Yonyou Network TechnologyLtd (SHSE:600588) shareholders are up 5.2% this past week, but still in the red over the last three years

Yonyou Network Technology Co.,Ltd. (SHSE:600588) shareholders will doubtless be very grateful to see the share price up 31% in the last month. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 62% in that time. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

On a more encouraging note the company has added CN¥1.9b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Yonyou Network TechnologyLtd

Because Yonyou Network TechnologyLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Yonyou Network TechnologyLtd grew revenue at 4.5% per year. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 18% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

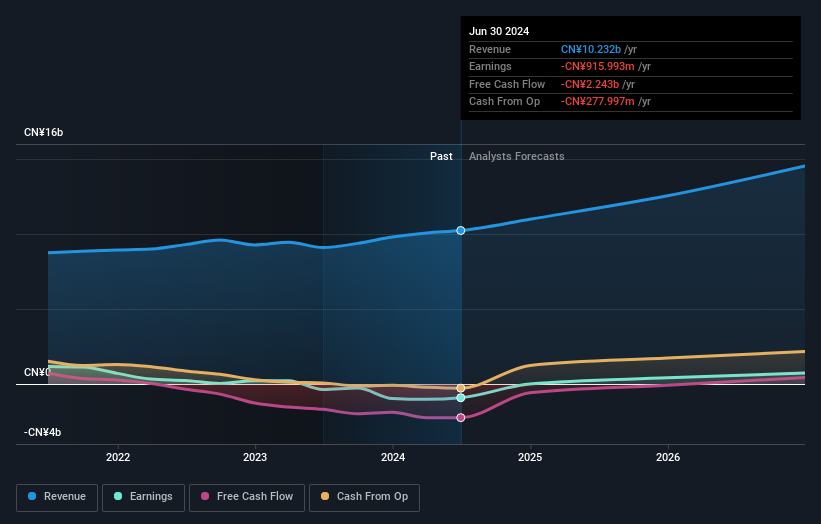

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Yonyou Network TechnologyLtd is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Yonyou Network TechnologyLtd stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 9.3% in the last year, Yonyou Network TechnologyLtd shareholders lost 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600588

Yonyou Network TechnologyLtd

Provides digital intelligence platform and services for enterprises and public organizations in China and internationally.

Good value with reasonable growth potential.