As global markets navigate a period of mixed performance, with concerns over elevated valuations and artificial intelligence spending impacting growth-oriented stocks, Asia's economic landscape presents its own set of challenges and opportunities. In this context, identifying growth companies with substantial insider ownership can be particularly appealing to investors seeking stability and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 118.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

Let's dive into some prime choices out of the screener.

Koal Software (SHSE:603232)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Koal Software Co., Ltd. develops public key infrastructure platforms in China and has a market cap of CN¥6.60 billion.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 30.5%

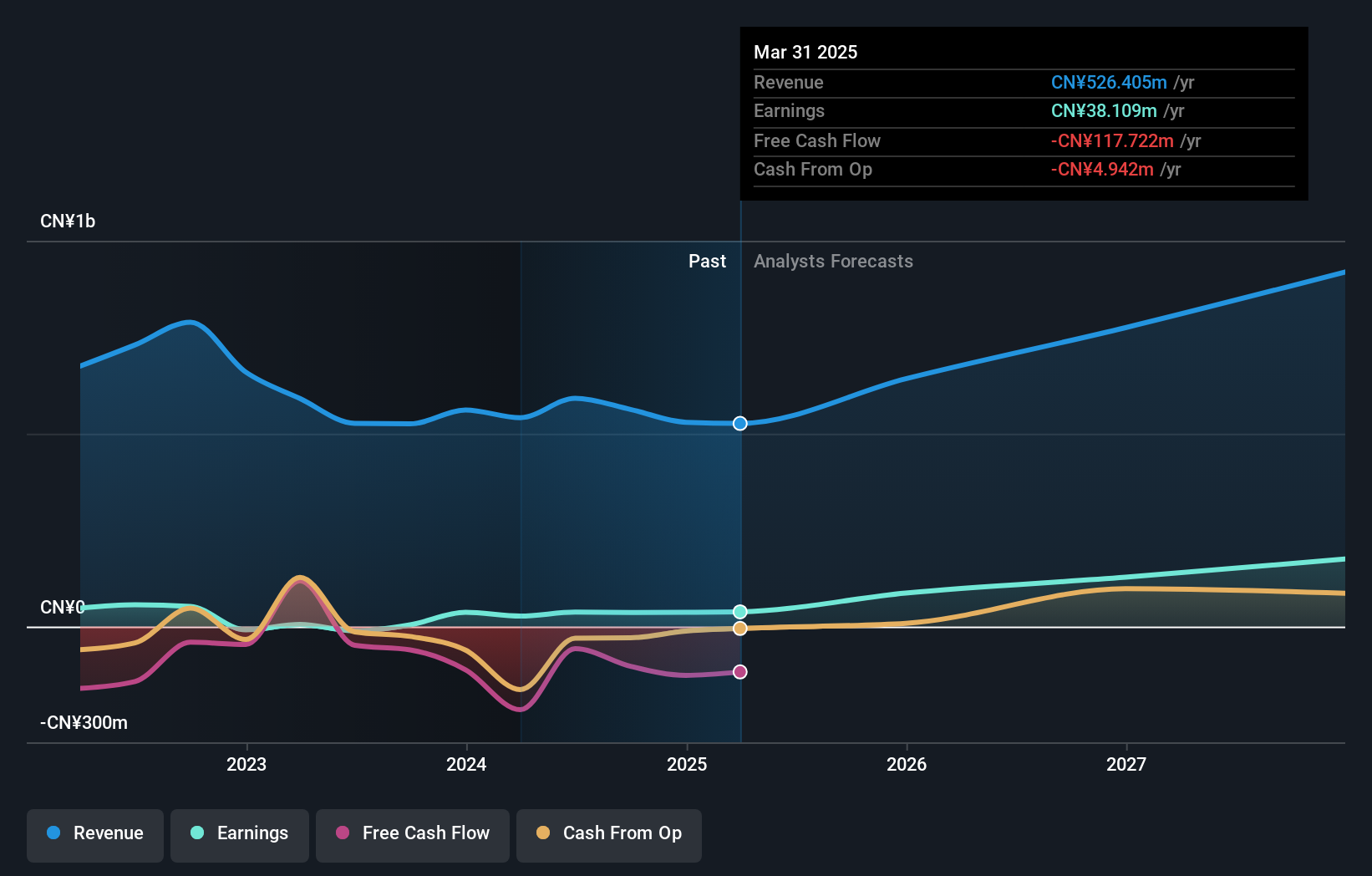

Koal Software is positioned for significant earnings growth, forecasted at 65% annually over the next three years, outpacing the Chinese market. However, recent financial results show a decline in revenue to CNY 235.44 million and an increased net loss of CNY 65.41 million for nine months ending September 2025. Despite high insider ownership and expected revenue growth exceeding market rates, profit margins have decreased to 2.2%, with share price volatility noted recently.

- Unlock comprehensive insights into our analysis of Koal Software stock in this growth report.

- Our valuation report unveils the possibility Koal Software's shares may be trading at a premium.

Shenzhen United Winners Laser (SHSE:688518)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen United Winners Laser Co., Ltd. manufactures and sells laser welding equipment both in China and internationally, with a market cap of CN¥8.73 billion.

Operations: Shenzhen United Winners Laser generates revenue primarily from the manufacture and sale of laser welding equipment in both domestic and international markets.

Insider Ownership: 16.5%

Shenzhen United Winners Laser is poised for substantial growth, with earnings forecasted to rise 44.49% annually over the next three years, surpassing the Chinese market's pace. Revenue is expected to grow at 20.5% per year, outpacing market averages. Recent financials show a modest increase in sales to CNY 2.25 billion and net income of CNY 108.1 million for nine months ending September 2025, although share price volatility remains a concern.

- Get an in-depth perspective on Shenzhen United Winners Laser's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Shenzhen United Winners Laser is priced lower than what may be justified by its financials.

Nan Juen International (TPEX:6584)

Simply Wall St Growth Rating: ★★★★★★

Overview: Nan Juen International Co., Ltd. operates in the research, development, manufacturing, and trading of steel ball guide rails across various global markets, with a market cap of NT$24.22 billion.

Operations: Revenue Segments (in millions of NT$):

Insider Ownership: 19.8%

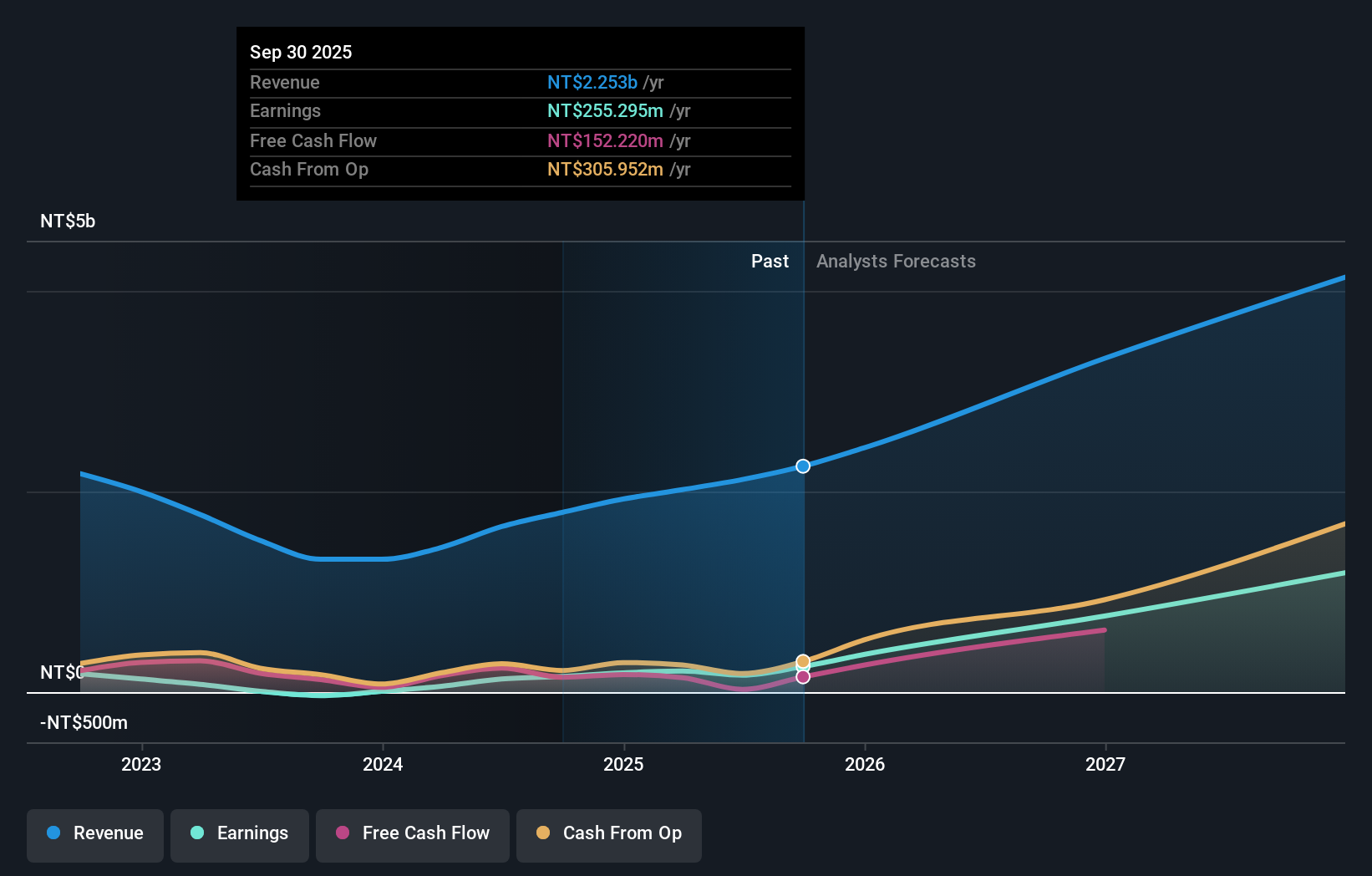

Nan Juen International's earnings are projected to grow significantly at 63.4% annually, outpacing the Taiwanese market. Revenue is anticipated to increase by 27.9% per year, also exceeding market averages. Recent financials reveal third-quarter sales of TWD 622.14 million and net income of TWD 130.27 million, marking substantial improvements from the previous year despite share price volatility concerns. The stock trades below estimated fair value, suggesting potential investment appeal amidst strong insider ownership dynamics.

- Navigate through the intricacies of Nan Juen International with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Nan Juen International shares in the market.

Next Steps

- Discover the full array of 622 Fast Growing Asian Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nan Juen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6584

Nan Juen International

Engages in the research, development, manufacturing, and trading of steel ball guide rails in the United States, Asia, Europe, Africa, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives