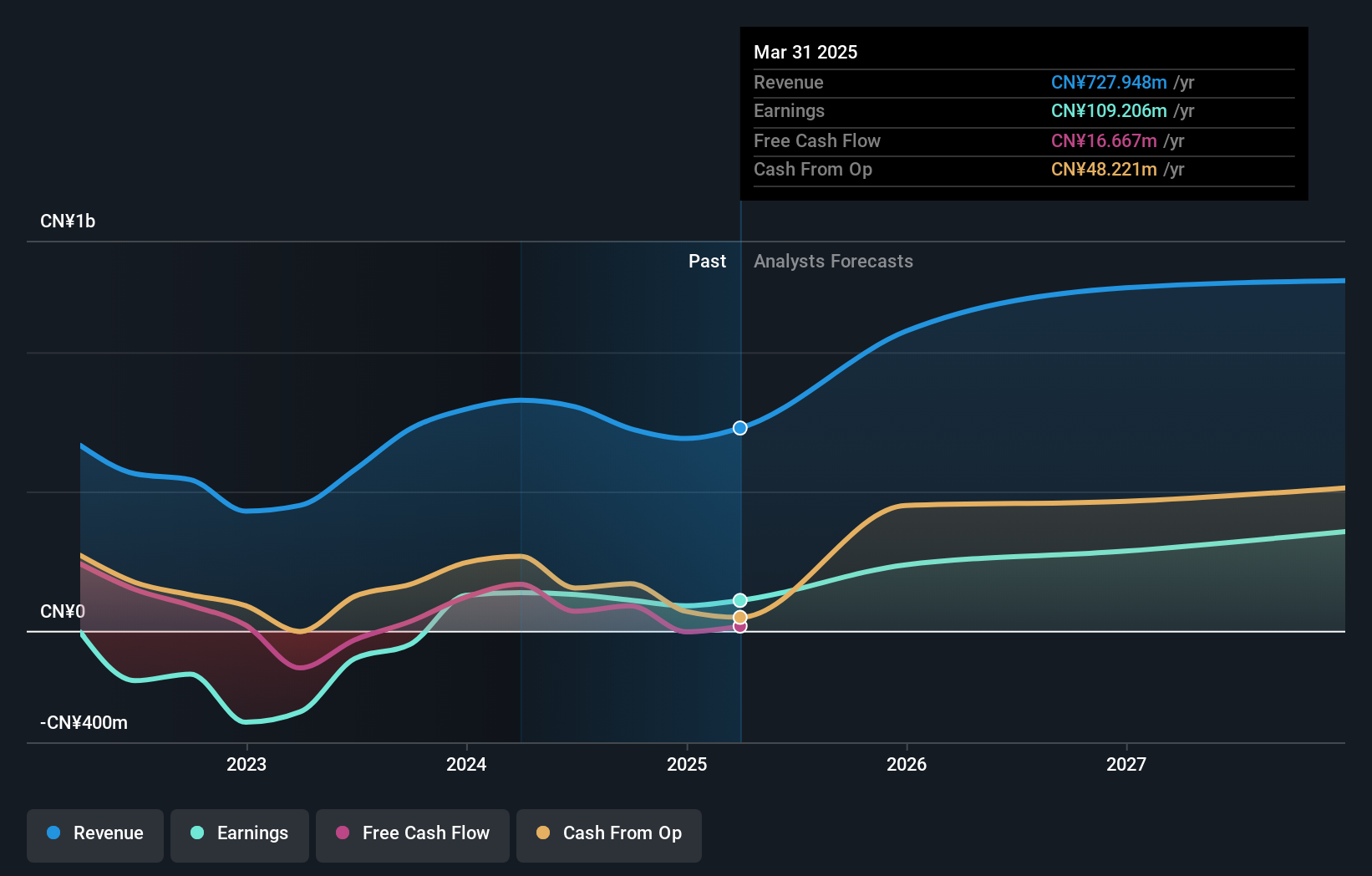

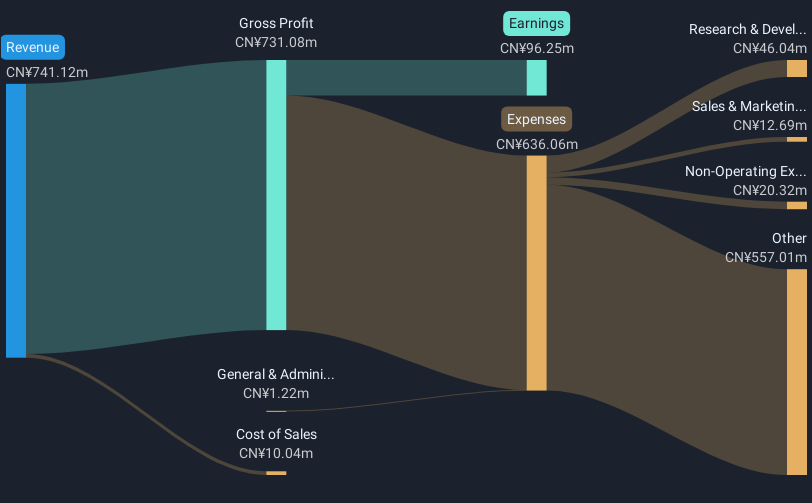

Shanghai Film has demonstrated robust financial performance with a significant uptick in sales, reaching CNY 722.61 million, up from CNY 559.75 million year-over-year, and a net income increase to CNY 139.42 million from CNY 107.41 million. This growth trajectory is underscored by an earnings surge of 41.67% annually, outpacing the broader CN market's average of 27.5%. Despite not outperforming the Entertainment industry's growth rate last year, Shanghai Film is poised for substantial future gains with expected revenue growth of 15.9% annually—faster than the CN market's forecast of 14.4%. These figures highlight Shanghai Film’s potential in leveraging its market position to capitalize on expanding demand within Asia’s high-growth tech landscape.

- Click here to discover the nuances of Shanghai Film with our detailed analytical health report.

Understand Shanghai Film's track record by examining our Past report.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market cap of CN¥18.12 billion.

Operations: ArcSoft focuses on developing algorithms and software solutions for the computer vision sector, serving a global market.

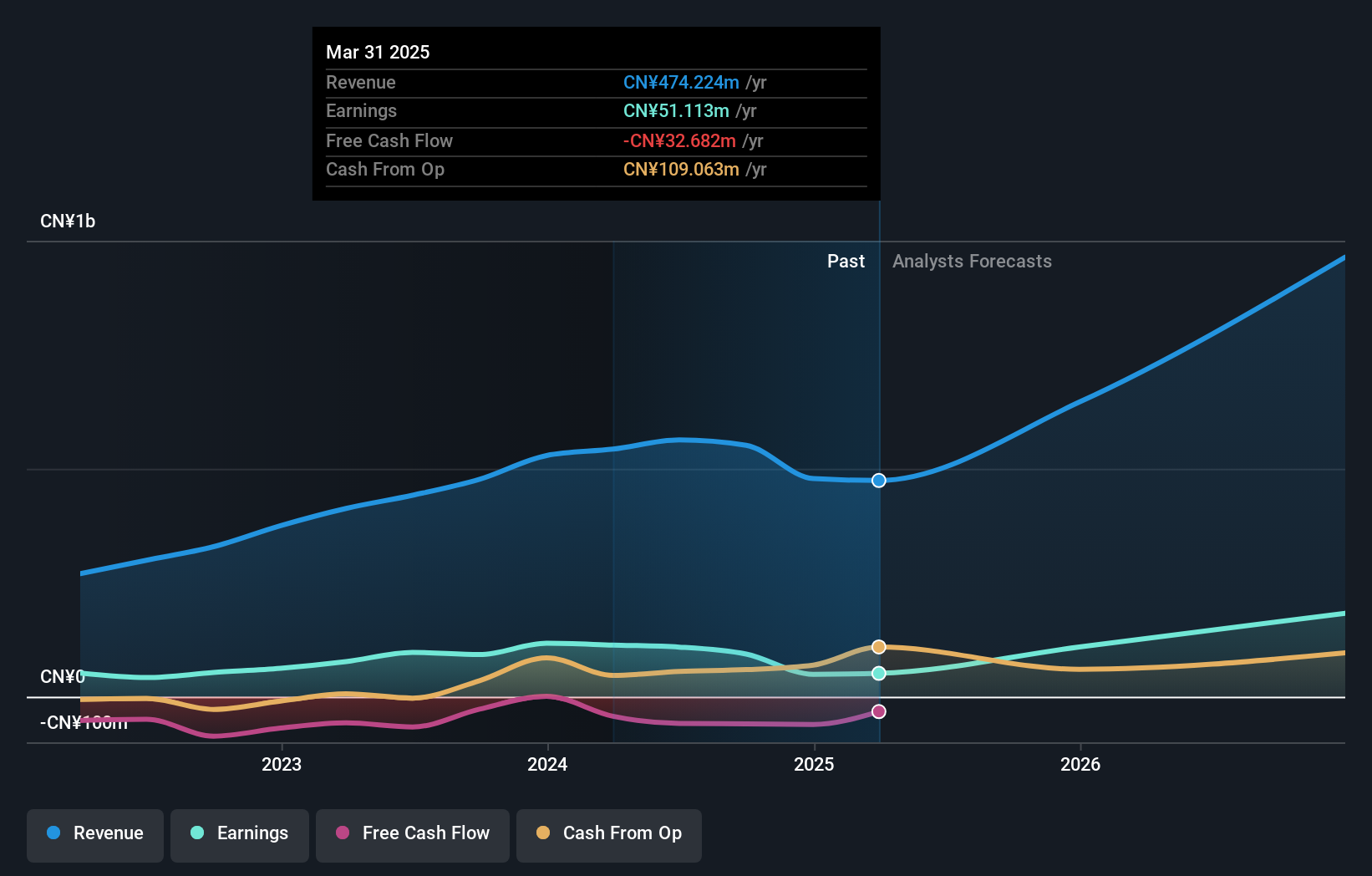

ArcSoft's recent financial performance underscores its robust position in Asia's tech sector, with a notable 9.4% increase in revenue to CNY 627.55 million and a substantial rise in net income to CNY 141.72 million, reflecting a year-over-year earnings growth of 137.5%. This growth significantly outpaces the broader software industry’s average of just 0.4%. With an expected annual revenue growth rate of 29.5% and profit growth forecast at 33.1%, ArcSoft is set to outperform the CN market projections substantially. These figures not only highlight its strong market execution but also suggest potential for sustained competitive advantage, particularly as it navigates through dynamic technological landscapes marked by rapid innovation cycles.

- Click here and access our complete health analysis report to understand the dynamics of ArcSoft.

Gain insights into ArcSoft's past trends and performance with our Past report.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hefei Kewell Power System Co., Ltd. specializes in providing testing equipment for test systems and intelligent manufacturing equipment in China, with a market capitalization of CN¥3.05 billion.

Operations: The company generates revenue primarily through the sale of testing equipment and intelligent manufacturing solutions. Its cost structure is influenced by production expenses, which impact profitability metrics such as gross profit margin.

Hefei Kewell Power System Co., Ltd. is navigating the competitive landscape of Asia's high-growth tech sector with promising financial indicators. The company's revenue is expected to grow at 54.9% annually, significantly outpacing the Chinese market forecast of 14.4%. Moreover, its earnings are projected to surge by 89% per year, highlighting robust growth potential. Despite a slight dip in net profit margins from 16.9% to 10.4%, Hefei Kewell has demonstrated commitment to shareholder value through recent share repurchases totaling CNY 29.15 million for about 1.18% of outstanding shares over the past year, signaling confidence in its financial health and future prospects.

Seize The Opportunity

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 188 more companies for you to explore.Click here to unveil our expertly curated list of 191 Asian High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601595

Shanghai Film

Engages in film distribution and screening activities in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives