- China

- /

- Semiconductors

- /

- SZSE:300223

October 2024's Top Chinese Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

China’s recent stimulus measures have provided a significant boost to its stock market, with major indices like the Shanghai Composite Index and the CSI 300 experiencing substantial gains. This positive economic backdrop creates an opportune environment for investors to consider growth companies, particularly those with high insider ownership, which often signals strong confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's uncover some gems from our specialized screener.

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Putailai New Energy Technology Co., Ltd. (SHSE:603659) develops and sells lithium-ion battery materials and automation equipment in China, with a market cap of CN¥31.80 billion.

Operations: The company's revenue segments include the development and sale of lithium-ion battery materials and automation equipment in China.

Insider Ownership: 36.6%

Shanghai Putailai New Energy Technology Ltd. demonstrates significant growth potential with forecasted earnings growth of 25.9% annually and revenue expected to grow at 16.5% per year, outpacing the broader Chinese market. Despite recent volatility and a decline in profit margins from 18.4% to 10.6%, the company maintains a good value with a P/E ratio of 21.7x compared to the market's 30x. The completion of its share buyback program, valued at CNY 299.98 million, underscores strong insider confidence amidst challenging earnings results for H1 2024.

- Dive into the specifics of Shanghai Putailai New Energy TechnologyLtd here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Shanghai Putailai New Energy TechnologyLtd is trading behind its estimated value.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ingenic Semiconductor Co., Ltd. engages in the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market cap of CN¥31.26 billion.

Operations: Ingenic Semiconductor Co., Ltd. generates revenue from the research, development, design, and sale of integrated circuit chip products in both domestic and international markets.

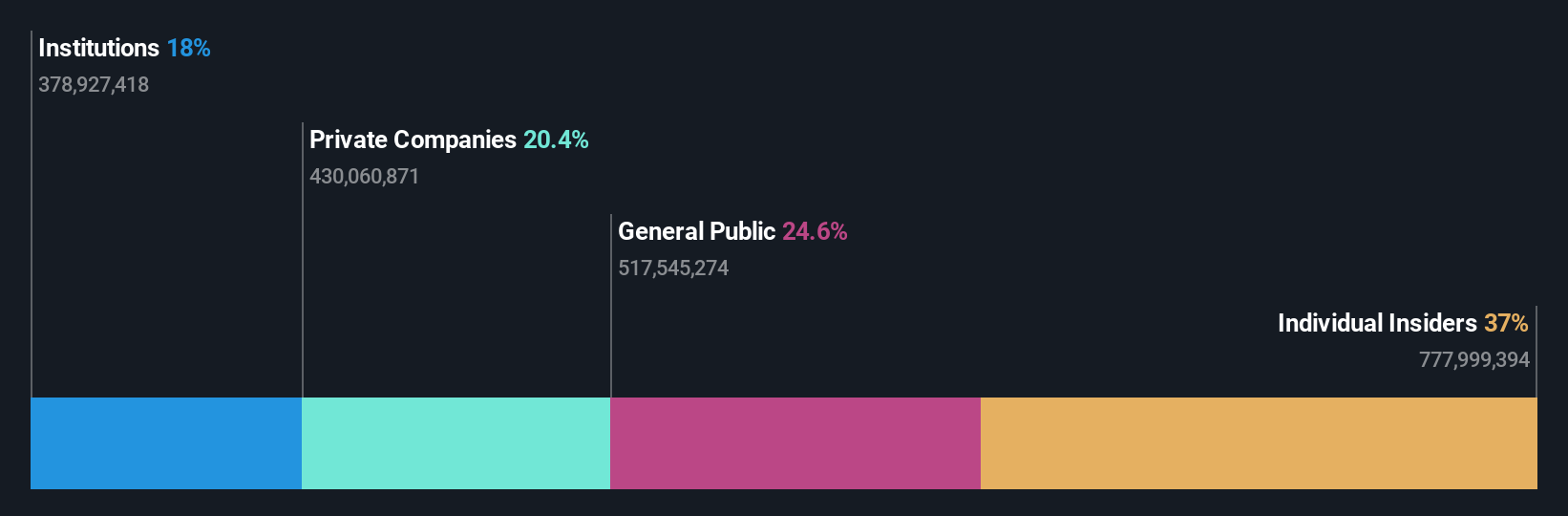

Insider Ownership: 16.7%

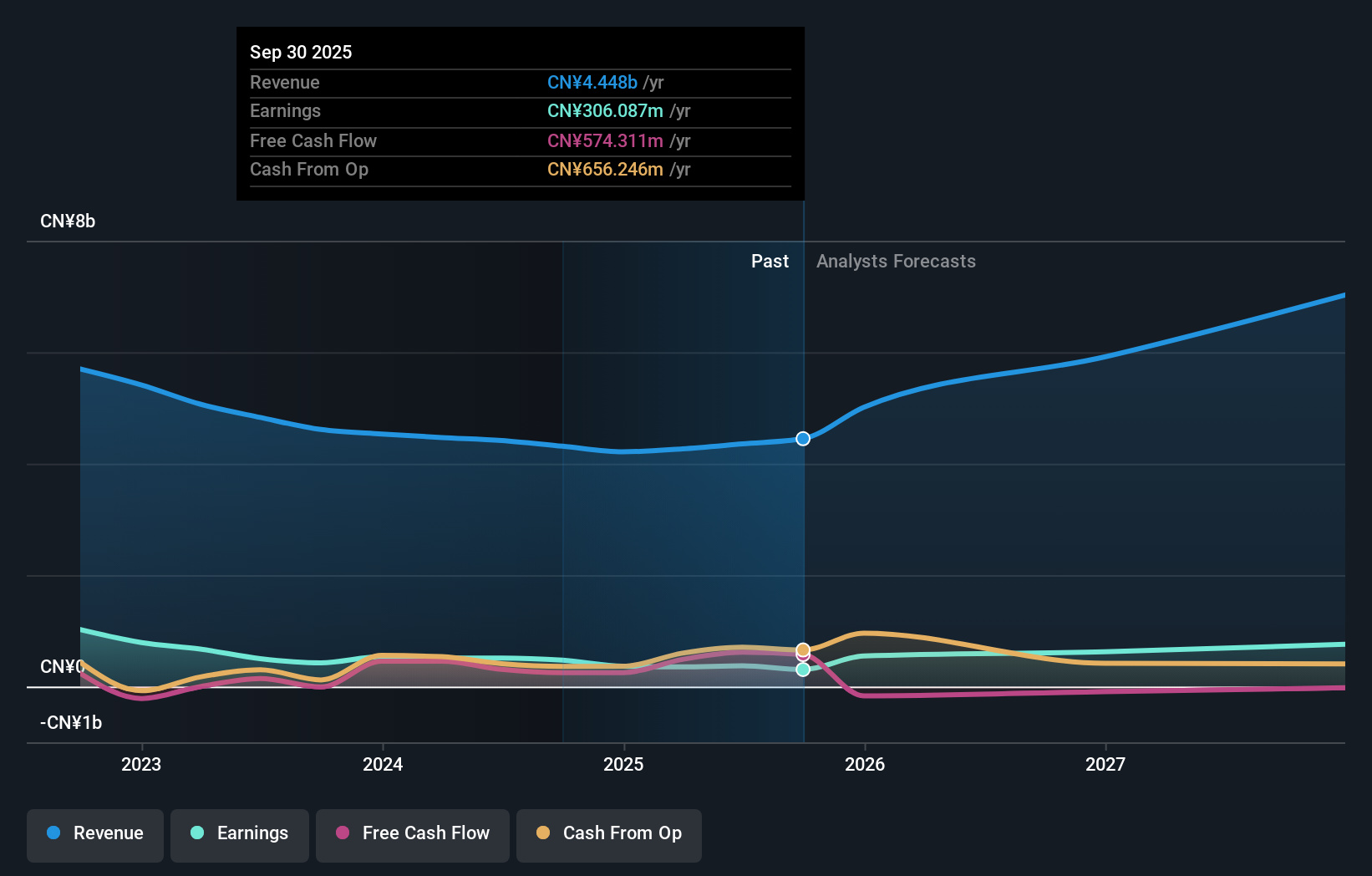

Ingenic Semiconductor Ltd. is poised for substantial growth with forecasted revenue and earnings expected to grow at 22% and 33.6% annually, respectively, outpacing the broader Chinese market. Despite a slight decline in H1 2024 earnings, the company maintains strong fundamentals. With no significant insider trading activity in recent months and a highly volatile share price, Ingenic remains an intriguing prospect among growth companies with high insider ownership in China.

- Click to explore a detailed breakdown of our findings in Ingenic SemiconductorLtd's earnings growth report.

- Our valuation report unveils the possibility Ingenic SemiconductorLtd's shares may be trading at a premium.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Changchuan Technology Co., Ltd. researches, develops, produces, and sells integrated circuit equipment and high-frequency communication materials with a market cap of CN¥23.76 billion.

Operations: Hangzhou Changchuan Technology Co., Ltd. generates revenue through the development, production, and sale of integrated circuit equipment and high-frequency communication materials.

Insider Ownership: 32.3%

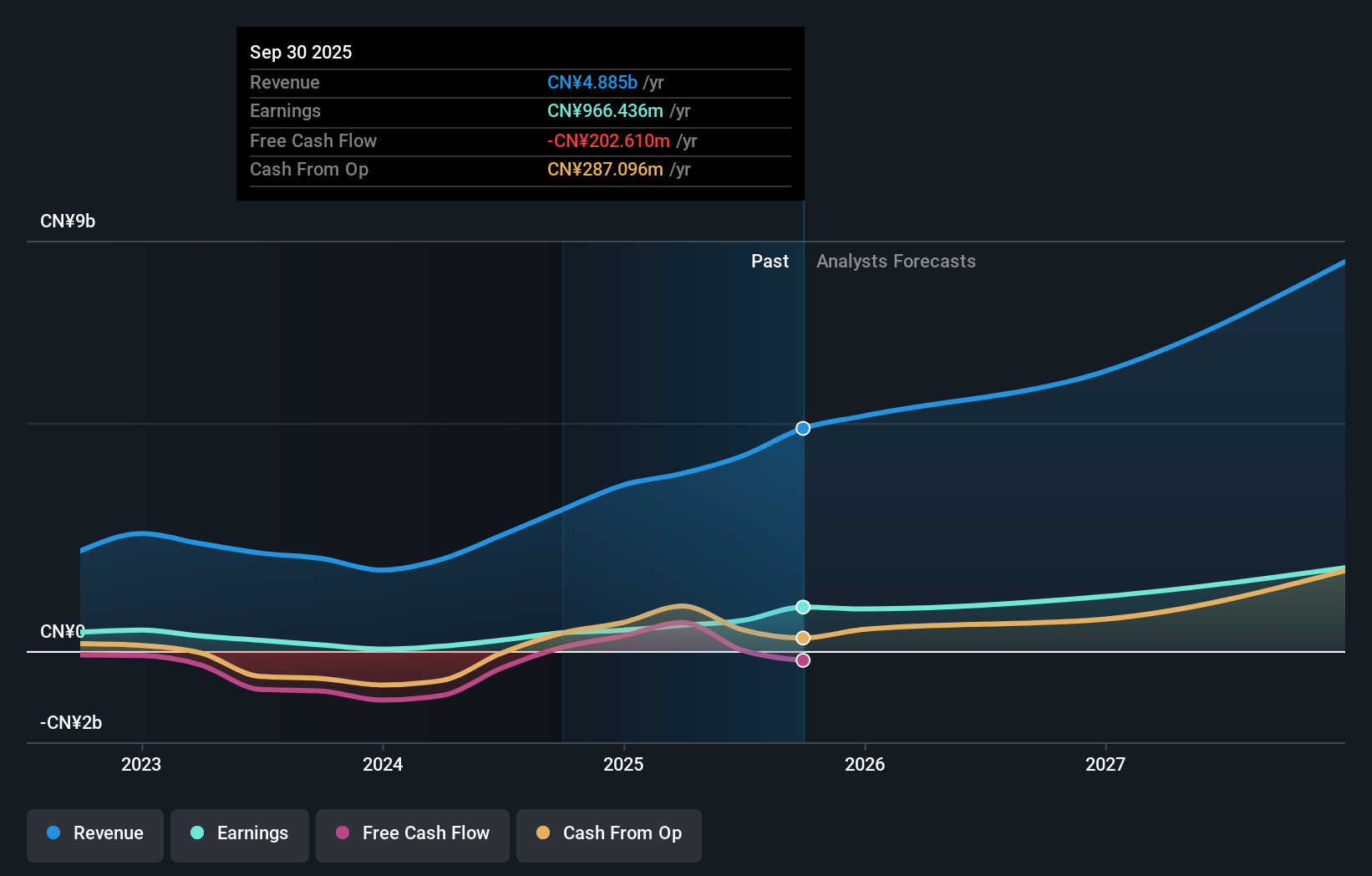

Hangzhou Changchuan Technology Ltd. is positioned for significant growth, with earnings forecasted to increase by 49.5% annually and revenue by 29.3%, both surpassing the broader Chinese market's growth rates. Recent financial results show a substantial improvement, with H1 2024 sales at CNY 1.53 billion and net income at CNY 214.88 million, reflecting strong operational performance despite high share price volatility and low future return on equity forecasts (19.7%).

- Delve into the full analysis future growth report here for a deeper understanding of Hangzhou Changchuan TechnologyLtd.

- Our expertly prepared valuation report Hangzhou Changchuan TechnologyLtd implies its share price may be too high.

Taking Advantage

- Reveal the 384 hidden gems among our Fast Growing Chinese Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300223

Ingenic SemiconductorLtd

Engages in the research and development, design, and sale of integrated circuit chip products in China and internationally.

Flawless balance sheet with high growth potential.