- China

- /

- Medical Equipment

- /

- SZSE:300888

3 Chinese Exchange Stocks Estimated To Trade At Discounts Between 16.5% And 23.2%

Reviewed by Simply Wall St

In recent weeks, Chinese equities have shown resilience despite a batch of disappointing economic data, with the Shanghai Composite Index and the blue-chip CSI 300 both posting gains. This performance comes amid expectations for further easing measures by China's government to stimulate the economy. In this context, identifying undervalued stocks can be particularly advantageous for investors looking to capitalize on potential market inefficiencies. Here are three Chinese exchange stocks currently estimated to trade at discounts between 16.5% and 23.2%.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| KPC PharmaceuticalsInc (SHSE:600422) | CN¥13.62 | CN¥25.33 | 46.2% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥34.20 | CN¥64.84 | 47.3% |

| NBTM New Materials Group (SHSE:600114) | CN¥14.20 | CN¥26.81 | 47% |

| Zhejiang Wolwo Bio-Pharmaceutical (SZSE:300357) | CN¥18.65 | CN¥35.84 | 48% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥17.45 | CN¥33.11 | 47.3% |

| Inmyshow Digital Technology(Group)Co.Ltd (SHSE:600556) | CN¥3.86 | CN¥7.43 | 48% |

| Suzhou Oriental Semiconductor (SHSE:688261) | CN¥31.73 | CN¥60.73 | 47.8% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.08 | CN¥3.98 | 47.8% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.66 | CN¥8.67 | 46.3% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.65 | CN¥16.84 | 48.6% |

Let's explore several standout options from the results in the screener.

Yonyou Network TechnologyLtd (SHSE:600588)

Overview: Yonyou Network Technology Co., Ltd. offers digital intelligence platforms and services to enterprises and public organizations both in China and internationally, with a market cap of CN¥32.60 billion.

Operations: Yonyou's revenue from its Cloud Service and Software Business segment is CN¥10.23 billion.

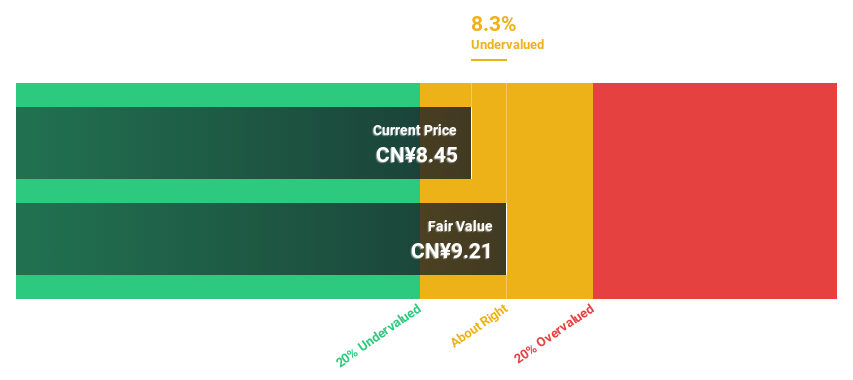

Estimated Discount To Fair Value: 22.7%

Yonyou Network Technology Ltd. appears undervalued based on cash flows, trading at CNY 9.54, below the estimated fair value of CNY 12.33. Recent earnings show revenue growth to CNY 3.81 billion from CNY 3.37 billion a year ago, despite a net loss reduction to CNY 793.94 million from CNY 845.12 million. The company announced a share repurchase program worth CNY 100 million, potentially enhancing shareholder value and signaling confidence in future profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Yonyou Network TechnologyLtd's future results.

- Dive into the specifics of Yonyou Network TechnologyLtd here with our thorough financial health report.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company specializing in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both in China and internationally, with a market cap of CN¥55 billion.

Operations: The company generates revenue primarily from the sale of in vitro diagnostic products, amounting to CN¥4.28 billion.

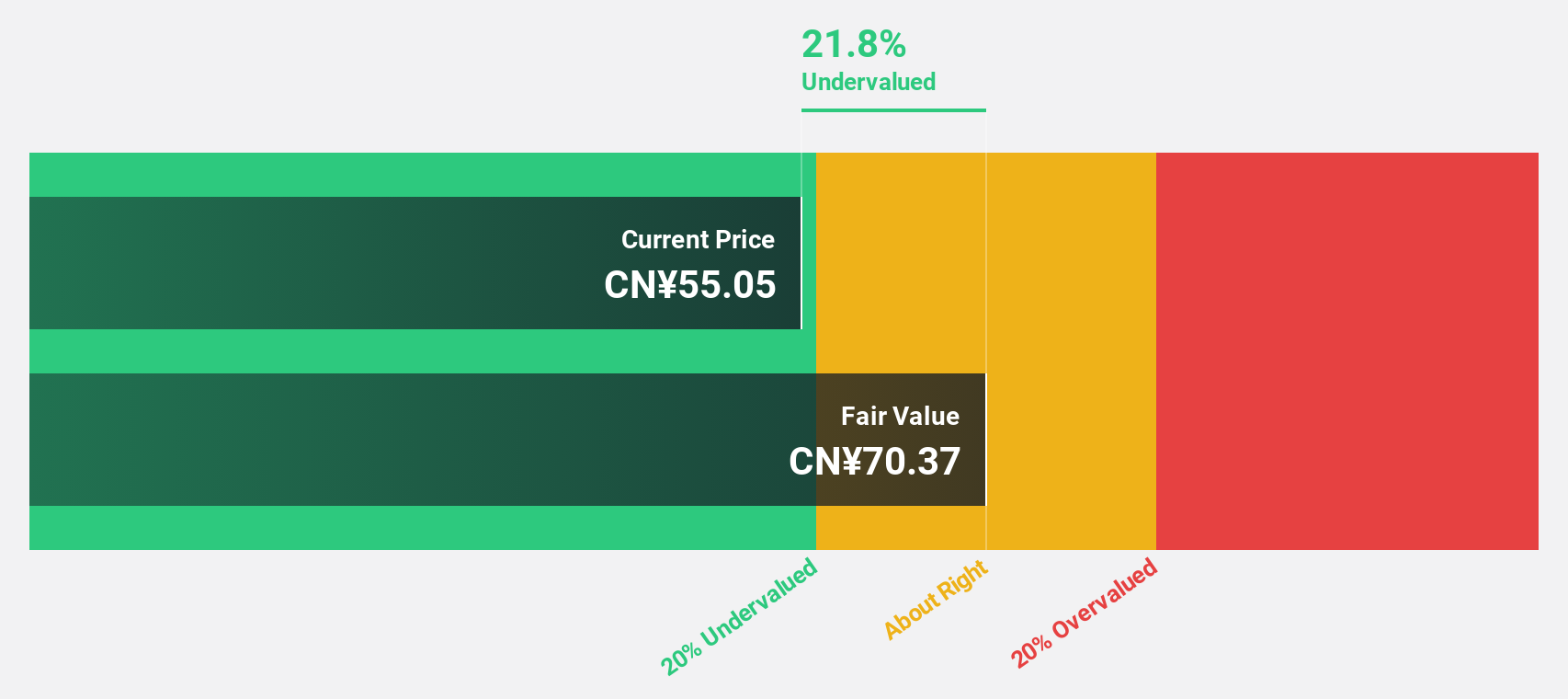

Estimated Discount To Fair Value: 23.2%

Shenzhen New Industries Biomedical Engineering appears undervalued, trading at CN¥70, below the estimated fair value of CN¥91.15. Earnings are forecast to grow 23.21% annually over the next three years, outpacing the market average. Recent earnings report showed revenue growth to CN¥2.21 billion from CN¥1.87 billion a year ago and net income increase to CN¥903 million from CN¥750 million, highlighting strong cash flow potential despite an unstable dividend track record.

- Our comprehensive growth report raises the possibility that Shenzhen New Industries Biomedical Engineering is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Shenzhen New Industries Biomedical Engineering's balance sheet health report.

Winner Medical (SZSE:300888)

Overview: Winner Medical Co., Ltd. (SZSE:300888) specializes in the R&D, manufacture, and marketing of cotton-based medical dressings, medical disposables, and consumer products in China with a market cap of CN¥15.72 billion.

Operations: Revenue Segments (in millions of CN¥):

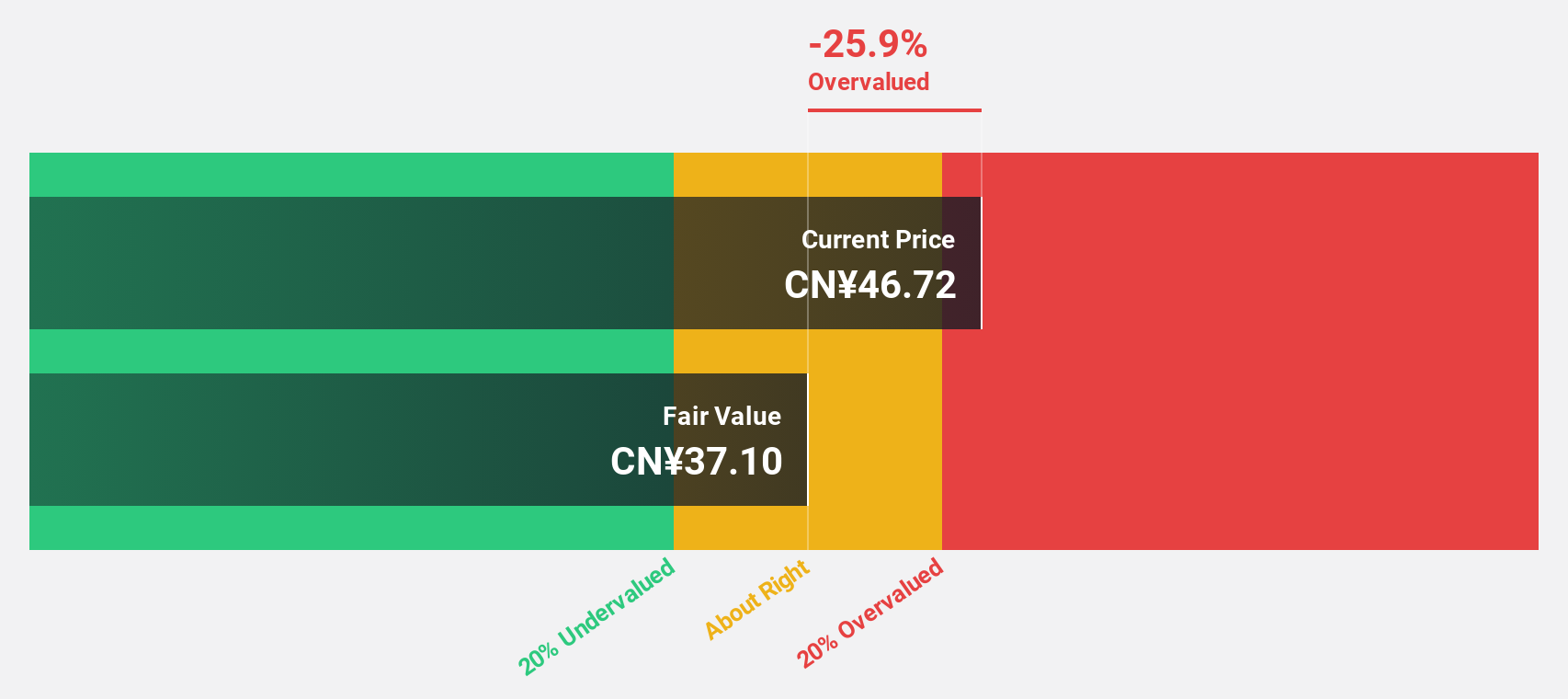

Estimated Discount To Fair Value: 16.5%

Winner Medical Co., Ltd. reported a decline in revenue to CN¥4 billion and net income to CN¥384.15 million for the first half of 2024, compared to last year. Despite this, the stock trades below its estimated fair value of CN¥32.32 at CN¥26.99, indicating potential undervaluation based on cash flows. The company has also affirmed an interim dividend of CN¥4 per 10 shares, suggesting ongoing shareholder returns amidst financial challenges.

- In light of our recent growth report, it seems possible that Winner Medical's financial performance will exceed current levels.

- Get an in-depth perspective on Winner Medical's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 111 more companies for you to explore.Click here to unveil our expertly curated list of 114 Undervalued Chinese Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winner Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300888

Winner Medical

Engages in the research and development, manufacture, and marketing of cotton-based medical dressings and medical disposables, and consumer products in China.

Excellent balance sheet with reasonable growth potential.