- China

- /

- Semiconductors

- /

- SZSE:300604

Hangzhou Changchuan TechnologyLtd's (SZSE:300604) five-year earnings growth trails the impressive shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the Hangzhou Changchuan Technology Co.,Ltd (SZSE:300604) share price has soared 216% in the last half decade. Most would be very happy with that. It's also good to see the share price up 15% over the last quarter.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Hangzhou Changchuan TechnologyLtd

We don't think that Hangzhou Changchuan TechnologyLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Hangzhou Changchuan TechnologyLtd can boast revenue growth at a rate of 37% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 26% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes Hangzhou Changchuan TechnologyLtd worth investigating - it may have its best days ahead.

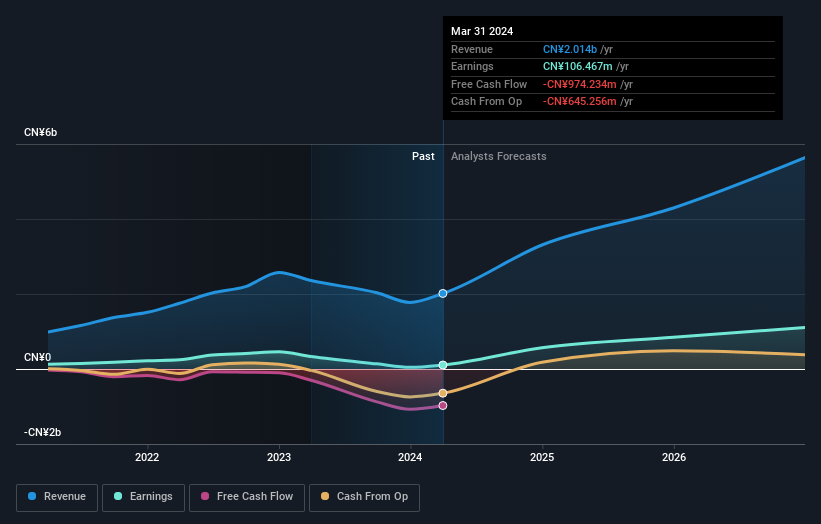

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Hangzhou Changchuan TechnologyLtd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hangzhou Changchuan TechnologyLtd the TSR over the last 5 years was 218%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 17% in the twelve months, Hangzhou Changchuan TechnologyLtd shareholders did even worse, losing 27% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 26%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hangzhou Changchuan TechnologyLtd has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Exceptional growth potential with mediocre balance sheet.