With A 27% Price Drop For Weaver Network Technology Co., Ltd. (SHSE:603039) You'll Still Get What You Pay For

Weaver Network Technology Co., Ltd. (SHSE:603039) shares have had a horrible month, losing 27% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

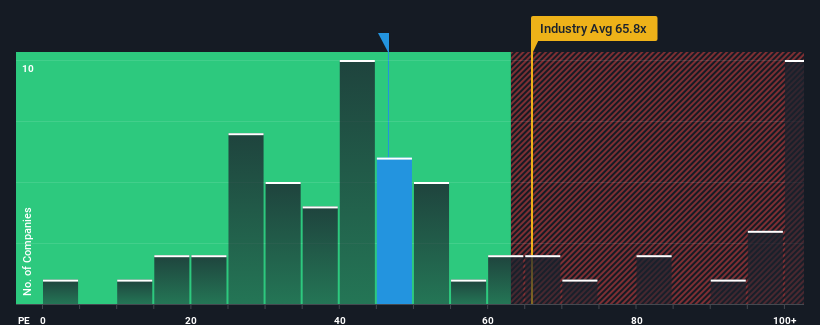

Although its price has dipped substantially, Weaver Network Technology may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 46.5x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Weaver Network Technology's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Weaver Network Technology

How Is Weaver Network Technology's Growth Trending?

Weaver Network Technology's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 24% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 26% per year over the next three years. With the market only predicted to deliver 21% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Weaver Network Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Weaver Network Technology's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Weaver Network Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Weaver Network Technology with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Weaver Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603039

Weaver Network Technology

Engages in the research and development, sale, and service of collaborative management and mobile office software products in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives