Exploring None High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields, with large-cap stocks outperforming small-caps and growth stocks leading the way, investors are closely monitoring economic indicators that suggest a moderated inflation environment and slower Fed rate cuts. In this context of fluctuating market dynamics, identifying high-growth tech stocks that align with current trends can potentially enhance a portfolio by capitalizing on the resilience and innovation characteristic of the technology sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of approximately CN¥37.19 billion.

Operations: The company generates revenue primarily through its Software Service Business, which amounts to approximately CN¥6.17 billion.

China National Software & Service, despite a challenging financial landscape with recent earnings showing a net loss reduction from CNY 422.18 million to CNY 337.55 million year-over-year, is poised for significant growth. The company's strategic focus on R&D, which currently stands at an impressive 16.8% of revenue, underscores its commitment to innovation and positions it well within the tech sector's competitive dynamics. Furthermore, anticipated annual earnings growth of 67.8% starkly outpaces the broader Chinese market's forecast of 24.4%, highlighting potential resilience and upward trajectory in its operational strategy. This robust focus on development is critical as it navigates through recovery phases post-losses; such investment in technology and product enhancement could catalyze its transition into profitability. With revenue also expected to grow annually by 16.8%, surpassing the market average of 13.7%, China National Software & Service seems geared towards reclaiming and possibly expanding its market share, driven by a clear directive towards leveraging technological advancements to streamline operations and enhance service offerings.

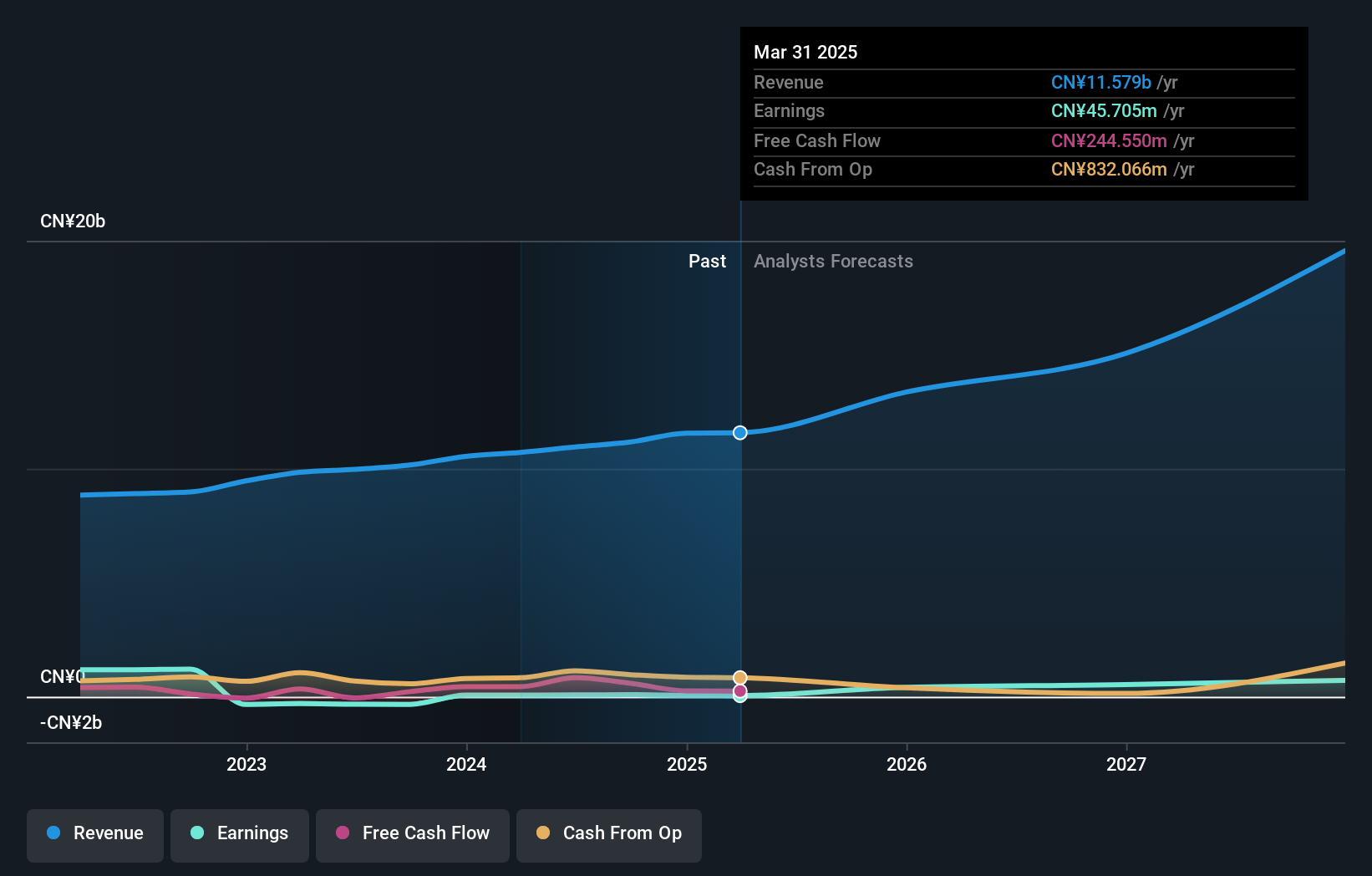

Yonyou Network TechnologyLtd (SHSE:600588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yonyou Network Technology Co., Ltd. offers digital intelligence platforms and services to enterprises and public organizations both in China and internationally, with a market capitalization of CN¥40.97 billion.

Operations: The company generates revenue primarily from its Cloud Service and Software Business, amounting to CN¥10.23 billion.

Yonyou Network Technology has demonstrated a commitment to innovation with a significant portion of its revenue directed towards R&D, amounting to 14.2%. This investment is crucial as the company aims to transition from current losses, evidenced by a net loss reduction this year, toward profitability with an expected earnings growth of 43.3% annually. Recent strategic moves include a share repurchase program valued at CNY 100 million, underscoring efforts to enhance shareholder value and stabilize its financial position amidst challenging market conditions. These steps reflect Yonyou's proactive stance in leveraging technological advancements for future growth within the competitive software industry landscape.

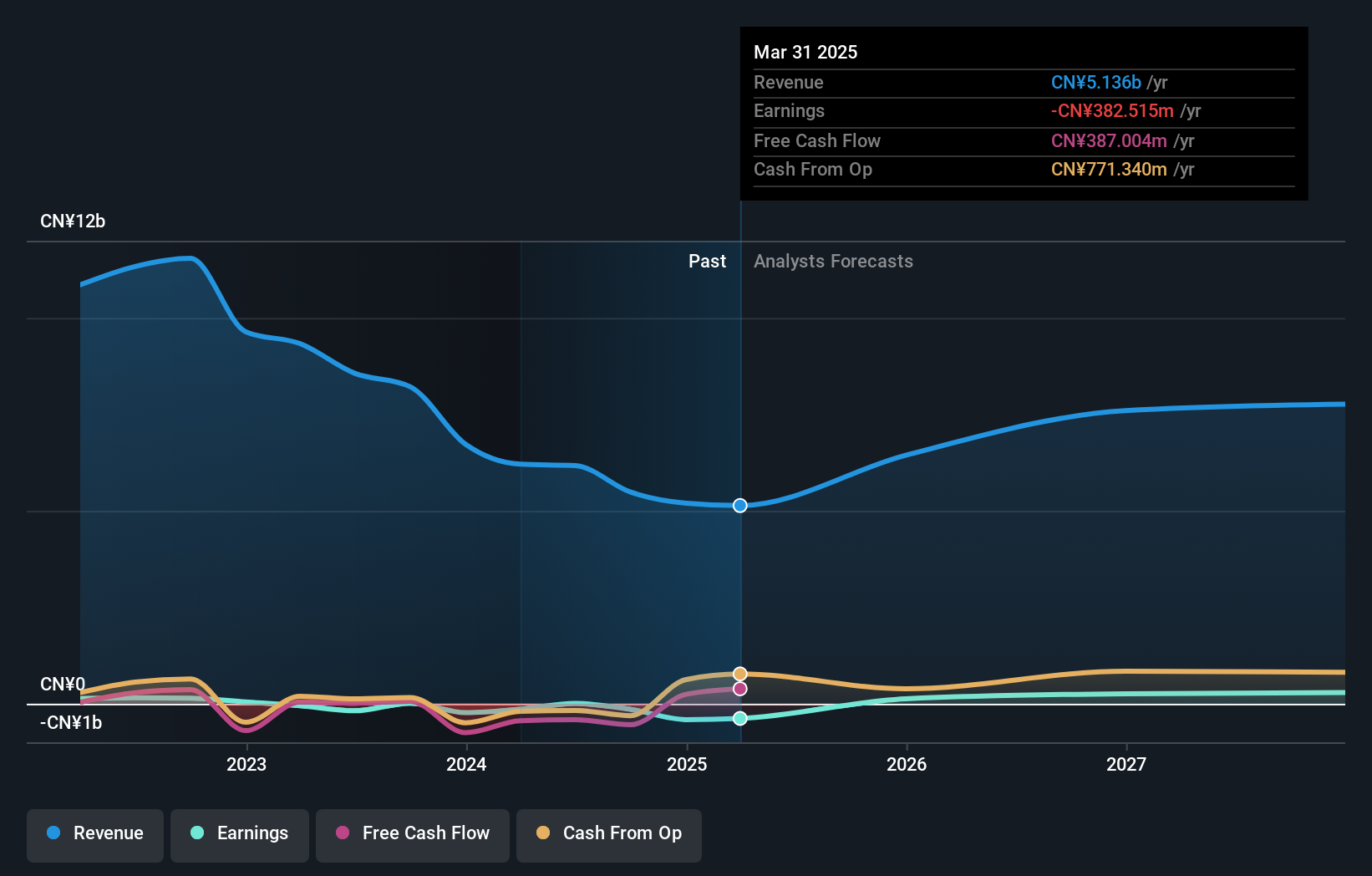

Neusoft (SHSE:600718)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Neusoft Corporation offers software and information technology solutions and services globally, with a market capitalization of CN¥13.18 billion.

Operations: The company generates revenue primarily from software and IT services worldwide. It has a market capitalization of CN¥13.18 billion.

Neusoft Corporation has shown a robust performance with a 19.3% annual revenue growth, outpacing the Chinese market's 13.7%. This growth is complemented by an impressive forecast of earnings expansion at 59.5% annually, signaling strong future potential in the tech sector. The company's commitment to R&D is evident from its strategic lease renewals for office space, ensuring continued innovation and operational efficiency. Neusoft's recent financial results reflect this upward trajectory, with sales reaching CNY 6.89 billion and net income improving to CNY 152.36 million over nine months, underscoring its resilience and adaptability in a competitive landscape.

- Navigate through the intricacies of Neusoft with our comprehensive health report here.

Review our historical performance report to gain insights into Neusoft's's past performance.

Taking Advantage

- Gain an insight into the universe of 1280 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600588

Yonyou Network TechnologyLtd

Provides digital intelligence platform and services for enterprises and public organizations in China and internationally.

Good value with reasonable growth potential.