ArcSoft Corporation Limited's (SHSE:688088) Shares Climb 30% But Its Business Is Yet to Catch Up

ArcSoft Corporation Limited (SHSE:688088) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

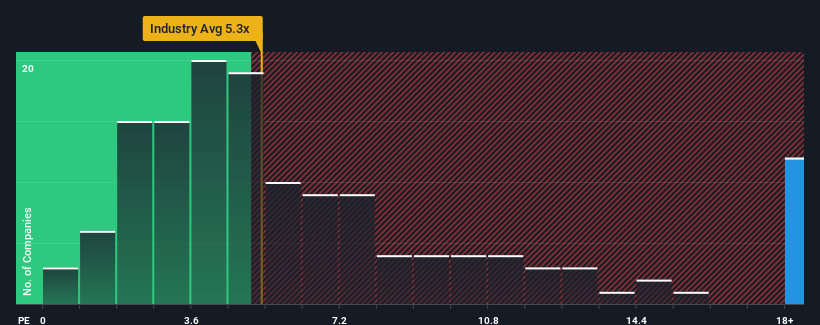

Since its price has surged higher, you could be forgiven for thinking ArcSoft is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 19.5x, considering almost half the companies in China's Software industry have P/S ratios below 5.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ArcSoft

How ArcSoft Has Been Performing

With revenue growth that's superior to most other companies of late, ArcSoft has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ArcSoft.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ArcSoft's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 1.9% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 33%, which is not materially different.

In light of this, it's curious that ArcSoft's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On ArcSoft's P/S

The strong share price surge has lead to ArcSoft's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that ArcSoft currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for ArcSoft that you should be aware of.

If you're unsure about the strength of ArcSoft's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives