- China

- /

- Electronic Equipment and Components

- /

- SHSE:603228

High Growth Tech Stocks In Asia Featuring Three Prominent Companies

Reviewed by Simply Wall St

As global markets experience mixed performance, with large-cap tech companies driving gains while smaller-cap indexes face declines, the Asian tech sector remains a focal point for investors seeking high-growth opportunities amid easing U.S.-China trade tensions. In this environment, identifying promising stocks often involves evaluating companies that can leverage technological advancements and maintain strong growth trajectories despite broader economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 27.82% | 34.58% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.73% | 34.36% | ★★★★★★ |

| Zhongji Innolight | 27.12% | 28.48% | ★★★★★★ |

| PharmaEssentia | 34.00% | 50.89% | ★★★★★★ |

| Fositek | 36.14% | 47.79% | ★★★★★★ |

| ASROCK Incorporation | 30.39% | 32.50% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

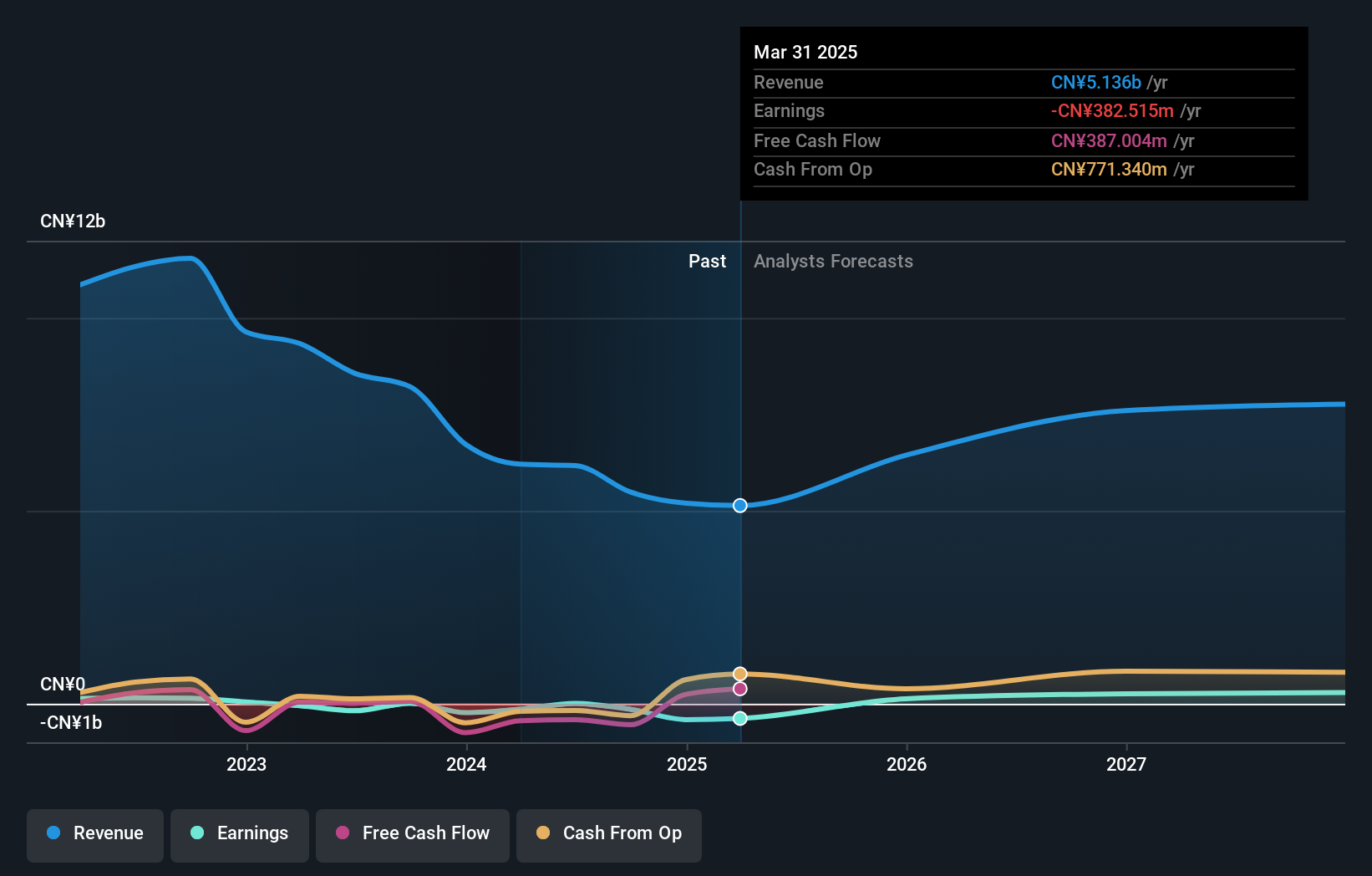

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited offers independent software products and industry solutions in China with a market cap of CN¥48.67 billion.

Operations: The company generates revenue primarily through its Software Service Business, which contributed CN¥5.48 billion.

China National Software & Service has demonstrated resilience and potential in a challenging market, evidenced by a significant reduction in its net loss to CNY 104.04 million from CNY 337.55 million year-over-year as of September 2025. This improvement aligns with an impressive forecast for earnings growth at an annual rate of 96.3%, positioning the company favorably against the broader software industry's average growth rate of just 1%. Despite current unprofitability, the firm's strategic focus on enhancing operational efficiencies and expanding its revenue base, which grew by 13.9% annually to CNY 3,197.81 million, suggests robust future prospects as it moves towards profitability within three years. This trajectory is further supported by its commitment to innovation and development, crucial for sustaining long-term competitiveness in the fast-evolving tech landscape of Asia.

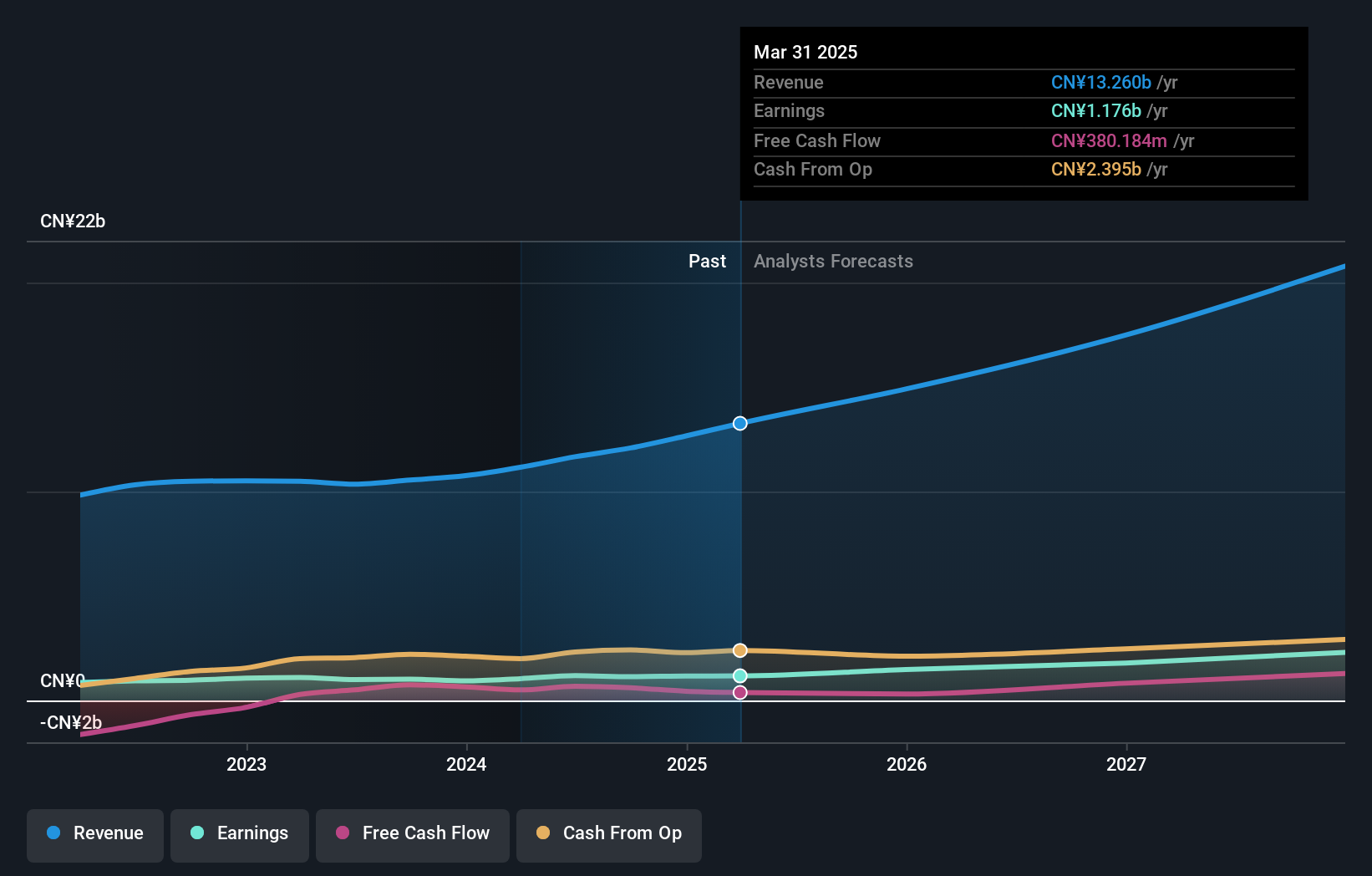

Shenzhen Kinwong Electronic (SHSE:603228)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Kinwong Electronic Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards and electronic materials both domestically in China and internationally, with a market capitalization of approximately CN¥71.50 billion.

Operations: Kinwong Electronic generates revenue primarily from its printed circuit board segment, amounting to CN¥14.66 billion. The company operates within both domestic and international markets, contributing to its substantial market presence.

Shenzhen Kinwong Electronic has showcased robust growth, with a 22% increase in revenue to CNY 11.08 billion and a slight rise in net income to CNY 948.12 million for the nine months ending September 2025. Despite earnings per share dipping slightly from CNY 1.05 to CNY 1.03, the company's revenue growth outpaces the Chinese market average of 13.6%. This performance is indicative of its potential in a competitive tech landscape, supported by an earnings forecast suggesting an annual growth rate of approximately 32.8%. As it continues to expand its market share and innovate within high-growth sectors, Shenzhen Kinwong's trajectory points towards significant future prospects amidst Asia’s dynamic tech industry.

Yageo (TWSE:2327)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yageo Corporation, along with its subsidiaries, manufactures and sells electronic components across China, Europe, the United States, and other parts of Asia with a market capitalization of NT$512.04 billion.

Operations: The company generates revenue primarily from the electronic components and parts segment, amounting to NT$125.62 billion. The business operates across key regions including China, Europe, the United States, and other parts of Asia.

Yageo has demonstrated resilience and adaptability in a fluctuating market, as evidenced by its latest financials which reveal a revenue boost to TWD 63.88 billion, up from TWD 59.92 billion year-over-year. This growth surpasses the Taiwanese market average, with Yageo's earnings also on an upward trajectory, increasing to TWD 10.53 billion from TWD 10.02 billion annually. The company's commitment to innovation is underscored by its R&D investments that focus on developing advanced electronic components, positioning it well for sustained growth amidst Asia’s competitive tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Yageo.

Understand Yageo's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 179 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603228

Shenzhen Kinwong Electronic

Engages in research, development, production, and sale of printed circuit boards (PCB) and electronic materials in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives