Even after rising 18% this past week, Jiangsu Lanfeng Bio-chemicalLtd (SZSE:002513) shareholders are still down 32% over the past year

While not a mind-blowing move, it is good to see that the Jiangsu Lanfeng Bio-chemical Co.,Ltd (SZSE:002513) share price has gained 30% in the last three months. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 32% in a year, falling short of the returns you could get by investing in an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Jiangsu Lanfeng Bio-chemicalLtd

Because Jiangsu Lanfeng Bio-chemicalLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Jiangsu Lanfeng Bio-chemicalLtd saw its revenue grow by 80%. That's well above most other pre-profit companies. The share price drop of 32% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized.

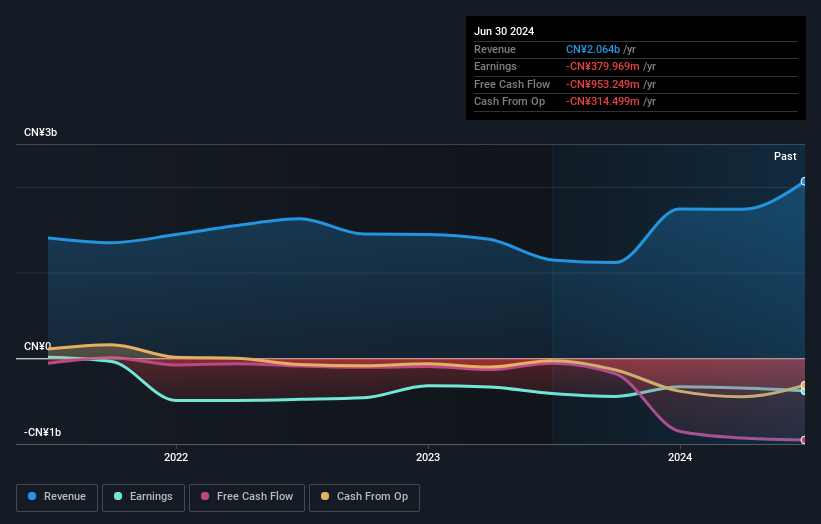

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Jiangsu Lanfeng Bio-chemicalLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 6.5% in the last year, Jiangsu Lanfeng Bio-chemicalLtd shareholders lost 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Jiangsu Lanfeng Bio-chemicalLtd you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002513

Jiangsu Lanfeng Bio-chemicalLtd

Researches, develops, produces, and sells pesticides, fungicides, insecticides, herbicides, and fine chemical intermediates in China and internationally.

Slightly overvalued with worrying balance sheet.