Global Growth Companies With High Insider Ownership And 36% Earnings Growth

Reviewed by Simply Wall St

In the current global market landscape, concerns about AI-related valuations and mixed economic signals have led to cautious sentiment among investors. Despite these challenges, growth companies with high insider ownership continue to attract attention due to their potential for strong earnings growth and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

We'll examine a selection from our screener results.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry, with a market cap of CN¥18.29 billion.

Operations: ArcSoft Corporation Limited generates revenue through its role as a provider of algorithms and software solutions within the global computer vision sector.

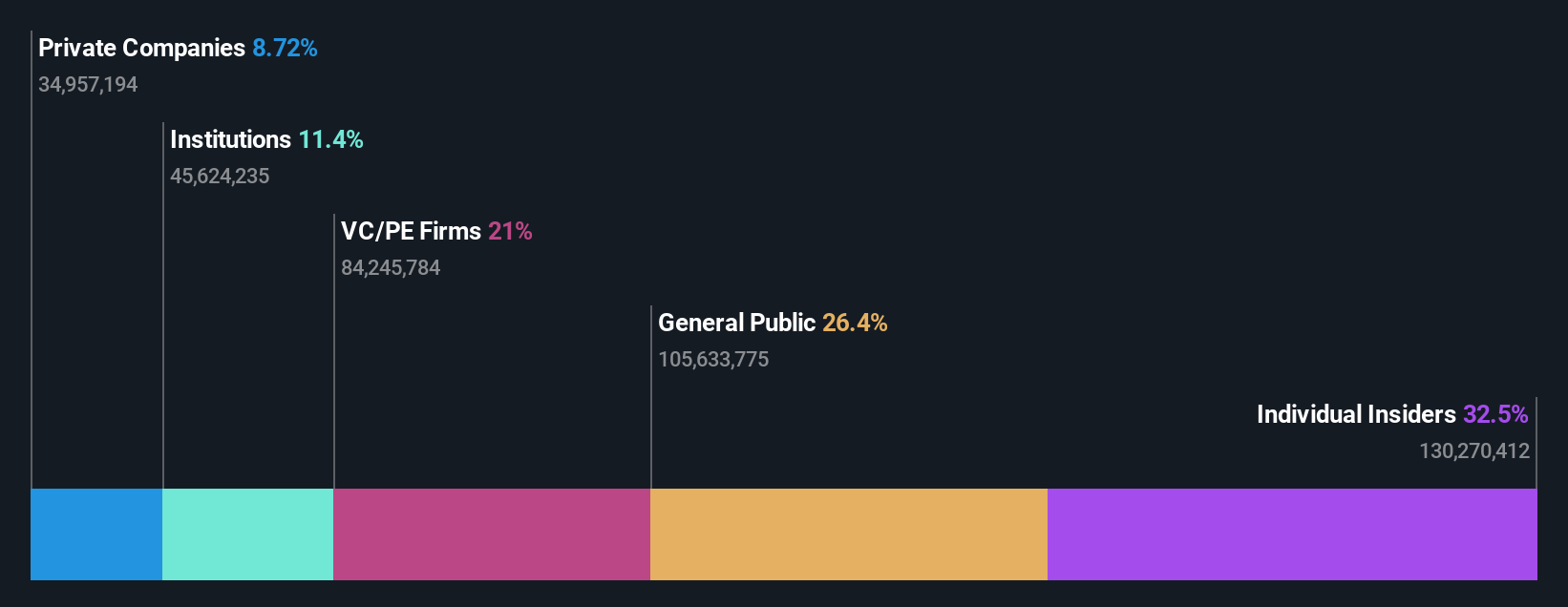

Insider Ownership: 32.5%

Earnings Growth Forecast: 33.1% p.a.

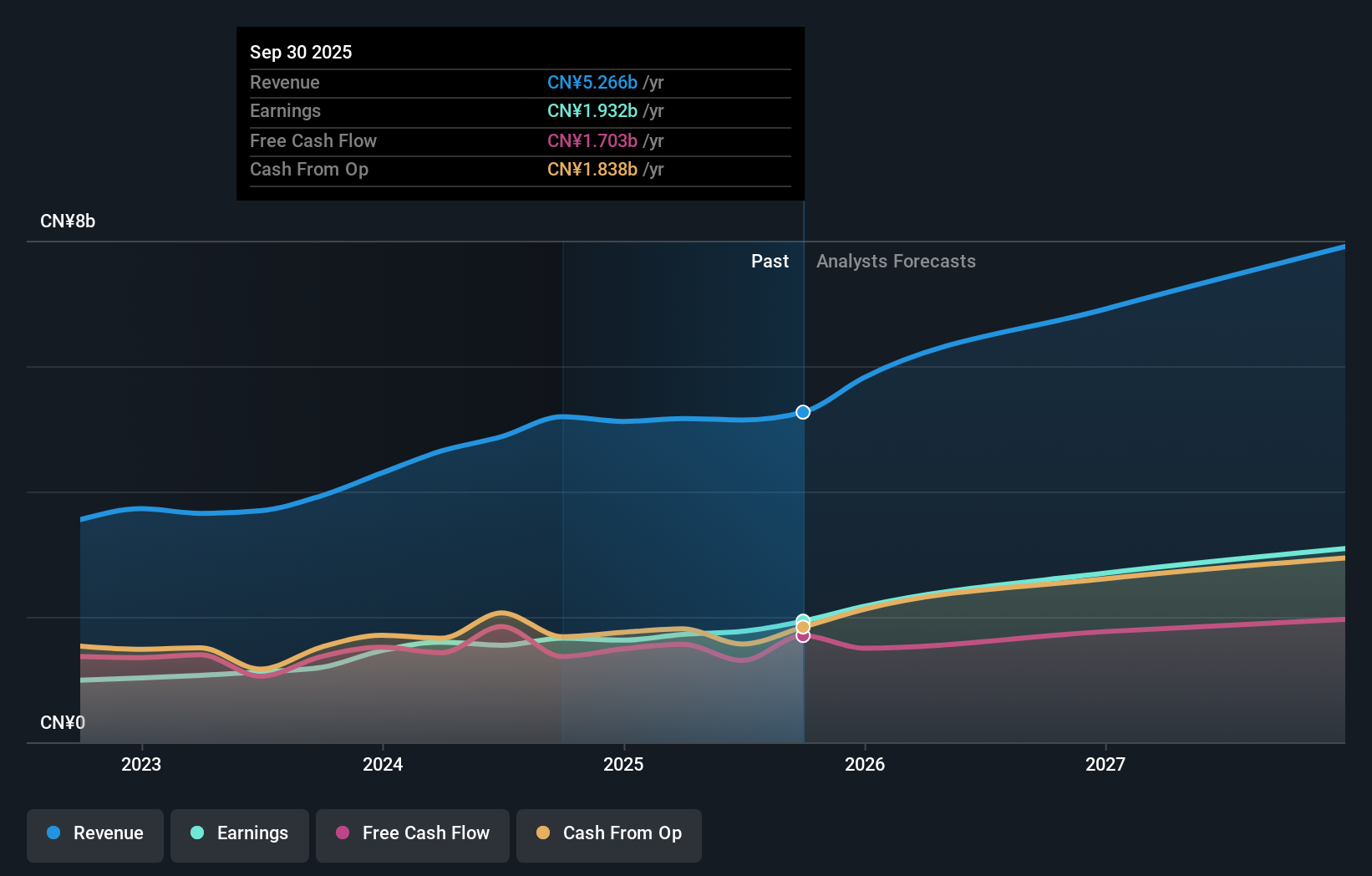

ArcSoft demonstrates strong growth potential, with revenue expected to increase by 29.5% annually, outpacing the Chinese market's 14.4%. Earnings are forecasted to grow significantly at 33.1% per year over the next three years. Despite its high volatility and unstable dividend track record, ArcSoft's recent earnings report showed a rise in net income to CNY 141.72 million from CNY 88.29 million year-on-year, reflecting robust financial performance amidst high insider ownership dynamics.

- Dive into the specifics of ArcSoft here with our thorough growth forecast report.

- The analysis detailed in our ArcSoft valuation report hints at an inflated share price compared to its estimated value.

Kingnet Network (SZSE:002517)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingnet Network Co., Ltd. is involved in the development, operation, and distribution of mobile games and has a market cap of CN¥44.57 billion.

Operations: The company generates revenue from its Internet Software and Services segment, amounting to CN¥5.27 billion.

Insider Ownership: 15.4%

Earnings Growth Forecast: 20.5% p.a.

Kingnet Network shows potential with earnings growing 40.4% annually over the past five years and forecasted to grow significantly at 20.54% per year. Its price-to-earnings ratio of 23.6x is favorable compared to the Chinese market's 41.9x, suggesting good value relative to peers. Recent earnings reports indicate net income rose to CNY 1,583.46 million from CNY 1,280.05 million year-on-year, supported by a share repurchase program enhancing shareholder value amidst high insider ownership dynamics.

- Navigate through the intricacies of Kingnet Network with our comprehensive analyst estimates report here.

- The analysis detailed in our Kingnet Network valuation report hints at an deflated share price compared to its estimated value.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market capitalization of CN¥121.56 billion.

Operations: The company generates revenue from its operations in the auto parts, Internet games, and cloud data sectors across both domestic and international markets.

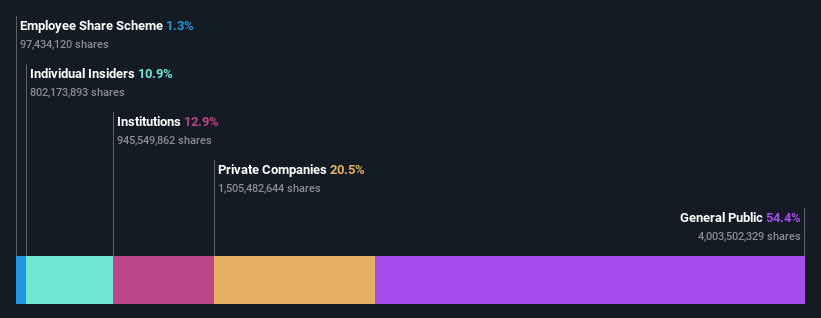

Insider Ownership: 10.4%

Earnings Growth Forecast: 36.4% p.a.

Zhejiang Century Huatong Group Ltd. exhibits strong growth potential with earnings expected to rise significantly at 36.4% annually, surpassing the Chinese market's forecasted growth. Despite recent volatility in its share price, the company trades at a substantial discount to its estimated fair value. Recent financials show robust performance with net income reaching CNY 4.36 billion for the nine months ending September 2025, up from CNY 1.80 billion year-on-year, reflecting solid revenue expansion and high insider ownership stability.

- Unlock comprehensive insights into our analysis of Zhejiang Century Huatong GroupLtd stock in this growth report.

- Our valuation report unveils the possibility Zhejiang Century Huatong GroupLtd's shares may be trading at a discount.

Summing It All Up

- Discover the full array of 855 Fast Growing Global Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives