Zwsoft Co.,Ltd. (SHSE:688083) Investors Are Less Pessimistic Than Expected

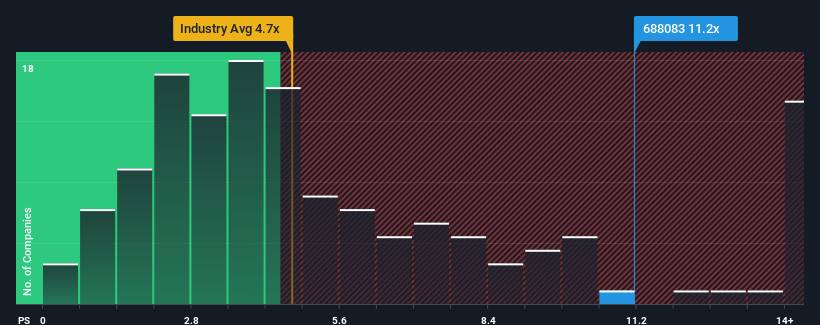

You may think that with a price-to-sales (or "P/S") ratio of 11.2x Zwsoft Co.,Ltd. (SHSE:688083) is a stock to avoid completely, seeing as almost half of all the Software companies in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ZwsoftLtd

How ZwsoftLtd Has Been Performing

Recent times have been advantageous for ZwsoftLtd as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think ZwsoftLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is ZwsoftLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as ZwsoftLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Pleasingly, revenue has also lifted 71% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 29% as estimated by the analysts watching the company. With the industry predicted to deliver 30% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that ZwsoftLtd's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From ZwsoftLtd's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting ZwsoftLtd's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for ZwsoftLtd that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZwsoftLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688083

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives