- China

- /

- Electronic Equipment and Components

- /

- SZSE:300007

Exploring High Growth Tech Giants In The Global Market

Reviewed by Simply Wall St

In the face of escalating geopolitical tensions and fluctuating economic indicators, global markets have experienced a mixed performance, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 facing notable declines. Amidst these challenges, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to rapidly changing market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited is a software company based in China with a market capitalization of approximately CN¥38.20 billion.

Operations: The company generates revenue primarily from its Software Service Business, which amounted to approximately CN¥5.14 billion.

China National Software & Service, despite recent challenges, is poised for significant transformation. In Q1 2025, the company reported a narrowed net loss of CNY 80.62 million from CNY 110.75 million year-over-year and a slight decrease in revenue to CNY 640.5 million from CNY 702.71 million. However, looking ahead, the firm is expected to reverse its fortunes with forecasted earnings growth of an impressive 102.4% annually and revenue growth at a robust rate of 15.7% per year—outpacing the broader Chinese market's average of 12.4%. This anticipated turnaround highlights the company's potential resilience and adaptability in a competitive tech landscape.

Hanwei Electronics Group (SZSE:300007)

Simply Wall St Growth Rating: ★★★★☆☆

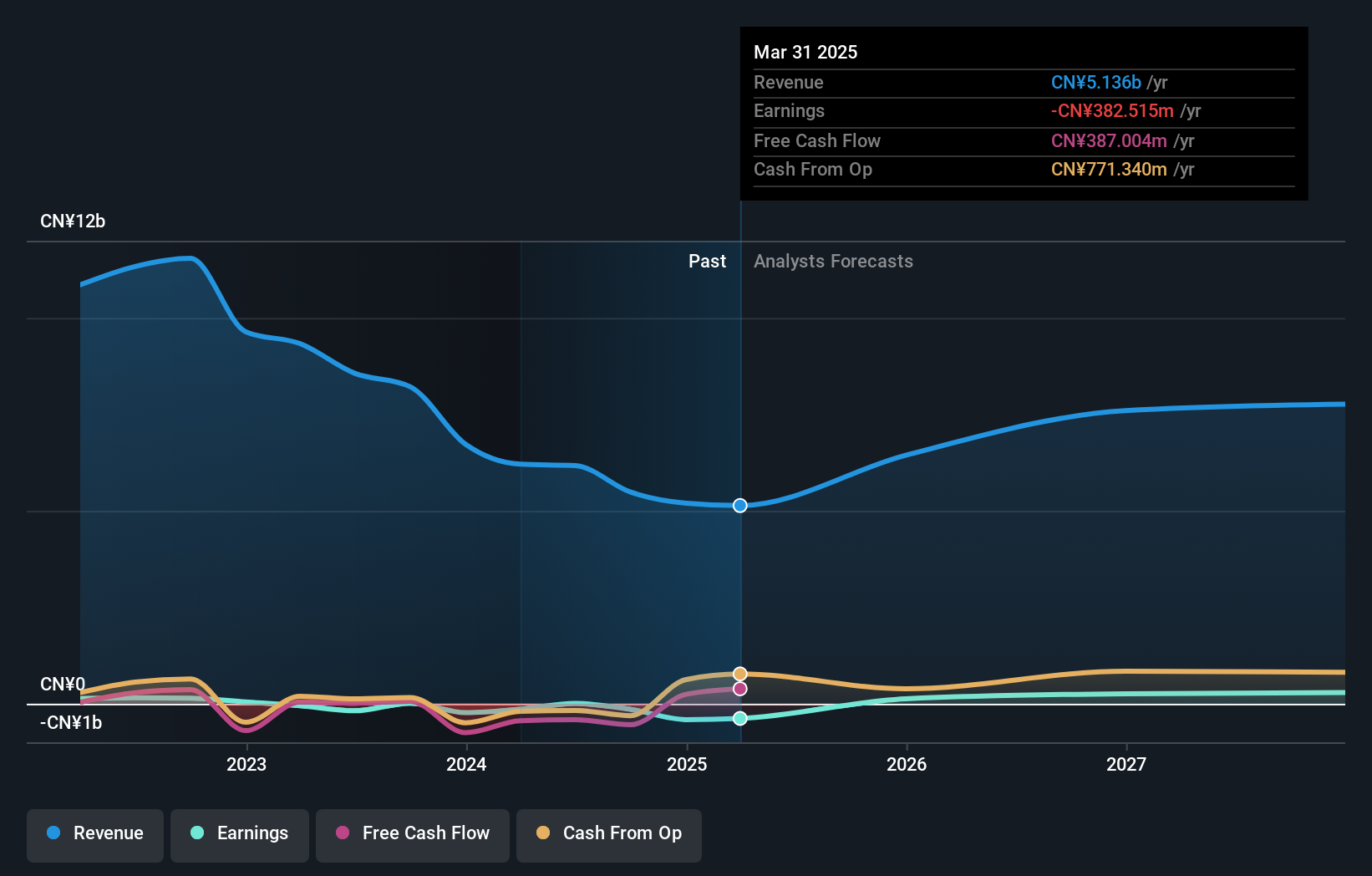

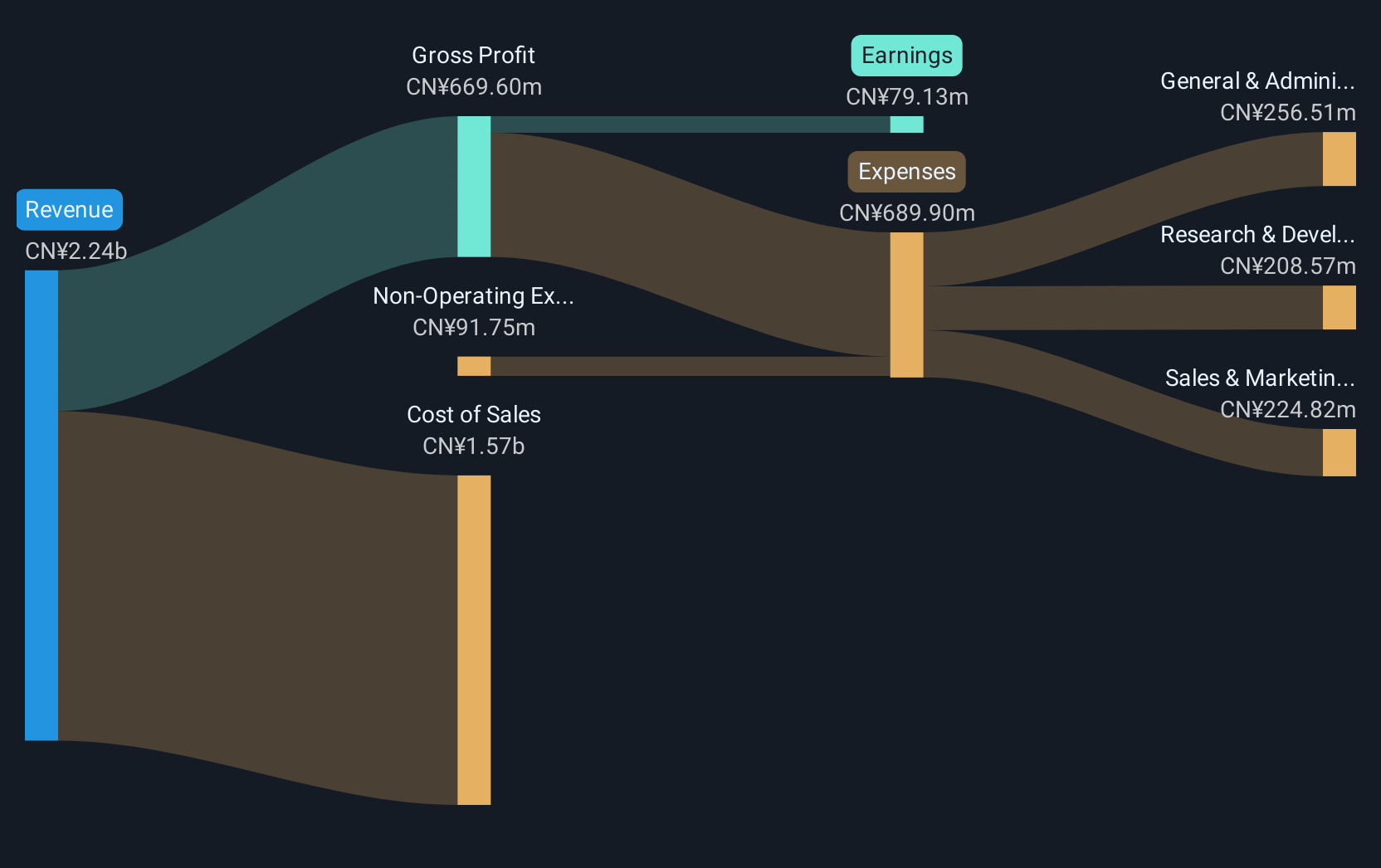

Overview: Hanwei Electronics Group Corporation, along with its subsidiaries, specializes in the provision of gas sensors and instruments both within China and internationally, with a market capitalization of CN¥11.65 billion.

Operations: Hanwei Electronics Group focuses on producing gas sensors and instruments, generating revenue primarily from these products both domestically and internationally. The company operates with a market capitalization of CN¥11.65 billion, reflecting its significant presence in the industry.

Hanwei Electronics Group Corporation has demonstrated resilience with a modest increase in Q1 2025 sales to CNY 602.57 million from CNY 593.4 million year-over-year, coupled with an uptick in net income to CNY 16.94 million from CNY 14.49 million, reflecting a steady operational improvement. Despite the broader market's volatility, Hanwei's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced technological offerings. The company's recent approval of a consistent dividend also underscores its financial stability and shareholder-friendly approach amidst fluctuating earnings and revenue trajectories observed over the past fiscal year.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★☆☆

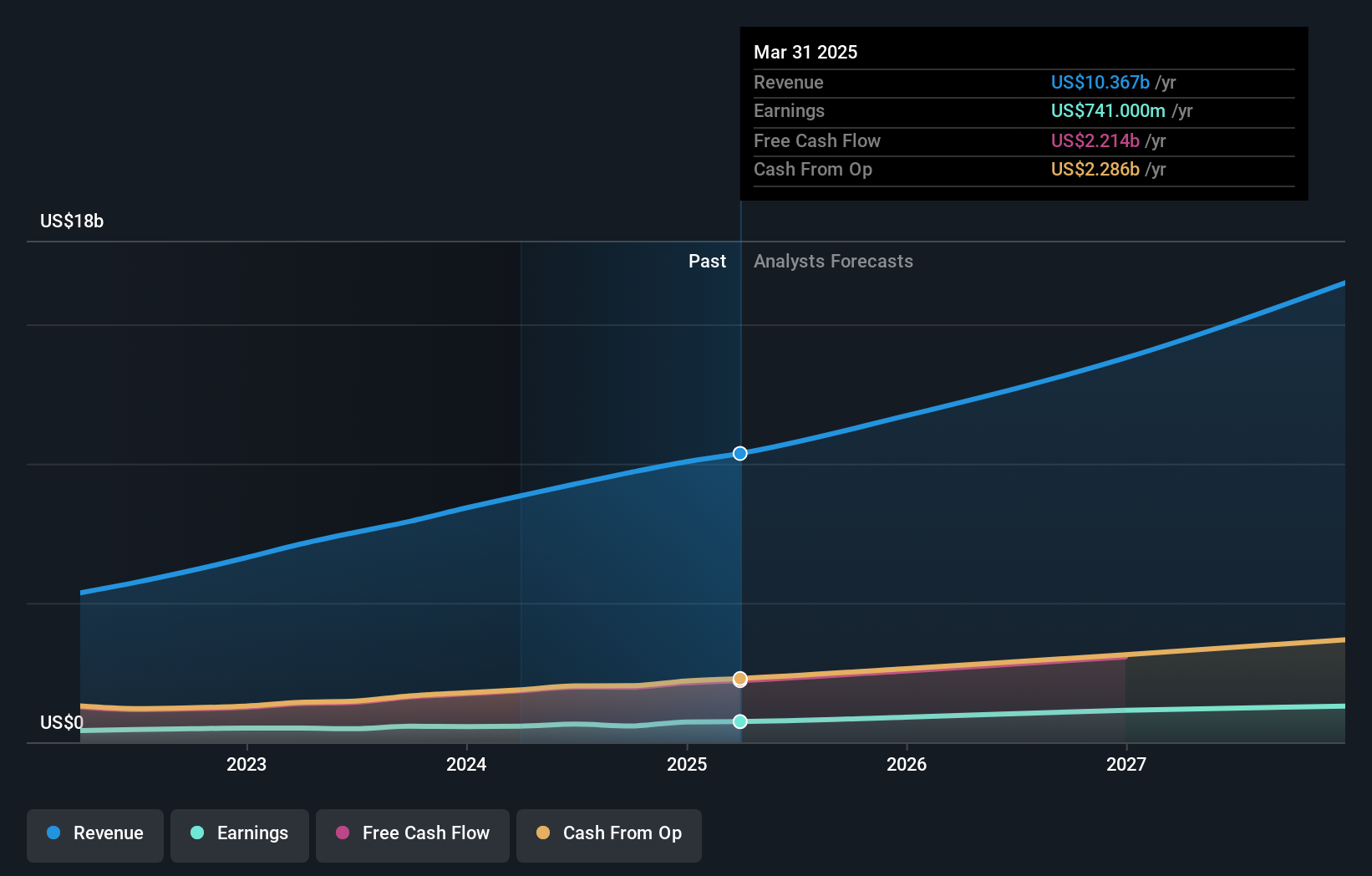

Overview: Constellation Software Inc. is a company that acquires, builds, and manages vertical market software businesses to provide mission-critical solutions for various sectors, with a market cap of CA$102.42 billion.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, which reported CA$10.37 billion. The company focuses on acquiring and managing software businesses that deliver essential solutions across diverse markets.

Constellation Software stands out with a robust 28.6% earnings growth over the past year, surpassing the software industry's average of 24.1%. This performance is underpinned by significant R&D investments, which are crucial for maintaining technological leadership and fueling future growth. With a revenue increase to $2.65 billion from $2.35 billion year-over-year in Q1 2025 and net income rising to $115 million from $105 million, Constellation demonstrates strong operational efficiency and financial health. The firm also continues to reward shareholders, evidenced by its consistent dividend payout, enhancing its appeal in a competitive sector where innovation drives success.

- Click here and access our complete health analysis report to understand the dynamics of Constellation Software.

Learn about Constellation Software's historical performance.

Next Steps

- Navigate through the entire inventory of 745 Global High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwei Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300007

Hanwei Electronics Group

Provides gas sensors and instruments in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives