Investors Aren't Buying Neusoft Corporation's (SHSE:600718) Revenues

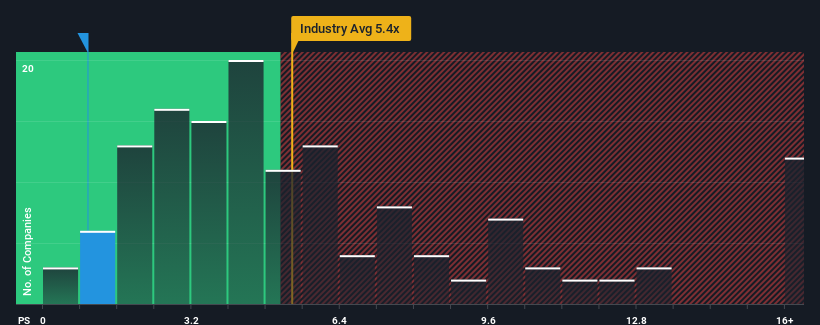

You may think that with a price-to-sales (or "P/S") ratio of 1x Neusoft Corporation (SHSE:600718) is definitely a stock worth checking out, seeing as almost half of all the Software companies in China have P/S ratios greater than 5.4x and even P/S above 10x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Neusoft

What Does Neusoft's Recent Performance Look Like?

Neusoft certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Neusoft's future stacks up against the industry? In that case, our free report is a great place to start.How Is Neusoft's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Neusoft's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the four analysts following the company. With the industry predicted to deliver 33% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Neusoft's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Neusoft's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Neusoft's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Neusoft with six simple checks.

If these risks are making you reconsider your opinion on Neusoft, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Neusoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600718

Neusoft

Engages in the provision of software and information technology solutions and services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives