Earnings Tell The Story For Shenzhen Kingdom Sci-Tech Co., Ltd (SHSE:600446) As Its Stock Soars 30%

Shenzhen Kingdom Sci-Tech Co., Ltd (SHSE:600446) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 45%.

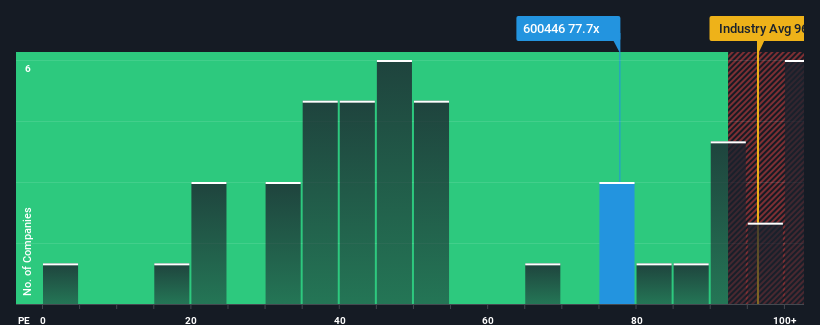

After such a large jump in price, Shenzhen Kingdom Sci-Tech's price-to-earnings (or "P/E") ratio of 77.7x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 36x and even P/E's below 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Shenzhen Kingdom Sci-Tech certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Shenzhen Kingdom Sci-Tech

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shenzhen Kingdom Sci-Tech's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 40% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 114% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Shenzhen Kingdom Sci-Tech's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shenzhen Kingdom Sci-Tech's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shenzhen Kingdom Sci-Tech maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Shenzhen Kingdom Sci-Tech with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Shenzhen Kingdom Sci-Tech. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600446

Excellent balance sheet and good value.

Market Insights

Community Narratives