- China

- /

- Tech Hardware

- /

- SZSE:002993

High Growth Tech Stocks To Explore This November 2024

Reviewed by Simply Wall St

In a week marked by busy earnings reports and key economic data releases, global markets saw some turbulence with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Despite these fluctuations, small-cap stocks demonstrated resilience compared to their larger counterparts. As investors navigate this dynamic landscape, identifying high-growth tech stocks requires a focus on companies that exhibit strong fundamentals and adaptability to shifting market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Linewell Software (SHSE:603636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Linewell Software Co., Ltd. is involved in software development and system integration services in China, with a market capitalization of CN¥6.38 billion.

Operations: Linewell Software Co., Ltd. generates revenue primarily through software development and system integration services in China. The company focuses on delivering tailored software solutions to meet the needs of its clients, leveraging its expertise in technology and integration capabilities.

Despite recent setbacks with a significant drop in sales to CNY 362.6 million and a deepening net loss of CNY 161.6 million, Linewell Software's forward-looking indicators suggest potential resilience and recovery. The company's expected revenue growth rate stands at an impressive 25.4% annually, outpacing the broader Chinese market projection of just 13.9%. This growth is underpinned by strategic R&D investments aimed at innovation and market adaptation, though current financial strains highlight the challenges of sustaining such high development costs in a competitive tech landscape. With earnings forecasted to surge by nearly 64% per year, Linewell’s trajectory might pivot from its current downturn if these aggressive growth forecasts materialize over the next three years, signaling a crucial period for the company’s strategic execution and market positioning.

- Get an in-depth perspective on Linewell Software's performance by reading our health report here.

Evaluate Linewell Software's historical performance by accessing our past performance report.

Cetc Potevio Science&TechnologyLtd (SZSE:002544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cetc Potevio Science&Technology Co., Ltd. offers network communication solutions in China and has a market cap of CN¥16.15 billion.

Operations: Cetc Potevio Science&Technology Co., Ltd. generates revenue primarily from its Software and IT Services segment, amounting to CN¥4.99 billion.

Cetc Potevio Science&TechnologyLtd has navigated a challenging period, as evidenced by a recent dip in sales to CNY 3.42 billion from CNY 3.89 billion year-over-year and a significant reduction in net income from CNY 64.23 million to CNY 18.25 million. Despite these hurdles, the company is poised for recovery with expected revenue growth at an impressive rate of 17.9% annually, outstripping the broader Chinese market's forecast of 13.9%. This optimism is further bolstered by projections of earnings growth surging by approximately 65%, signaling robust future prospects if these targets are achieved amid current market dynamics and strategic R&D commitments that underscore its potential resilience and adaptability in the evolving tech landscape.

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Growth Rating: ★★★★☆☆

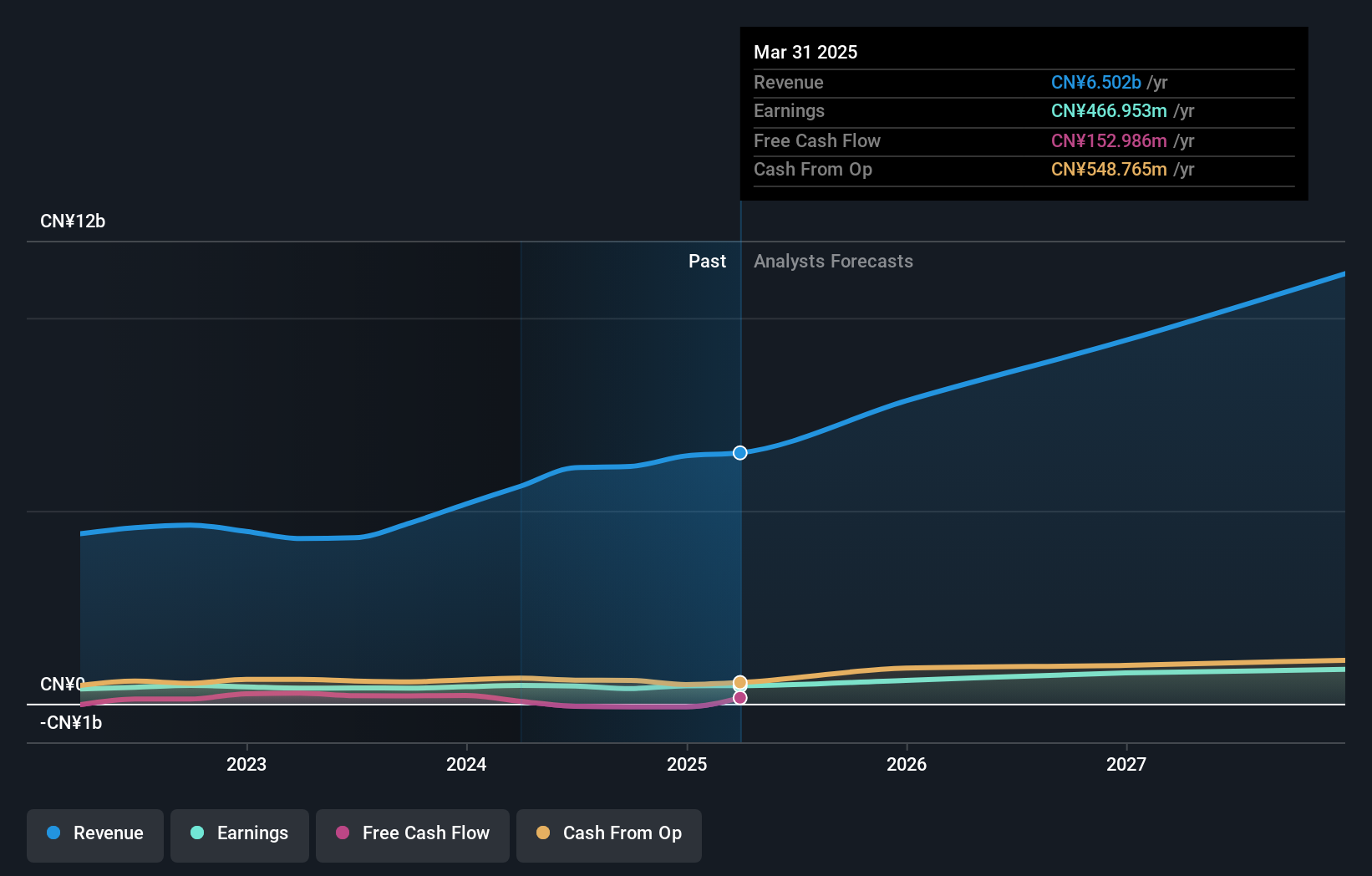

Overview: Dongguan Aohai Technology Co., Ltd. engages in the research, development, production, and sale of consumer electronics products both in China and internationally, with a market capitalization of approximately CN¥8.04 billion.

Operations: Aohai Technology generates revenue primarily from the Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥6.12 billion. The company's operations span both domestic and international markets within the consumer electronics sector.

Dongguan Aohai Technology has recently demonstrated robust financial agility, with a notable revenue jump from CNY 2 billion to nearly CNY 3 billion in the first half of 2024 alone. This surge aligns with an aggressive R&D investment strategy, where the company channels significant funds—evidenced by their latest earnings report—into innovation, securing a competitive edge in tech development. Moreover, their recent share repurchase announcement for up to CNY 80 million underscores a strategic move to bolster shareholder value through equity incentives and employee stock ownership plans. With projected annual revenue growth at an impressive 20.4%, outpacing the broader Chinese market's forecast of 13.9%, and earnings expected to climb by 26.1% annually, Dongguan Aohai is positioning itself as a formidable contender in the tech arena despite some challenges in maintaining comparable profit margins.

- Delve into the full analysis health report here for a deeper understanding of Dongguan Aohai Technology.

Learn about Dongguan Aohai Technology's historical performance.

Make It Happen

- Embark on your investment journey to our 1285 High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002993

Dongguan Aohai Technology

Research, develops, produces, and sells consumer electronics products in China and internationally.

Excellent balance sheet and fair value.